10 Best ECN Brokers for Retail Traders in 2024 - Techopedia

ECN brokers give you access to the Electronic Communications Network – which is used by banks and other institutional traders. Therefore, ECN accounts offer the lowest spreads in the global forex markets.

This guide compares the 10 best ECN brokers in 2024. Our impartial reviews cover the most important metrics – including account minimums, average spreads, commissions, available pairs, and margin requirements.

The Top 10 ECN Brokers Ranked

The 10 best ECN brokers for 2024 are ranked on the list below:

- Pepperstone: Top-rated forex broker with ECN-like pricing, Pepperstone offers razor accounts with 0.0 pip spreads on selected major and minor pairs. Commissions amount to $3.50 per traded lot, per slide. There's no minimum deposit requirement at Pepperstone and multiple payment types are supported. More than 60 currency pairs are available and leverage of up to 1:200 is offered to eligible clients.

- Tickmill: Established forex broker offering spreads from 0.0 pips and competitive commissions of 2 units per 100,000 traded, per slide. Tickmill supports 62 forex pairs, alongside stocks, bonds, commodities, and other assets. The minimum deposit to access the Electronic Communications Network is just $100. Eligible clients can trade with leverage of up to 1:500 and both MT4 and MT5 are supported.

- IC Markets: Trade 61 forex pairs with spreads starting from 0.0 pips. IC Markets charges a standard commission of $3.50 per traded lot, per slide. It offers tier-one liquidity and fast execution speeds, making the broker ideal for scalpers and high-frequency trading. IC Markets has a minimum deposit requirement of $200 and leverage of up to 1:1000 is available. Other supported markets include stocks, commodities, and cryptocurrencies.

- FXTM: Offers two ECN accounts to choose from, with minimum deposit requirements starting at just $200. Traders can select an account based on their preferred spread/commission structure. There's also a professional account with 0.0 pip spreads and 0% commission, but this requires at least $25,000. FXTM is another high-leverage broker, with minimum margin requirements of just 0.1%.

- FP Markets: This ECN broker offers fast execution speeds that average just 40 milliseconds. Its tier-one liquidity providers ensure traders get the most competitive spreads at all times. Raw accounts come with minimum spreads of 0.0 pips and a standard commission of $2 per traded lot, per slide. FP Markets supports over 70 currency pairs, including plenty of exotic markets. Leverage of up to 1:500 is available, but only to those covered by FSCA regulation.

- Eightcap: Open an ECN account from just $100 without paying deposit fees. Beginners will appreciate Eightcap's free demo accounts, which can be used across MT4 and MT5. Eightcap supports over 800 financial markets, covering forex, stocks, commodities, and cryptocurrencies. Additional features include market insights, educational tools, and an AI-powered economic calendar.

- Interactive Brokers: Seasoned currency traders from the US will be suited for Interactive Brokers. It offers an advanced proprietary platform – IBKR TWS, which comes packed with high-level analysis tools. Interactive Brokers supports over 100 forex pairs and commissions start from just 0.008 basis points. Spreads are the best in the industry, with Interactive Brokers connecting to 17 of the world's largest currency exchange dealers.

- Exness: Trade the world's top 30 financial instruments without paying any spreads – including major pairs like EUR/USD. Commissions are super-low at Exness, costing just $0.20 per traded lot, per slide. There's a minimum deposit requirement of $1,000, although eligible clients can trade forex with unlimited leverage.

- InstaForex: Access spreads of 0.0 pips on major forex pairs, with commissions costing between 0.03% and 0.07%. InstaForex is ideal for budget-conscious investors, as the minimum deposit requirement is just $1. More than 30 payment methods are accepted, including debit/credit cards and local bank transfers. InstaForex supports 108 pairs, in addition to stocks, commodities, and futures.

- RoboForex: This popular broker offers ECN accounts without a minimum deposit requirement. RoboForex charges a $20 commission for every $1 million traded, which is competitive. Spreads start from 0.0 pips but ECN accounts only support 36 currency pairs. RoboForex offers leverage of up to 1:500 to eligible clients, and both MT4 and MT5 are supported.

Best ECN Forex Brokers Reviews

The forex ECN brokers listed above will now be reviewed in full. Read on to choose the most suitable broker for your requirements.

1. Pepperstone – Regulated Broker Offering ECN-Like Pricing With 0.0 Pip Spreads and No Intermediary

Pepperstone is one of the best forex brokers in the market. It supports more than 60 currency pairs, covering all majors and minors – plus selected exotics. Pepperstone's razor account offers ECN-like pricing, so you'll benefit from some of the best spreads available. For example, pairs like GBP/USD, USD/JPY, AUD/CAD, EUR/USD, and USD/CHF come with minimum spreads of 0.0 pips.

Other popular pairs, such as USD/CAD and EUR/GBP, start from just 0.1 pips. In terms of commissions, you'll pay $3.50 per traded lot, per slide. Non-USD quoted pairs are charged the currency equivalent. For instance, GBP pairs are charged £2.50. Although Pepperstone isn't a 'true' ECN broker, its framework operates like one.

For example, there are no intermediaries providing prices and it doesn't run a proprietary trading book. On the contrary, tier-one liquidity providers supply real-time quotes via the Electronic Communications Network. This means that Pepperstone traders pay exactly the same rates as banks and other institutions. Unlike traditional ECN accounts, Pepperstone doesn't have a high minimum deposit.

In fact, Pepperstone allows you to get started with any amount you're comfortable with. Accepted payment types include debit/credit cards and e-wallets, and there are no deposit fees charged. In addition to forex, Pepperstone also supports other asset classes. This includes commodities like gold, silver, oil, natural gas, and coffee.

Indices are also supported, as are individual stocks. This covers stock exchanges from the US, UK, Hong Kong, Germany, and Australia. Pepperstone offers leverage on all supported markets. That said, limits depend on which financial regulator you fall under. For example, retail clients protected by the FCA(UK), ASIC (Australia), or DFSA (Dubai) are capped at 1:30.

Accounts covered by the SCB (Bahamas) can trade with leverage of up to 1:200. When it comes to trading platforms, Pepperstone supports cTrader, MT4, MT5, and TradingView. It doesn't have a native trading suite, which could be considered a drawback. Moreover, all financial instruments are backed by contracts-for-differences (CFDs), so US clients cannot open an account.

| No. Pairs | 60+ |

| Other Assets | Stocks, ETFs, commodities, indices, cryptocurrencies |

| Commission | $3.50 per traded lot, per slide (currency equivalent on non-USD quoted pairs) |

| EUR/USD Spread | From 0.0 pips |

| Platforms | cTrader, MT4, MT5, TradingView |

| Max. Leverage | 1:200 (country-specific) |

| US Clients? | No, not accepted |

Pros

- ECN-like pricing with spreads starting from 0.0 pips

- Competitive commissions of $3.50 per traded lot, per slide

- Regulated by multiple tier-one bodies – including the FCA, ASIC, and DFSA

- Rated 4.6/5 on TradingView and 4.5/5 on TrustPilot

- Leverage of up to 1:200 for clients falling under SCB regulation

Cons

- Not a 'true' ECN broker by definition

- All markets are backed by CFD instruments – so US clients are not accepted

75.6% of retail investor accounts lose money when trading CFDs with this provider.

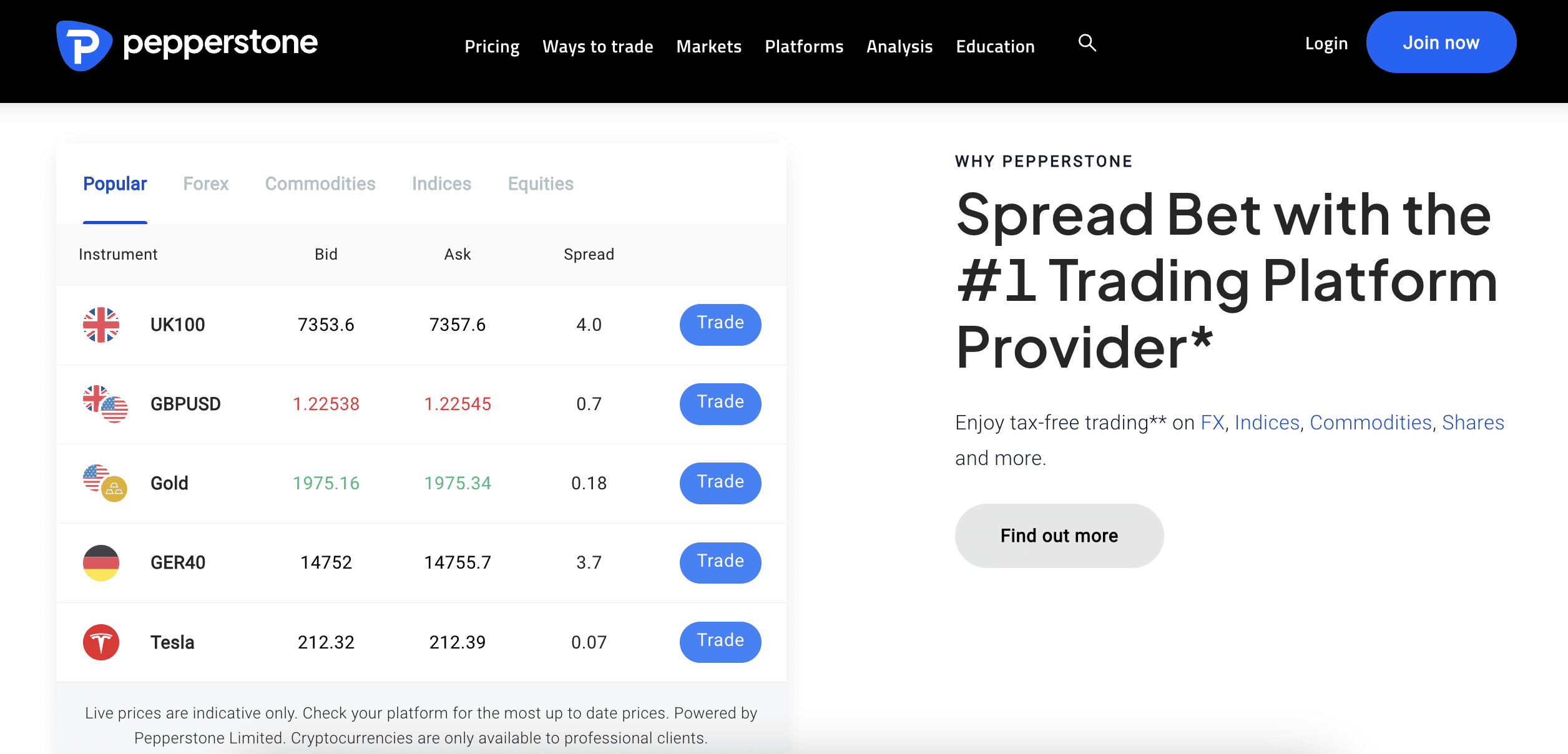

2. Tickmill – Competitive Commission of $2 per Traded Lot and Leverage of up to 1:500

Tickmill is also considered one of the best ECN brokers in the market. You'll need to open a pro account to access the Electronic Communications Network. This requires a small minimum deposit of $100 or the currency equivalent. Accepted base currencies include USD, EUR, GBP, and ZAR.

Tickmill supports 62 currency pairs and the minimum trade size is 0.01 lots. In terms of pricing, spreads start from 0.0 pips on majors and selected minors. That said, specific spreads are determined by the Electronic Communications Network. Commissions are very competitive at Pepperstone; you'll pay just 2 currency units per 100,000 traded. For example, if you're trading EUR/USD, that's just $2 per $100,000, per slide.

Tickmill is also one of the best high-leverage brokers. The maximum leverage available is 1:500. However, country-specific restrictions are in place if you're a retail client. When it comes to platforms, Tickmill supports MT4 and MT5 on all available devices. It also offers an iOS and Android app for mobile trading, which is proprietary.

Tickmill is also popular for its educational resources. It offers ebooks, seminars, webinars, and a forex glossary. It also offers market insights, forex calculators, and an economic calendar. Tickmill also supports other asset classes, which are backed by CFDs. This includes stocks, bonds, commodities, indices, and some of the best cryptocurrencies to trade. No commissions are charged on non-forex markets.

| No. Pairs | 62 |

| Other Assets | Stocks, ETFs, commodities, bonds, indices, cryptocurrencies |

| Commission | 2 currency units per traded lot, per slide |

| EUR/USD Spread | From 0.0 pips |

| Platforms | MT4, MT5, Proprietary app for iOS and Android |

| Max. Leverage | 1:500 (country-specific) |

| US Clients? | No, not accepted |

Pros

- Competitive forex commissions of 2 currency units per lot, per slide

- Supports 62 currency pairs

- Leverage of up to 1:500 for eligible clients

- Reasonable minimum deposit of $100

- Trade forex on MT4 or MT5

Cons

- Doesn't offer a proprietary desktop platform – mobile app only

- Live customer support isn't available 24/7

Trading financial products on margin carries a high degree of risk and is not suitable for all investors

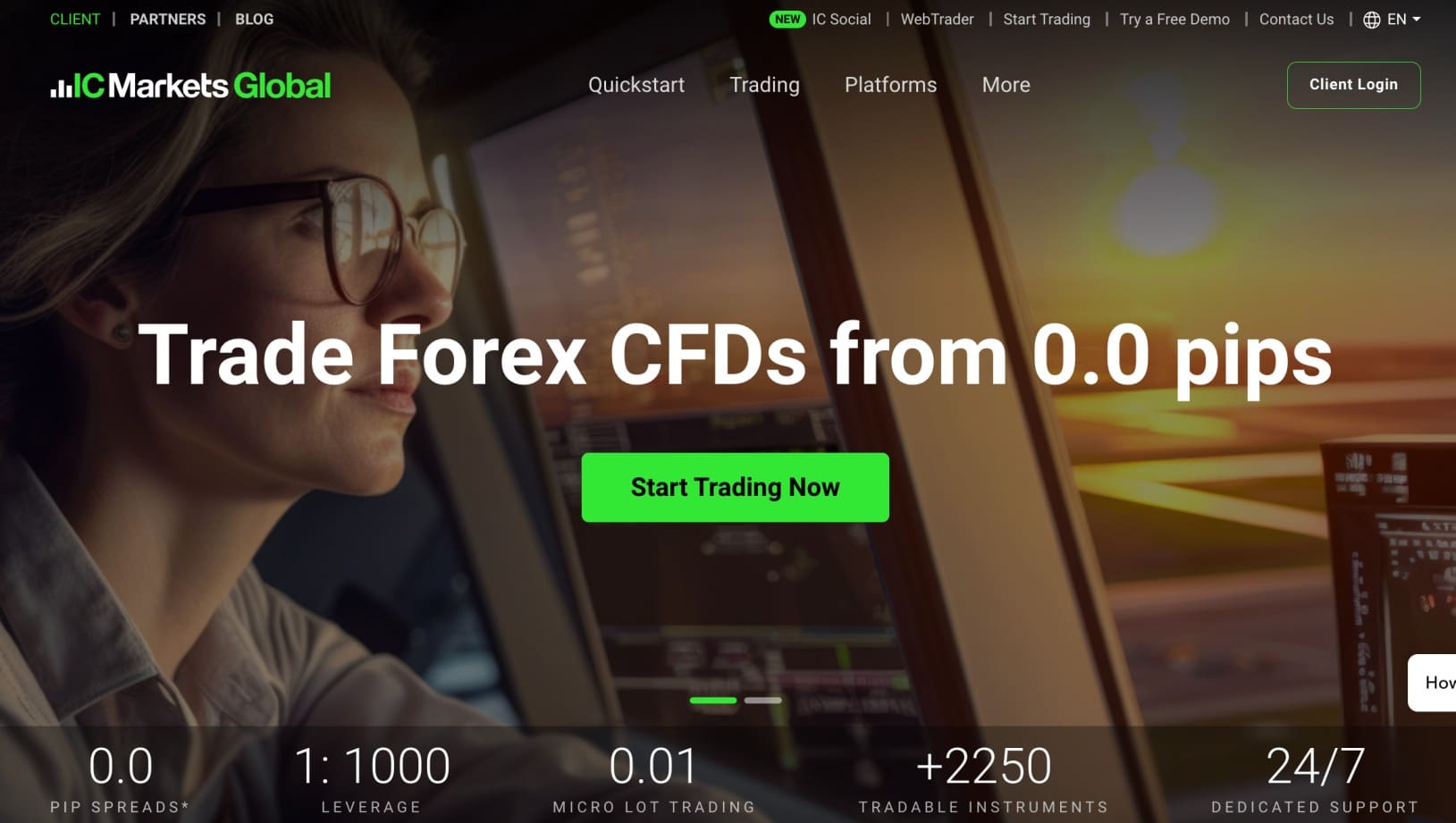

3. IC Markets – ECN Accounts With Minimum Margin Requirements of Just 0.1%

IC Markets offers raw spread accounts that connect to the Electronic Communications Network without any intermediary or dealing desk. Therefore, traders secure the same spreads as other market participants. IC Markets only deals with tier-one liquidity providers, so the best spreads are available around the clock. According to IC Markets, the average spread on EUR/USD is 0.1 pips.

That said, during busy hours (e.g. the London/New York crossover), this is reduced to 0.0 pips. There is a standard commission of $3.50 per traded lot, per slide. The average trade latency at IC Markets is just 1 millisecond, making the broker ideal for scalping and high-frequency trading. In terms of supported currencies, IC Markets lists 61 forex pairs.

It also supports stocks, commodities, indices, cryptocurrencies, and futures. IC Markets is also a high-leverage broker; forex can be traded with a margin requirement of just 0.1%. This means that for every $1,000 traded, you'd need just $1 in your brokerage account. IC Markets doesn't offer a native trading suite, but it does support popular third-party platforms. This includes cTrader, MT4, and MT5.

We also like that IC Markets offers a free demo account. This takes less than 30 seconds to open and there's no requirement to make a deposit. If you're looking to get started with real money, IC Markets accepts debit/credit cards and e-wallets like Neteller, Skrill, and PayPal. The minimum first-time deposit is $200 or the currency equivalent.

| No. Pairs | 61 |

| Other Assets | Stocks, commodities, indices, cryptocurrencies, futures |

| Commission | $3.50 per traded lot, per slide |

| EUR/USD Spread | From 0.0 pips |

| Platforms | cTrader, MT4, and MT5 |

| Max. Leverage | 1:1000 (country-specific) |

| US Clients? | No, not accepted |

Pros

- Best ECN forex broker for high leverage (up to 1:1000)

- 0.0 pip forex spreads with commissions of $3.50 per traded lot, per slide

- Fast execution speeds of just 1 millisecond

- Popular with scalpers and high-frequency trading strategies

- Also one of the best MT5 brokers

Cons

- US clients are not accepted

- Only supports third-party trading platforms

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose.

4. FXTM – 2 ECN Forex Accounts to Choose From With Competitive Pricing and Support for 48 Pairs

ForexTime (FXTM) is an established forex broker that supports 48 currency pairs. It offers two account types that offer access to the Electronic Communications Network. First, there's the standard ECN account – which comes with a $500 minimum deposit. This offers a minimum spread of 0.1 pips. There's also a small commission of $2 per traded lot, which is competitive.

The standard ECN account also comes with a demo facility. This enables you to trade forex with paper funds, while still accessing the live markets. The second option is the ECN zero account. This comes with a smaller minimum deposit requirement of $200. Unlike the standard ECN account, there are no trading commissions charged.

However, the minimum spread is 1.5 pips. Both the standard and zero ECN accounts also come with swap-free trading when using MT4. MT5 is also supported, but this comes with standard overnight financing fees. We should also mention the FXTM pro account, which is aimed at professional traders.

This still falls under the ECN umbrella but requires a minimum deposit of $25,000. This account offers spreads from 0.0 pips and there are no commissions to pay. The likelihood is that FXTM makes money from overnight financing on this account type. FXTM also supports other financial instruments, should you wish to diversify. This included stocks, commodities, and indices.

| No. Pairs | 48 |

| Other Assets | Stocks, commodities, indices, cryptocurrencies |

| Commission | ECN standard ($2 per traded lot, per slide), ECN zero ($0), FXTM pro ($0) |

| EUR/USD Spread | ECN standard (0.1 pips), ECN zero (1.5 pips), FXTM pro (0.0 pips) |

| Platforms | MT4, and MT5 |

| Max. Leverage | 1:2000 (country-specific) |

| US Clients? | No, not accepted |

Pros

- Retail clients have 2 ECN accounts to choose from

- Professional traders are also catered for

- Leverage of up to 1:2000 offered to eligible traders

- Client funds are segregated and covered by insurance

Cons

- Traders from the US, New Zealand, Hong Kong, and other countries are not accepted

- Only supports MT4 and MT5

Trading is risky. Your capital is at risk.

5. FP Markets – Regulated Forex Broker With ECN Accounts and Ultra-Fast Execution Speeds

FP Markets is a reputable trading platform that holds brokerage licenses from multiple bodies. This includes ASIC (Australia), FSCA (South Africa), and CySEC (Cyprus). Those falling within the remit of ASIC or CySEC will be capped to leverage of 1:30. This is increased to 1:500 for those covered by FSCA. Nonetheless, FP Markets offers two accounts, both offering ECN pricing.

The first option is the raw account. This comes with a minimum spread of 0.0 pips. Commissions are reasonable at just $3 per traded lot, per slide. The second option is the standard account. Although this offers commission-free trading, spreads start from 1 pip. Both accounts have a minimum trade requirement of 0.01 lots.

The minimum deposit is just $100 and multiple payment methods are accepted. This includes debit/credit cards, bank wires, and selected e-wallets. Although deposits are free, some payment types attract withdrawal fees. In terms of markets, this popular trading platform supports over 70 forex pairs.

Other financial instruments are also covered, including commodities, stocks, cryptocurrencies, and indices. Although FP Markets supports all device types, it doesn't have a native trading suite. Instead, you'll need to choose from MT4, MT5, or cTrader. We also found that FP Markets is one of the best ECN brokers for execution speeds – trades average just 40 milliseconds.

| No. Pairs | 70+ |

| Other Assets | Stocks, commodities, indices, cryptocurrencies, bonds, ETFs |

| Commission | Raw ($3 per traded lot, per slide), Standard ($0) |

| EUR/USD Spread | Raw (0.0 pips), Standard (1 pip) |

| Platforms | cTrader, MT4, and MT5 |

| Max. Leverage | 1:500 (country-specific) |

| US Clients? | No, not accepted |

Pros

- Spreads start from 0.0 pips

- Raw account commissions cost just $3 per traded lot, per slide

- More than 70 forex pairs are supported

- All account types come with a minimum deposit requirement of $100

- No deposit fees are charged

Cons

- Some payment methods attract withdrawal fees

- Retail traders covered by ASIC and CySEC are limited to leverage of 1:30

Derivative products are highly leveraged, carry a high level of risk and may not be appropriate for all investors.

6. Eightcap – User-Friendly ECN Broker With Trade Minimums of 0.01 Lots

Eightcap is one of the best ECN brokers for forex traders on a budget. After opening a raw account, you'll only need to deposit $100 to start trading. What's more, the minimum trade requirement is just 0.01 lots, so that's $1,000 on USD-quoted pairs. That said, eligible clients can trade forex with leverage of up to 1:500. This reduces the minimum trade size to just $2.

Eightcap's raw accounts connect to the Electronic Communications Network, so spreads start from 0.0 pips. There is a commission of $3.50 per traded lot, per slide. Although Eightcap also offers a commission-free account, this doesn't come with ECN pricing. Eightcap is also a good option if you want to practice trade or try new forex strategies.

This is because users can open up to six demo accounts between MT4 and MT5. You'll have an unlimited amount of paper funds at your disposal, but demo accounts expire after 30 days. Eightcap supports over 800 financial markets in total. This includes dozens of forex pairs, plus cryptocurrencies, stocks, indices, and commodities. Eightcap connects to MT4, MT5, and TradingView.

| No. Pairs...

|

Comments

Post a Comment