Forex Day Trading: Beginners Guide - Coinspeaker

Forex Day Trading: Beginners Guide - Coinspeaker |

- Forex Day Trading: Beginners Guide - Coinspeaker

- The Advantages of Mobile Forex Trading - iLounge

- Top Trade Setups in Forex – Trades Awaits NFP Tomorrow! - FXStreet

| Forex Day Trading: Beginners Guide - Coinspeaker Posted: 10 Feb 2020 01:02 AM PST  Gaining the professional stature of an expert Forex day trader takes years of dedication, commitment, and willingness backed by strategies that are clearly defined and that promise persistent profitability. The rewards that are earned are worth the efforts with huge income and a lavish lifestyle that the majority can only dream of. Favorable circumstances abound for these players who may either think of working for foreign banks or hedge funds or just slide into their pajamas and trade from their home offices. Scroll down to get an idea of what it is like to live the life of a day trader for a single day, who has to tackle private accounts that include family funds and other people's money. Learning the Tricks of the TradeAs long as the world of foreign exchange is concerned, day trading can always be a lucrative option depending on the time zone of your state/country. Suppose you wish to trade the stocks and futures of the US, the initial two hours of the day are the most crucial hours that offer the best opportunities for earning profits. Residing in the Eastern Time, 8.30 AM is the best time by which it is expected for the day trader to start trading if he wishes to trade during the usual trading hours. For a potential day trader, you'll get more choices though the aforementioned time also works well for the Forex market as well. That is the time when companies and banks in America just start working and when markets in London are already open. Hence, these few hours are said to be of the highest liquidity and volatility as against other times of the day. Preparing for Day Trade: the Key to Being DisciplinedYou have the discretion of doing anything that you want when you work as a day trader from the comfort of your home. Get up one hour prior to the time you start trading and here are the preparations you should take for having a great day:

Become a Successful Forex Day TraderPost the official opening time of the market (9.30 – 10.30 AM EST in case of futures, Forex, stocks), you should definitely trade the initial hour to make the best gains. In the case of the Forex market, you may start by 8-8.30 AM, particularly when you trade EURUSD or GBPUSD. On the contrary, while trading in an active market, you may continue trading up to 11.30 AM EST as the volatility decreases thereafter. Do you find your day trade journey to be challenging enough? If yes, there's a high chance that there's something not right. The trader may not have been armed for various market environments or he might be taking on too much risk. The job of a Forex trader is to keep finding trade setups and later on handling them as per his Forex technical analysis or strategy. How the Entire Day Looks LikeOnce day trading is done with, which for some may end at 10.30 AM or for some at 4.00 PM EST, make sure you save a screenshot of the trading chart. Have a clear idea of the profit and losses of all the trades that you've made during the day also note the below-mentioned points:

Mentioning the figures in the dollar can sometimes be misleading since the balance in your account will keep fluctuating with time leading to trades of variable size. The screenshots should be carefully kept in different folders so that you can go through them later on and learn from your mistakes. Besides reviewing the trading time, there's not much that you have to do unless you decide to trade on a definite issue. ConclusionIf you thought Forex trading is always a bed of roses, you're wrong as there are days when the job will seem way too monotonous. A Forex day trader spends few days trading for 2-5 hours a day and trading for 5 hours at a stretch is the best that they can do. Therefore it is needless to mention that you can sneak out time for all your other pursuits and hobbies. share this: | ||||||||||||||||||||||||||||||

| The Advantages of Mobile Forex Trading - iLounge Posted: 10 Feb 2020 08:33 AM PST When the very first iPhone was launched by the legendary Steve Jobs back in 2007, who could have known just how much it was going to transform our way of life? It literally put the internet in our hands, with no need to be tied to a PC or laptop if we want to go online. As smartphone popularity grew, more and more apps were developed, allowing even more uses for the device. Then, in 2010, the arrival of the iPad meant that the larger screen size made even more possible. It's hardly any surprise that a decade after the original smartphone breakthrough, more people were using mobile devices to access the internet than using static computers. In fact, around 52% of all website traffic comes from mobiles, as consistently reported. It's also little surprise that virtually every sector has had to adapt the way it operates to accommodate this shift in consumer behavior. Table of Contents The mobile trading revolutionA prime example of this is the world of mobile trading, and in particular foreign exchange trading, or forex for short. Before the internet, this was an activity mainly restricted to the big banks and other financial institutions who would trade in millions of dollars worth of currency virtually every day. But, like so many things, the internet has opened the activity up to almost anyone who likes the idea of speculating on the world currency markets. That's because today there are countless online currency trading platforms on which it's simple to open an account and get to work. What's more, many of them offer the option of mobile forex trading on the go, so you can be constantly connected to the markets, as long as there's an internet connection you can use. Such a "democratization" of trading as both a profession and a hobby has meant increasing popularity with almost all demographics, as well as more user-friendly interfaces – and, of course, greater public interest in forex trading. Always in touchJust like all financial markets, for example the stock exchanges all around the world, forex offers a constantly shifting picture, with some prices rising while others fall. It's not just a matter of convenience; to have the greatest potential of success it stands to reason that the better connected you are and the more constant flow of data that you're receiving, the better informed you'll be and the more opportunity you'll have to be able to make the right move at the right time, free from the limitations of being near a computer. This means that the very first advantage of mobile forex trading is that you're able to track market trends as and when they occur. You're also then able to react to the information by choosing to buy, sell or even sit tight on your investment. Better informed and prepared In addition to the online news and price information that you can stream to your phone or tablet, the mobile forex trading revolution has meant that you're also able to access a wide range of training tools. These are especially useful for novices, as they can allow you to test strategies using one of the demo accounts that most online dealers make available, without actually having to invest any money. There are also multiple educational services and even information forums, which are a rich source of advice and knowledge that are freely available. Previously, this kind of help would cost a great deal of money to obtain; and it would have taken many years to gain the equivalent level of experience. Mobile users also have access to a wide range of tools that help analyze the markets, which can cover anything from price movements to the volume of trading being carried out or from volatility predictions to so-called "moving averages." The latter are examinations of the previous performance of a currency which can be used to try to predict where it's headed in the future. It all adds up to the general democratizing of the process of forex trading. Where it was previously only been an activity open to relatively few, now it's available to almost everyone. Special mobile bonusesAs in any sector where there are a wide number of operators, often with very few differences between them, competition is fierce to draw in new business. One strategy that a number of online forex trading platforms use is to offer bonuses for new customers. These can take a number of forms ranging from extra money to invest to cashback to reward customers. If you are considering forex trading online, it's well worth spending a little time exploring the different options available and comparing what they're offering in exchange for your custom. Choosing the right deviceBy its very nature, forex trading involves reading a great deal of information, so smaller mobile screens can make fairly challenging to some to use all the analytical tools available, at least for some. That's why many mobile forex traders favor tablets, simply for the extra control they offer. With the news that the next generation of iPad Pro is rumored to have a laptop-quality keyboard, it looks like the device might become an even better tool for mobile traders. Summing up . . .So there are very many reasons to choose mobile as your preferred method of mobile trading – but the most important of all is that you'll be perfectly placed to take advantage of this fast-moving market whenever, and wherever, you want to. | ||||||||||||||||||||||||||||||

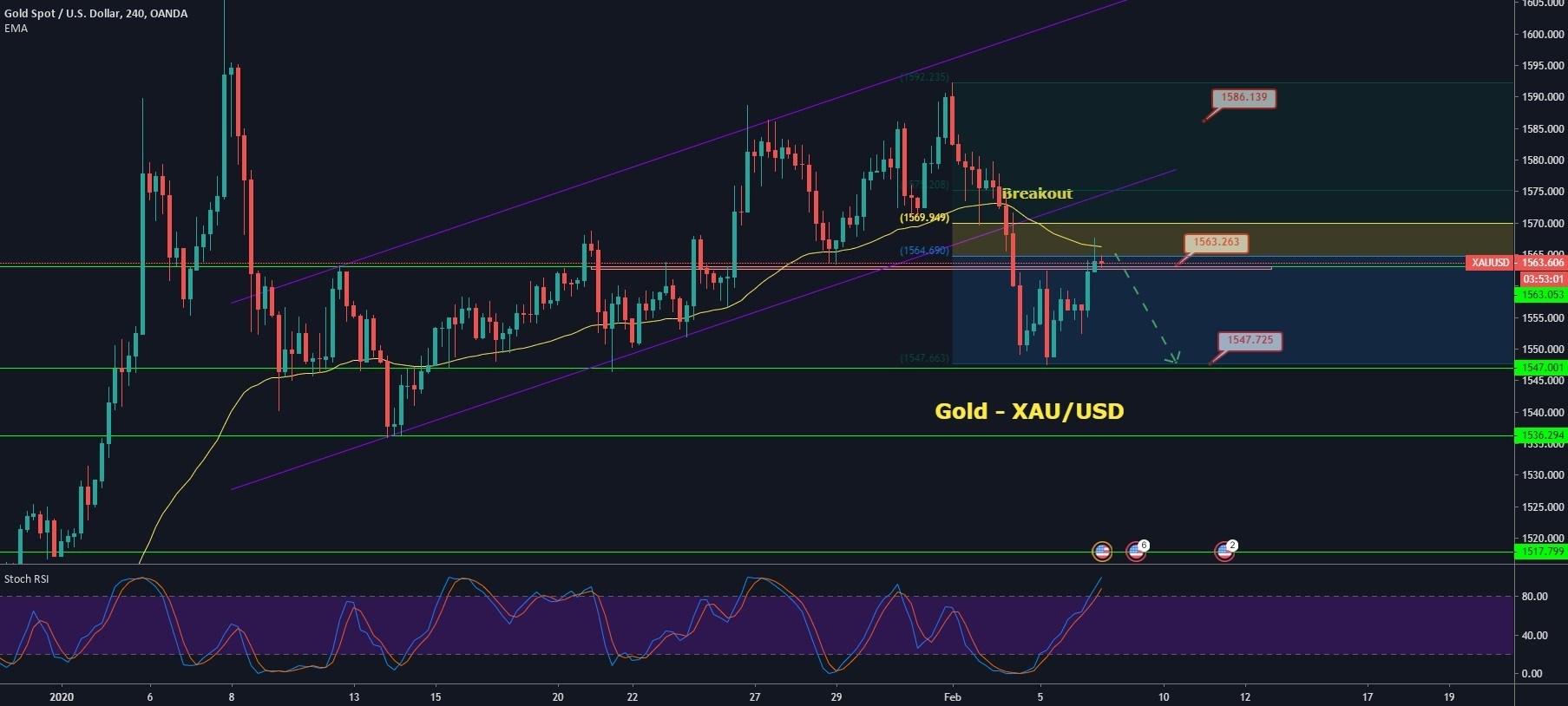

| Top Trade Setups in Forex – Trades Awaits NFP Tomorrow! - FXStreet Posted: 06 Feb 2020 06:56 AM PST The U.S. stocks continued their rally, boosted by upbeat economic data and seemingly-abating worries about China's coronavirus outbreak. Both the S&P 500 (+37 points or 1.1% to 3334) and the Nasdaq 100 (+33 points or 0.4% to 9367) made fresh record closes, and the Dow Jones Industrial Average surged 483 points (+1.7%) to 29290. Research firm Markit will publish January German Construction PMI. The German Federal Statistical Office will report December factory orders (+0.7% on month expected). The U.S. Labor Department will post initial jobless claims in the week ended February 01 (215,000 expected). XAU/USD - 50 EMA Resistance Pushes Gold LowerThe precious metal gold soared higher as traders assessed the economic consequence of the coronavirus revolution as the death losses jumped through 500, but the profits in bullion were capped by China's settlement to halve taxes on U.S. imports. The death losses from the disease in mainland China soared to 563, as authorities stepped up attempts to combat a virus that has shut down Chinese towns and drove thousands more into quarantine encompassing the globe. The latest headline came that the total confirmed cases of the coronavirus infected people from Hubei, the epicenter of the epidemic, has grown to 19,665 on February 05. It was also stated that the cumulative death losses grew to 549 with the latest addition of 70 people. China's total of confirmed coronavirus cases increased to 28,018, with the number of people died due to the contagion rising to 563. On the positive side, the Chinese researchers have produced a medicine that will use in treating the coronavirus. XAU/USD - Daily Technical Levels

XAU/USD - Daily Trade SentimentGold dropped dramatically to examine the support mark of 1,550, and presently it's possible to test the 50% retracement level at 1,566, which may prolong solid resistance to gold today. On the upper side, the resistance is likely to be 1,566, and below this level, the chances of bearish reversal can be seen until 1,555 level today. USD/CAD - Bullish Channel Continues to PlayThe USD/CAD edged up 0.1% to 1.3284. Government data showed that Canada recorded a trade deficit of 370 million Canadian dollars (610 million Canadian dollars deficit estimated). At the coronavirus front, the latest headline came that the total confirmed cases of the coronavirus infected people from Hubei, the epicenter of the epidemic, has risen to 19,665 by the end of February 05. It was also mentioned that the total death losses rose to 549 with the latest addition of 70 people. China's total of confirmed coronavirus cases increased to 28,018 with the number of people died due to the contagion rising to 563. On the positive side, the Chinese researchers have produced a medicine that will use in treating the coronavirus. Oil prices had difficulty in posting a rebound despite reports that the Organization of the Petroleum Exporting Countries (OPEC) and its allies may call for deeper production cuts amid the expectation of lower demand caused by the coronavirus outbreak. Nymex crude oil futures dropped 1.0% to $49.61, and Brent was down 0.9% to $53.96. USD/CAD - Daily Technical Levels

USD/CAD - Daily Trade SentimentThe USD/CAD is trading bullish at 1.3285, holding an immediate resistance nearby 1.3300. The USD/CAD is still retaining the bullish channel that is extending support around 1.3260, alongside the resistance around 1.3345. The USD/CAD is trading below a strong resistance level of 1.3305, which marks the double top pattern has the potential to drive slight retracement until 1.3260, and in case 1.3260 gets violated, we may see further selling until 1.3245. Whereas, the bullish breakout of 1.3304 can drive more buying until 1.3330. AUD/USD – Triangle Pattern BreakoutThe AUD/USD currency pair continues to trade in the bullish territory despite the weaker-than-expected Aussie data release. The currency pair could put further bids if other investment banks also push back rate cut proposals. The AUD/USD currency pair is currently trading at 0.6759, representing 0.14% gains on the day, and the pair consolidates in the range between the 0.675 - 0.6765. At the data front, Australia's Trade Balance dipped to A$ 5,223 million, driven by a 2% rise in imports and a 1% rise in exports. Markets had penciled in a trade surplus of A$ 5,950 million after December's A$ 5,800 million figure. Whereas, consumption, as represented by Retail Sales, declined 0.5% in December, compared to an estimated drop of 0.2% after November's 0.9% rise. It is worth to mention that the reduction in the spending and the decline in the trade surplus did not succeed to push the pair lower, such as the currency pair still trading in the green territory above 0.6750. However, the reason behind the Australian Dollar strength could be the growing discussions that the Reserve Bank of Australias needs further time and definite proof to be assured that the on-going coronavirus is creating a deeper economic slowdown. The RBA may keep the rate unchanged for an extended period. Meanwhile, several investment banks are still expecting for the rate cut by the Reserve Bank of Australia in the 2nd-quarter, while the Goldman Sachs thinks that the central bank will likely keep the rate unchanged until any noticeable declines have not come in the labor market. AUD/USD - Technical Levels

AUD/USD - Daily Trade SentimentThe AUD/USD is trading sideways below a strong double top resistance level of 0.6775. The AUD/USD is facing support around 0.6685, which is the same level from where AUD/USD bounced off yesterday. The AUD/USD has also formed a downward channel, which is extending resistance at 0.6785 along with support at 0.6645. Today, I will be looking for a bearish trade below 0.6770 as the RSI and Stochastics are heading below 50, into the selling zone. Try Secure Leveraged Trading with EagleFX! |

| You are subscribed to email updates from "forex trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment