Gold Price Chart Warns of Trend Reversal Before Fed Rate Decision - DailyFX

Gold Price Chart Warns of Trend Reversal Before Fed Rate Decision - DailyFX |

- Gold Price Chart Warns of Trend Reversal Before Fed Rate Decision - DailyFX

- Forexlive Asia FX news wrap: The GBP trend lower continues. BOJ keeps policy unchanged - ForexLive

- GBP Technical Outlook: EUR/GBP to Resistance, GBP/USD Plummets - DailyFX

| Gold Price Chart Warns of Trend Reversal Before Fed Rate Decision - DailyFX Posted: 28 Jul 2019 11:31 PM PDT GOLD & CRUDE OIL TALKING POINTS:

Bellwether commodity prices are idling as markets brace for a week loaded with heavy duty event risk, from the resumption of US-China trade negotiations to a much-anticipated Fed monetary policy announcement. The former will bring USTR Robert Lighthizer to Shanghai for the first face-to-face with Beijing officials since talks broke down in May. The latter is widely expected to bring a rate cut. It seems too early to hope that Washington and Beijing with secure a decisive breakthrough, but a bit of reassurance in the surrounding commentary from key officials may cheer investors somewhat. The Fed might quickly quash any such optimism. It has been reluctant to pre-commit and so probably will not endorse the markets' call for 25-50bps in further easing before year-end, souring sentiment. Traders will probably withhold directional conviction at least until the US central bank has had its say, with lackluster progress one way or another in the interim. Pace-setting S&P 500 futures are pointing to a cautiously risk-off start to the week. That might translate into slightly weaker crude oil prices. Meanwhile, gold may have to balance a supportive downtick in bond yields with a slightly stronger US Dollar. Get the latest crude oil and gold forecasts to see what will drive prices in the third quarter! GOLD TECHNICAL ANALYSISGold prices are stalling but a Bearish Engulfing candlestick pattern coupled with negative RSI divergence continue to hint a top is taking shape. A daily close below rising trend support opens the door for a test of the July 1 low at 1381.91. Alternatively, a breach of the 38.2% Fibonacci expansion at 1447.90 targets the 50% level at 1468.29.  CRUDE OIL TECHNICAL ANALYSISCrude oil prices remain locked in a narrow range above support at 54.84. A break downward confirmed on a daily closing basis initially exposes the 49.41-50.60 area. Alternatively, a rebound above resistance at 58.19 sets the stage for a retest of the 60.04-84 zone.  COMMODITY TRADING RESOURCES--- Written by Ilya Spivak, Currency Strategist for DailyFX.com To contact Ilya, use the comments section below or @IlyaSpivak on Twitter |

| Forexlive Asia FX news wrap: The GBP trend lower continues. BOJ keeps policy unchanged - ForexLive Posted: 29 Jul 2019 09:47 PM PDT Forex news for Asian trading on July 30, 2019In other markets:

From a news standpoint, the Asian session was dominated more by Japan employment which came in mixed with the Unemployment rate dipping to recent multi-year lows at 2.4%,but the job-to applicant ratio also dipping slightly. The impact was limited. Later, industrial production was much weaker than expected at -3.6% vs -1.7% estimate. That helped the USDJPY move a little higher, but the pair ran out of upside steam and started to move back lower into the next key event - the BOJ decision. No change was expected, but the market expected a softening of the forward guidance a bit. When the statement was released, and the BOJ kept the forward guidance the same, the USDJPY started to move lower. The price went from about 108.80 to a low at 108.62. We currently trade near that level. Other data came out of New Zealand where building permits slumped -3.9% after rising an oversized 13.2% in May. Needless to say, the data for that series can be volatile and there was little in the way of price action. In fact, through the first 8 or so hours of trading in the new day, the NZD price range is only about 9 pips...yes 9.

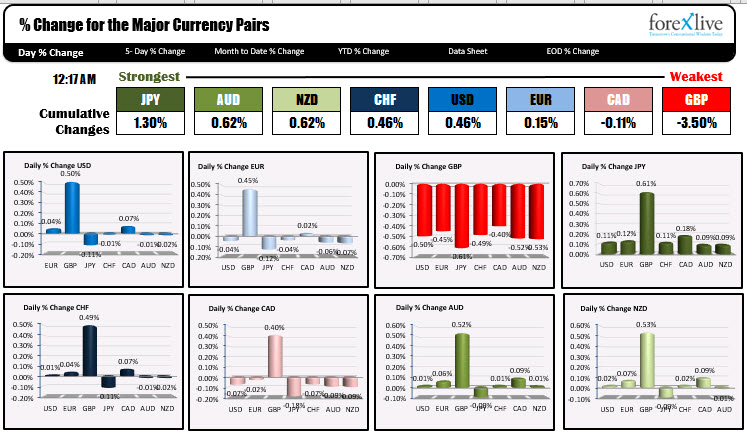

What did move in the session was the GBPUSD (and GBP pairs). Looking at the snapshot of the strongest and weakest pairs (see charts above), all the GBP pairs are lower with declines at the time of the snapshot, of -0.40% (for GBPCAD) to -0.62% (for GBPJPY). The GBPUSD fell -0.50% and the EURGBP saw the GBP decline by -0.45%. Those declines were on top of the sharp declines yesterday where GBP pairs fell -1.13% to -1.49% (we are even lower now as I type). Although there was nothing in the form of news, there was a pretty easy crack below the 1.2200 level in the GBPUSD (was supposed to be a support leve). That easy break, had traders selling and scrambling. The price has just printed down to 1.2118. That is the lowest level since March 2017 and takes the pair to within 5 pips of a lower trend line (see chart below). Can the level hold as the European/London session approaches? Key level for the pair.  |

| GBP Technical Outlook: EUR/GBP to Resistance, GBP/USD Plummets - DailyFX Posted: 29 Jul 2019 07:03 AM PDT GBPUSD, EURGBP, British Pound Talking Points:GBPUSD Plummets to Fresh Two-Year-Lows Ahead of FOMC, BoE Super ThursdayIt's been a rough start to the week for the British Pound as the currency has been slammed-lower to start this week's trade. While much of the economic world's attention is focused squarely on Washington DC for the Wednesday FOMC rate decision, threats of No-Deal Brexit have pushed GBP/USD to its lowest spot rate since March of 2017. As discussed over the past two weeks, GBPUSD has been one of the more attractive long-USD scenarios. As the Greenback has continued to gain, bearish prognostications around the Pound have helped GBP/USD to remain aggressively-offered over the past month. GBP/USD Four-Hour Price Chart Chart prepared by James Stanley Super Thursday AwaitsLess than 24 hours after that Federal Reserve rate decision and another item of importance comes up on the economic calendar for the British Pound, and that's the Super Thursday rate decision. This is when the Bank of England will offer updated projections and a press conference to go along with the rate decision itself and this is often where markets can gain some insight to project potential policy action from the bank. Of note, this will be the first BoE rate decision since the Boris Johnson win, so it'll be interesting to hear the bank's take on what might need to happen in the event that No-Deal Brexit continues as a potential outcome. Likely, we will hear the BoE take on a very dovish tone. On a longer-term basis, this can be a tough area to chase that recent bearish breakout. From the weekly chart, traders can zoom out to see a relative lack of price action in the current area and nothing since April of 2017 when prices rose above 1.2500 and didn't look back, until a couple of weeks ago, that is. GBP/USD Weekly Price Chart Chart prepared by James Stanley GBPUSD Bearish PotentialAt this point, traders are left with a couple of options to work with the short-side of this theme. Either chase the already well-developed breakout; or wait for a pullback to some element of resistance that could be used for stop placement. The former of those approaches appears imprudent given how stretched the bearish theme already is; but below, I look into two areas of possible lower-high resistance that could re-open the door for bearish exposure in the pair ahead of Wednesday's FOMC rate decision. Current support appears to be showing around the 1.2250 psychological level, and prior support around 1.2400 could be of interest for lower-high resistance. The quandary with that latter level is that it would require a 130+ pip bounce to come into play, and one must ask in that scenario if the bearish backdrop on the pair remains as attractive. A bit closer is another potential zone of interest around 1.2340. This area had a quick support/resistance check earlier today and may soon become usable. GBPUSD Hourly Price Chart Chart prepared by James Stanley GBP Reversal PotentialFor those that'd like to fade this recent round of GBP-weakness, EUR/GBP could remain attractive. The cross-pair has taken advantage of this recent rush of Sterling weakness to catapult up to a zone of resistance that's already twice-turned around bullish advances in the pair over the past year. This takes place around the 23.6% Fibonacci retracement of the April-August 2017 bullish run. This scenario would also have the luxury of picking on a potentially-weak Euro with the prospect of looser policy and, perhaps even future QE outlays from the European Central Bank. EUR/GBP Weekly Price Chart Chart prepared by James Stanley To read more:Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator. Forex Trading Resources DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you're looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we're looking at what we're looking at. If you're looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management. --- Written by James Stanley, Strategist for DailyFX.com Contact and follow James on Twitter: @JStanleyFX |

| You are subscribed to email updates from "forex charts" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment