London forex trading boss fined for unauthorised WhatsApp investment advice - City A.M.

London forex trading boss fined for unauthorised WhatsApp investment advice - City A.M. |

- London forex trading boss fined for unauthorised WhatsApp investment advice - City A.M.

- FOREX-Dollar gains as U.S. recovery bets stoke Treasury yields - Investing.com India

- Analysis: Swiss Forex Traders Investing More Again - Finance Magnates

- FX Trader Who Posted WhatsApp Advice Ordered to Return $727000 - Bloomberg

| London forex trading boss fined for unauthorised WhatsApp investment advice - City A.M. Posted: 26 Mar 2021 02:35 AM PDT  The High Court has fined the boss of a Bow-based forex trading business after it provided unauthorised investment advice to customers via WhatsApp. Mohammed Fuaath Haja Maideen Maricar was ordered to pay restitution in excess of £530,000. The recovered fund will be distributed customers. Read more: FCA gives tentative go ahead on Amigo's compensation scheme The court found 24HR Trading, an unregulated firm, unlawfully provided trading signals to customers for a fee. The trading signals were sent via WhatsApp and contained recommendations about contracts for difference (CFDs) relating to currencies and commodities. The court found these signals amounted to unlawful investment advice. Unauthorised investment advice exposes consumers to risk of substantial losses because the adviser has not met the financial watchdog's tests of competence and fitness. Nor do customers have access to lifeboat schemes if things go wrong. 24HR Trading also encouraged customers to open trading accounts with 'partnered brokers' to place their CFD trades. Maricar received a significant sign-up bonus and other commissions from these brokers. Read more: Gut instinct and social media drives young people to risky investment decisions, warns FCA Financial Conduct Authority (FCA) executive director of enforcement and market oversight Mark Steward said: "Neither 24HR Trading nor Mr Maricar were permitted to give investment advice which, in this case, included sending trading signals via social media and their conduct risked substantial losses for customers. "We urge consumers to make sure they are dealing with FCA authorised firms when seeking investment advice, including offers to provide tips or signals via social media apps, and to stay clear of unauthorised operators like 24HR Trading and Mr Maricar." 24HR Trading could not be reached for comment. |

| FOREX-Dollar gains as U.S. recovery bets stoke Treasury yields - Investing.com India Posted: 30 Mar 2021 02:01 AM PDT  * Graphic: World FX rates https://tmsnrt.rs/2RBWI5E By Iain Withers LONDON, March 30 (Reuters) - The dollar gained against major currencies on Tuesday and climbed to a one-year high against the yen, as accelerating U.S. vaccinations and plans for a major stimulus package stoked inflation expectations and Treasury yields. The safe-haven greenback found support across the board as investors also digested the fallout from the collapse of highly leveraged investment fund Archegos Capital. rose above the 93 mark and was last up around a quarter of a percent at 93.122, its highest level in four months. =USD The greenback rose above 110 yen, a level not seen since March last year. It is on track for the best month since late 2016, with the end of Japan's fiscal year this month driving up dollar demand as companies square their books. Analysts said the yen was also vulnerable to higher inflation expectations in the U.S. than Japan and a rise in long-term U.S. yields. rose to 14-month highs on Tuesday, the day before President Joe Biden is set to outline how he would pay for a $3 trillion to $4 trillion infrastructure plan. has by far the highest correlation amongst G10 currencies with long-term US yields," said Lee Hardman, currency economist at MUFG in a note. "Upward pressure on long-term US yields is expected to be supported by another fiscal stimulus policy announcement from the Biden administration." The euro also weakened on the day to $1.17335, its lowest level since November. Tougher coronavirus curbs in France and Germany have dimmed the short-term outlook for the European economy, while a widening spread between U.S. and German bond yields is adding pressure on the single currency. The monthly U.S. non-farm payrolls report will be closely watched at the end of this week, with Federal Reserve policymakers so far citing slack in the labour market for their continued lower-for-longer stance on interest rates. "In a week when the market is feeling so optimistic about the forthcoming payrolls release, it seems very likely that the greenback will find strong support," Rabobank currency strategist Jane Foley wrote in a report. However, "the market is in danger of pricing in too much inflation risk," meaning "we see scope for the USD to soften in the months ahead," the report said. <^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ World FX rates https://tmsnrt.rs/2RBWI5E ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> |

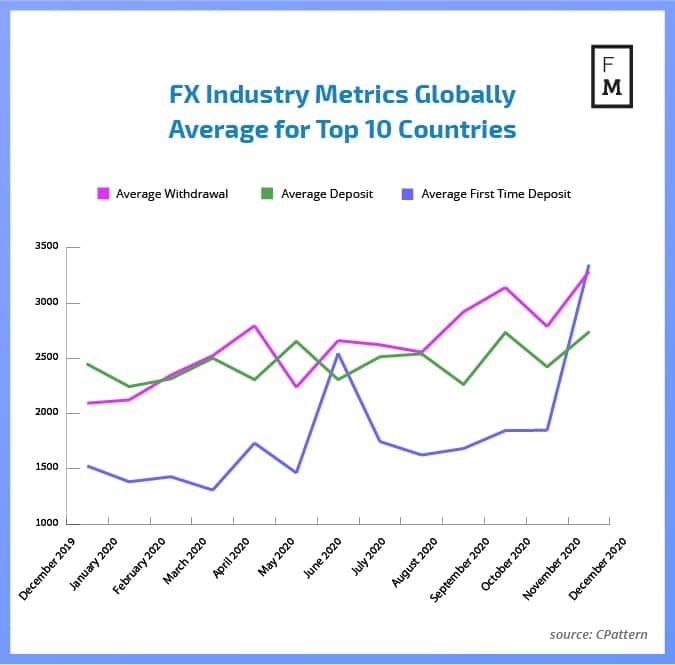

| Analysis: Swiss Forex Traders Investing More Again - Finance Magnates Posted: 08 Mar 2021 05:55 AM PST  In December 2020, the retail forex industry witnessed solid growth in all three major areas of customer-related operations covered by our cyclical analysis. At the same time, 2020 came to an end marking an overall annual improvement over 2019. The first thing that stands out in the December data, shared with Finance Magnates Intelligence by cPattern, is growth in account funding values. The average single deposit to accounts grew from $2,423.14 to $2,738.20. Even bigger growth was registered in the case of withdrawals where single pay-outs from accounts grew from $2,788.60 to a level of $3,286.34.

However, the most impressive improvement was seen in the First Time Deposits(FTD) value, which in December skyrocketed from $1,849.03 to $3,348.30. What is interesting is that the first two places in the FTD rank were taken by Asian countries, Hong Kong and Taiwan, with results of $4,755.00 and $4,384.70, respectively. Maybe even more interesting is the fact that Brazil, the country with a challenging regulatory situation, was third with an average FTD at $4,311.80.

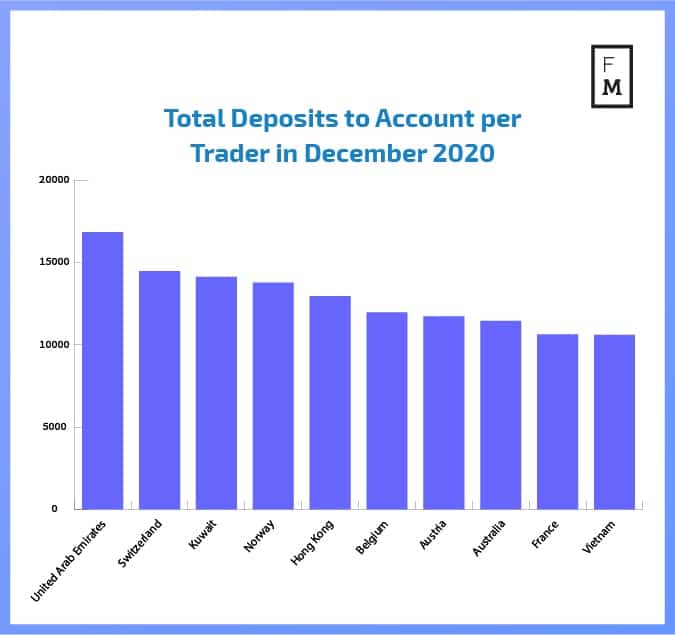

Suggested articlesHow are Different Technologies Impacting the Lives of Traders & Brokers?Go to article >> Traditionally, the biggest total deposits made throughout the whole of December were made by traders from the United Arab Emirates. On average, these traders left $16,844.00 in their accounts and were closely followed by Swiss traders. Retail FX accounts in Switzerland were found with an average amount of $14,479.00 in December. Swiss Retail Forex Industry ReboundsIt is good to see retail forex trading improving in Switzerland. Recently, this country has caught the attention of the financial industry with developments in new technologies. Local broker Swissquote announced in December that it has partnered with the world's largest electric car manufacturer, Tesla to increase its services in the credit sector. The broker said it was launching a new digital leasing offering in cooperation with Tesla to help Swiss clients interested in purchasing new cars. This is the latest publication from the Finance Magnates Intelligence on key customer-related data. In today's business world, big-data analysis and access to objective information sources are crucial for success. Are you trying to understand the industry? Do you plan to expand your business to new markets? To get the bigger picture of the FX/CFD industry in chosen countries and metrics, contact our Intelligence Department. |

| FX Trader Who Posted WhatsApp Advice Ordered to Return $727000 - Bloomberg Posted: 25 Mar 2021 10:04 AM PDT [unable to retrieve full-text content]FX Trader Who Posted WhatsApp Advice Ordered to Return $727000 Bloomberg |

| You are subscribed to email updates from "investing forex" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment