I Tried 'Forex' Trading to See How Much Easy Money I Could Make Online - VICE

I Tried 'Forex' Trading to See How Much Easy Money I Could Make Online - VICE |

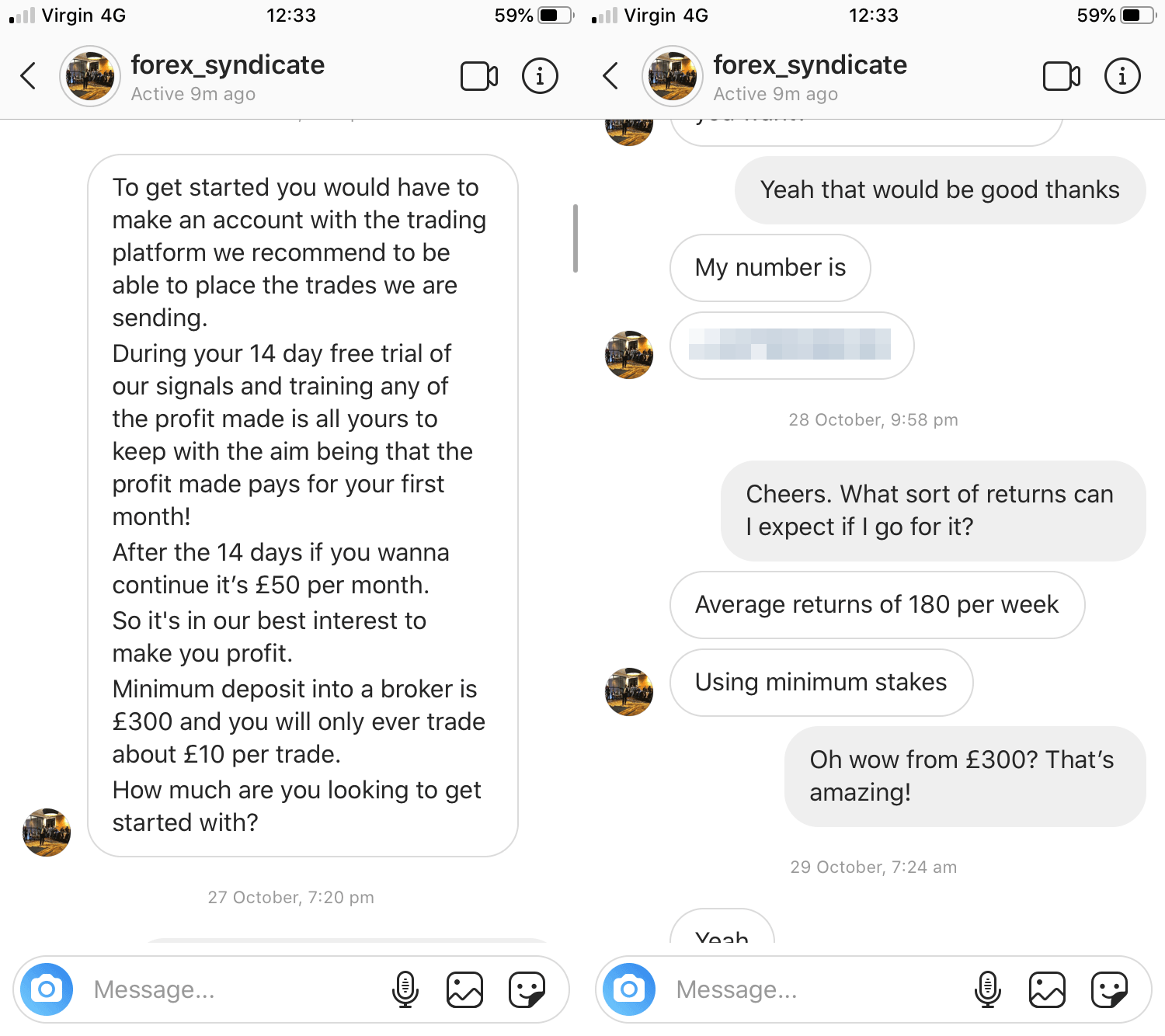

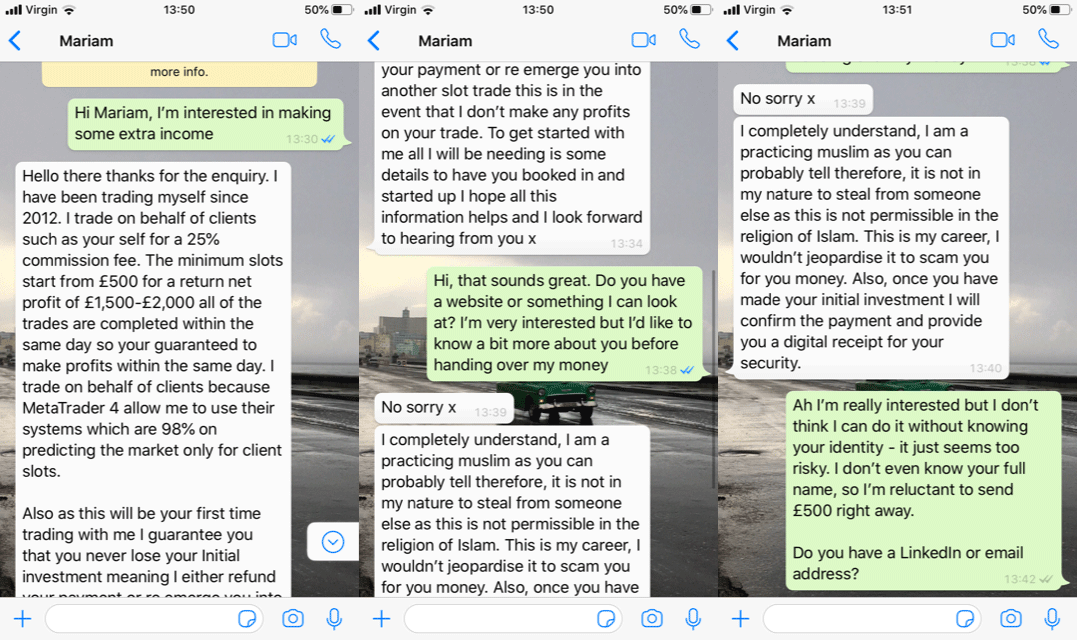

| I Tried 'Forex' Trading to See How Much Easy Money I Could Make Online - VICE Posted: 01 Jan 2020 12:00 AM PST This article originally appeared on VICE UK. The pound seems to be falling down a bottomless pit as we hurtle towards Brexit. Despite knowing absolutely nothing about the financial markets, I wonder if I can turn this to my advantage? Reports suggest hedge funds could make a killing from "shorting" – betting on a fall in value – of the pound in the event of no deal. This sounds like a piece of piss, so I'm going to see if I can blag my way to becoming a profitable trader in one month. Thanks to the internet, in recent years trading has become possible for anyone with a computer and a few hundred quid to spare. The foreign exchange market (usually shortened to forex or FX) is responsible for trading the world's currencies, and is the largest market in the world – dwarfing even the global stock market. It is open 24/5, with trades taking place across the globe. It's possible to take part at any hour of the working week with just a few clicks from your phone. On the face of it, the trading process is pretty simple. Currencies, such as the pound, US dollars and Japanese yen, are organised into pairs. When you place a trade you predict whether one currency will rise in value (buy) or fall in value (sell) against another. This is called a contract for difference (CFD). Get it right and you make a profit, get it wrong and you lose money. Of course, more often than not, consumer traders lose. Trading platforms therefore carry warnings like this: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. "It's important to go in with realistic expectations and accept that if you've never done it before, chances are you're going to be part of the 75 percent who lose," David Jones, chief market strategist at Capital.com, tells me. "Definitely don't go in thinking it's easy money." With David's words of warning ringing in my ears, I shop around the various trading platforms and practice with a few demo accounts. Most give you £10,000 of Monopoly money, so it doesn't really feel like you're risking anything. I finally settle on Plus500 for my real account, because the minimum deposit of £200 is as low as I find and I don't have a lot of money to throw away. For my first real money trade I sell the pound (GBP) against US dollars (USD), thinking that Boris Johnson's failure to get a Brexit deal through Parliament that day should impact the price of the pound. Traders rely on strategies like this to make money from the foreign exchange market. These vary from studying currency charts for patterns and favourable signals that can be used to predict price movement, to the less nerdy option of using news events as indicators. Really, though, it's a coin flip. David says I should trade as small as possible, which sounds like sensible advice, but leverage means this is not as easy as I first thought. Because it's not actually possible to trade with sums as low as the ones most consumers can afford to invest, retail forex accounts offer high leverage, which involves borrowing the funds needed to enter the market from a broker. On Plus500, my leverage is 1:30, meaning that every £1 I trade is magnified by 30 – increasing potential profits and, of course, losses. With leverage, the minimum I can trade is £1,000, but this only requires a £33 margin, meaning I'm not risking a huge amount of the £200 I have in my account. I also set a stop loss order – the safety mechanism that ends the trade if it loses a certain amount of money – then I cross my fingers. The trade starts in the red and gets worse from there. It lasts no more than a couple of minutes and I'm already down. I brush it off and place more trades in the next few days. I try different strategies, setting wider stop loss and take profit orders (the reverse of a stop loss – it cashes you out once you hit a certain profit). I gain a few wins, but these are outnumbered by losses and my initial £200 investment slowly starts shrinking. I chase my losses from my desk at work. I really thought about my first few trades before committing, but I gradually get more impulsive. My early optimism is crumbling. I fairly sure I'm going to be one of the vast number of rubes who lose money. "It's the age-old problem: people take their profits too quickly and let their losses run too far," says David. As well as working within the industry, he also trades off his own back and is under no illusions about how hard it is to turn a profit. "As human beings we're pretty crap when it comes to trading, because our brains aren't really geared up for thinking that way." With my losses mounting, I look for help the only place I know: Google. Fortunately, there are a huge number of people on the internet willing to help inexperienced forex traders get profitable. Unfortunately, most of them are scammers. There are a few places to look for help for free, including YouTube tutorials and babypips.com, but retail forex has a whole scam industry orbiting it. Ultra-aspirational social media culture – think Wolf of Wall Street memes and traders posting pictures of them standing next to other people's Ferraris – has fed the idea that there is easy money to be made in forex. Scammers prey on this by offering "signals" for a fee to novice traders, or signing them up to fake trading platforms and falsifying profits. They promise big returns if you follow their trading tips, but many offer bad advice or simply vanish after taking your money. "Even if the firm is genuine and not a scam, there are still huge risks in forex trading for retail consumers, particularly if they are promising high returns, because forex dealing is one of the riskiest types of trading you can engage in," Mark Steward of the Financial Conduct Authority – the body in charge of regulating financial services – tells me. He also points me to the FCA's ScamSmart page, which has information on how to spot and avoid investment scams.  Searching for help, I find a number of forex accounts on Instagram offering unrealistically high profits in exchange for signals or commission fees. One account, @forex_syndicate, says he can offer average returns of £180 per week on a £300 investment. With a consistent 60 percent return rate like that, your £300 would grow into £1,416,709 after just 18 weeks if you reinvested all your earnings. When I confronted him, the person running the account would not reveal his identity, but denied running a scam and said: "We simply provide training and share tips on how to trade the financial markets, which reduced the chance of people losing money if they were to start trading blind." Another account, @finemariam_, offered me a return of £1,500 to £2,000 on an investment of £500 and said she could not be a scammer because she is a practicing Muslim, before sending over a copy of her ID. She then ruined all the hard work she had done in winning me over by saying her trades are 98 percent accurate, higher than any legitimate trader could guarantee. Finally, @theonlykeke offered me a £3,000 return on a £600 investment by "buying US dollars for under a third of the original value" on my behalf. If only trading forex were that simple. Neither account replied to multiple requests for comment after I suggested they were running scams.  "I was following signals from an individual and it would be a real rollercoaster – not just in terms of emotions, but results as well," Tom, an experienced forex trader, tells me. He lost money on dodgy signals when he was a rookie, but continued paying out of a misplaced sense of pride. "It was only after a while I thought: 'This guy doesn't know any more than I do. I might as well be throwing darts at a dartboard.'" Tom has been trading for 15 years and he now does it full-time after quitting his HR job at a bank and moving to Mexico. Although he has been profitable for the past five years, he says it is only really in the last two years that those profits have given him consistent returns. He also supplements his forex income with matched betting and other remote work. "You can go to work and come back poorer than you started," he says. "That's probably the biggest hurdle to get your head round." With the scams too much of a minefield to navigate, I push forward alone. My biggest win comes off the back of a piece of news: an MRP poll, which is seen as a reliable general election result predictor, forecasts a Conservative majority and GBP rises quickly against the Euro because markets tend to prefer the Tories to Labour. This is as close as I get to my "big short" moment – but it's not enough to make up for my losses. I had stopped trading by the time the general election rolled around, and it was probably for the best. I thought Labour might do better than expected, perhaps snatching another hung parliament, but in the end they were crushed by the Tories. In the immediate wake of the exit poll the pound surged more than 2 percent, its biggest one day rise since January of 2017. At the time of writing, Brexit anxiety has crept back in to dampen the gains, but would I have predicted any of this accurately enough to make money from the turbulence? Probably not. Before I started trading forex, I thought I'd either scrape a profit, or lose it all in a blaze of glory. Either would have made for better copy, but in the end it turned out to be far more dull than that. My £200 ebbed away, only for a few winning trades to edge it back up again slightly. I finished with £172.89, 8.5 per cent down on my initial investment. I made 35 trades in total – 15 were profitable and the rest lost money. Like three-quarters of retail forex traders, I proved to be a flop. "People coming into it are quite naive," says David. "If you can make 1.5 percent month-in, month-out, you're a superstar hedge fund manager. I'm not saying it can't be done – clearly there are people who make lots of money – but if you've never done it before, why do you think you're going to be making money hand over fist?" @HaydenVernon / @lilylambie_kiernan |

| Forex Trading in Nigeria - DailyForex.com Posted: 06 Jan 2020 03:00 AM PST Forex trading in Nigeria has become easier to get involved in during the past decade, which have also mostly seen strong economic growth and rising disposable incomes for many Nigerians despite post-2014 economic problems. Nigerian Forex traders can learn here how to get started trading Forex, the correct approach to learning how to trade and deciding upon a profitable trading strategy for use, and which Forex brokers are most suitable. Nigeria's Financial SituationNigeria is home to over 186 million inhabitants, making it the most populous country in Africa and the seventh most populous in the world. The population is anticipated to exceed 250 million by 2050, while the country is already home to the third-largest youth population as well as the twentieth largest economy in the world. A good measure of Nigeria's increasing prosperity is the fact the gross domestic product per capita (per person) increased from $352 in 2001 to $3,222 in 2014 – an increase of approximately 900%! However, the figure has fallen sharply since 2014 to a little less than $2,000. Despite Nigeria's position as a relatively prosperous African country, most Nigerians would agree that getting by is neither easy nor simple. When you combine these challenges with the fact that it is not impossible to get some spare cash together, you can see why Forex trading continues to become more and more popular in Nigeria. Despite this plus the fact that Forex traders in Nigeria are believed to trade positions worth as much as $1.25 million daily on average, very few international Forex / CFD brokerages maintain a presence in Nigeria, so Nigerian Forex traders are in need of more impartial guidance, which can be found in this article.

How to Start Forex Trading in NigeriaThe essential requirements to get started are the same as in any other country. Traders need to have a computer or mobile device, a stable internet connection, trading capital (more on how much you will need later), and an account with a trusted Forex broker. Reliability of internet connections and electricity supplies have become considerably more reliable in recent years, especially in urban areas, which makes Forex trading easier. However, these factors mean traders in Nigeria should be careful to never execute a trade without inputting a hard stop loss, to prevent catastrophic losses in the event of a lost connection which cannot be re-established quickly. Later sections in this article will discuss the practicalities of getting set up as a Forex trader. At this point, I emphasize that there is no point in trading Forex until you have a profitable trading strategy which you are psychologically ready to execute. You will not succeed in Forex with positive psychology alone, but a lack of psychological preparation can ruin the ability to successfully execute even a winning, profitable trading strategy. The lack of a sound trading strategy reduces Forex trading to gambling, with the odds stacked against the trader, and the eventual loss of the entire trading account. The most proven trading strategy which has been proven to succeed over the years is a strategy which trades only in the direction of a strong trend, cuts losing trades short, and lets winners run. However, even with such a good strategy, there will be losing trades and losing periods, which the trader must be psychologically ready to accept as inevitable. By keeping risk small, a Forex trader can ensure survival through the losing periods and coming up ready to profit when the market turns profitable again. It is important not to assume that Forex trading is easy money. It requires mental work and dedication. Is Forex Trading Legal in Nigeria?It is clear that Forex trading is legal in Nigeria if you trade your money for your personal benefit alone. This mirrors retail trading regulations in most countries. Raising capital from third parties for their benefit without a proper license to do so is illegal and, tempting as it may be, can get you into trouble if the third parties become dissatisfied and complain. Forex trading where you are managing other people' money is extremely challenging psychologically. For these reasons, please trade only with your own money where losses are not catastrophic to your ability to pay your essential costs of living. How Much do I Need to Start Trading Forex in Nigeria?There are some Forex and CFD brokerages which require no minimum deposit and accept Nigerian residents as customers, so in theory at least, you can trade Forex in Nigeria with as little as $1. The problem is that due to issues of leverage and currency exchange with most Forex brokers not accepting deposits directly in Nigerian Naira, it is impractical to trade Forex with much less than $100 or its equivalent. Even $100 can be problematic due to trade size and leverage issues, so it is certainly true that something close to $500 will work better. One Forex broker with expertise in serving Nigerian resident clients is FXTM, which, unusually for a major international Forex brokerage, has a physical presence in Nigeria. FXTM requires a minimum deposit from Nigerian residents of only ₦2,000. Forex Brokers in NigeriaThe Nigerian Forex market went through a boom-and-bust cycle between 2004 and 2010, and a wave of Ponzi schemes swept the country during this period. This atmosphere prevented interest in Forex trading in Nigeria from taking off, but the picture has improved considerably since 2010 as a calmer financial environment and generally increasing prosperity began to prevail. FXTM is the sole international Forex / CFD broker with a physical location in the country. Adding to its appeal is the Naira trading account, which makes it very simple for traders to manage their portfolios as no currency conversion are required in order to execute deposits and withdrawals to and from an FXTM trading account. The acceptance of bank wires from Nigerian banks is a further improvement to the services offered by FXTM to Nigerian resident traders. While there are a few local Nigerian Forex brokers currently operating, if I were a Nigerian resident Forex trader, I would strongly prefer to open an account with an international brokerage instead of a local solution. Other international Forex / CFD brokerages which service Nigerian residents include AvaTrade, Pepperstone, and IC Markets. Unfortunately, none of these brokers offer Naira accounts. Nigerian Forex traders will have to ensure that the brokers provide a payment processor catering to Nigeria, as currency conversions may pose a challenge. Happily, the Forex market in Nigeria continues to strengthen and become a more attractive venue for international business, with the Central Bank of Nigeria (CBA) and the Securities and Exchange Commission (SEC) developing a stronger regulatory framework in recent years. More international Forex brokers are anticipated to follow FXTM into Nigeria, widening the choice for Nigerian Forex traders. Best Forex Trading Platforms in NigeriaThe best Forex trading platforms for Nigerian resident traders are those offered through the Forex brokers mentioned in the previous section. The MetaTrader 4 platform is available at every broker mentioned, while the MetaTrader 5 and cTrader platforms are also available at some of them. Forex Training in NigeriaThere are several institutions in Nigeria which claim to be able to train aspiring Forex traders for trading success and profit, in return for a fee covering the provision of this apparent education. Although a few of these institutions may be sincere in their intentions, and the attempts of aspiring traders to invest in a proper trading education laudable, the fact remains that paying for Forex training in Nigeria is not be recommended. Simply put, you can find everything you need to know to become a successful and profitable Forex trader for free on the internet. Aspiring Nigerian Forex traders will see a better return from time spent reading through this site and searching through google for good material than they will see from investing in Nigerian Forex educators. When you do find material on Forex trading strategies, ask yourself whether any supporting historical data is shown to support the claims made. If not, ask yourself why not. Best Time to Trade Forex in NigeriaOne advantage that can be enjoyed for free by everyone trading Forex in Nigeria is the time zone. Nigeria is one hour ahead of London, the global center of Forex markets. The best time to trade Forex is the time during which there is the most volume and liquidity in the market. Studies have shown that the highest volume and liquidity in the Forex market occurs during the overlap between the London and New York sessions, with both remaining relatively high until New York closes for business at the end of its day. Happily, this means that the best time to trade Forex is between 2pm and 10pm Nigerian time. This is convenient for most Nigerian Forex traders, as it means it will be easy for most to be awake during this period, and most of this time is after normal working hours, meaning that Nigerians do not have to give up their normal day jobs in order to day trade Forex successfully during peak market hours. |

| You are subscribed to email updates from "forex trading platforms" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment