FOREX-Dollar hits fresh highs on U.S. recovery bets, yield support - Investing.com India

FOREX-Dollar hits fresh highs on U.S. recovery bets, yield support - Investing.com India |

- FOREX-Dollar hits fresh highs on U.S. recovery bets, yield support - Investing.com India

- Analysis: Swiss Forex Traders Investing More Again - Finance Magnates

- Why Is Forex Trading So Popular? - NuWireInvestor - NuWire Investor

- FOREX-Dollar finds footing on U.S. economy as euro falters - Investing.com India

| FOREX-Dollar hits fresh highs on U.S. recovery bets, yield support - Investing.com India Posted: 31 Mar 2021 01:19 AM PDT  * Dollar marks fresh 1-year high vs. yen * Euro hits 5-month low vs. dollar * Graphic: World FX rates https://tmsnrt.rs/2RBWI5E By Ritvik Carvalho LONDON, March 31 (Reuters) - The dollar hit a fresh one-year high versus the yen and multi-month peaks with other rivals on Wednesday as investors bet that massive fiscal stimulus and aggressive vaccinations will help the United States lead a global pandemic recovery. President Joe Biden is set to outline later on Wednesday how he intends to pay for a $3-$4 trillion infrastructure plan, after earlier this week saying 90% of adult Americans would be eligible for vaccination by April 19. =USD rose as far as 93.439, the highest in almost five months. It has climbed from close to 90 at the start of March, on course for its best month since 2016. The greenback set a fresh one-year top of 110.97 yen and marked an almost five-month high of $1.1705 per euro , although it gave up some of those gains in early deals in London. The dollar was also supported from a spike in U.S. bond yields, which make the currency more attractive as an investment. The yield on the benchmark 10-year Treasury note jumped to a one-year high of 1.776% on Tuesday. "With U.S. Treasuries meaningfully under pressure yesterday, the environment is clearly supportive for the U.S. dollar, particularly as Europe continues to battle with a third Covid wave," said ING's global head of markets, Chris Turner, in a note to clients. "Still, Europe should see an economic rebound in late 2Q as the vaccination process gathers pace and US Treasury moves should become less erratic (vs. the scale of the move in February, particularly when the infrastructure spending is expected to be accompanied by $1.8tn worth of tax hikes – as per media reports yesterday)." Investors will watch closely monthly U.S. nonfarm payrolls data on Friday, with Federal Reserve policymakers so far citing slack in the jobs market for their continued lower-for-longer stance on interest rates, which has boosted the growth outlook but also stoked worries about inflation. Data overnight showed U.S. consumer confidence soared this month to the highest since the start of the pandemic, supporting views that economic growth will accelerate in the coming months, driven by more fiscal stimulus and an improving public health situation. dollar edged up to $0.76085, consolidating after its drop to $0.7564 last week, the lowest level seen this year. The Chinese yuan CNH= traded around 6.57 per dollar in the offshore market, from the weakest since November at 6.5838, touched on both Monday and Tuesday. briefly topped $59,000, trying to close the distance to the record peak at $61,781.83 set earlier this month. PayPal Holdings said Tuesday it launched a "Checkout with Crypto" service, which will allow U.S. users to use their cryptocurrency holdings to pay online merchants worldwide, adding to the growing global acceptance of the digital tokens on both Wall Street and Main Street. "The big companies have to question whether they can afford to ignore it anymore," Julius de Kempenaer, senior analyst at StockCharts.com, said about bitcoin, which has already doubled in value this year. He said his first target was for the token to rise above $70,000, but that considering the current momentum, "the best thing to do is just follow the trend and let the market tell you where it's going to end." <^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ World FX rates https://tmsnrt.rs/2RBWI5E ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> |

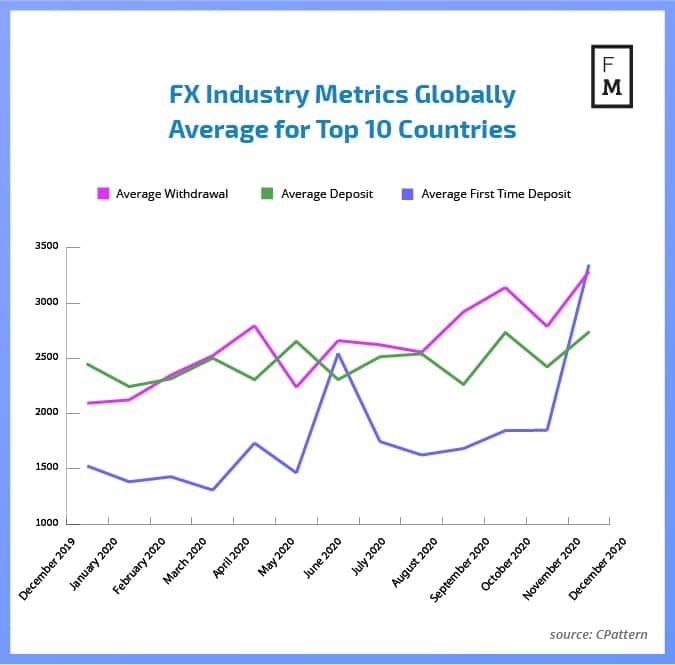

| Analysis: Swiss Forex Traders Investing More Again - Finance Magnates Posted: 08 Mar 2021 12:00 AM PST  In December 2020, the retail forex industry witnessed solid growth in all three major areas of customer-related operations covered by our cyclical analysis. At the same time, 2020 came to an end marking an overall annual improvement over 2019. The first thing that stands out in the December data, shared with Finance Magnates Intelligence by cPattern, is growth in account funding values. The average single deposit to accounts grew from $2,423.14 to $2,738.20. Even bigger growth was registered in the case of withdrawals where single pay-outs from accounts grew from $2,788.60 to a level of $3,286.34.

However, the most impressive improvement was seen in the First Time Deposits(FTD) value, which in December skyrocketed from $1,849.03 to $3,348.30. What is interesting is that the first two places in the FTD rank were taken by Asian countries, Hong Kong and Taiwan, with results of $4,755.00 and $4,384.70, respectively. Maybe even more interesting is the fact that Brazil, the country with a challenging regulatory situation, was third with an average FTD at $4,311.80.

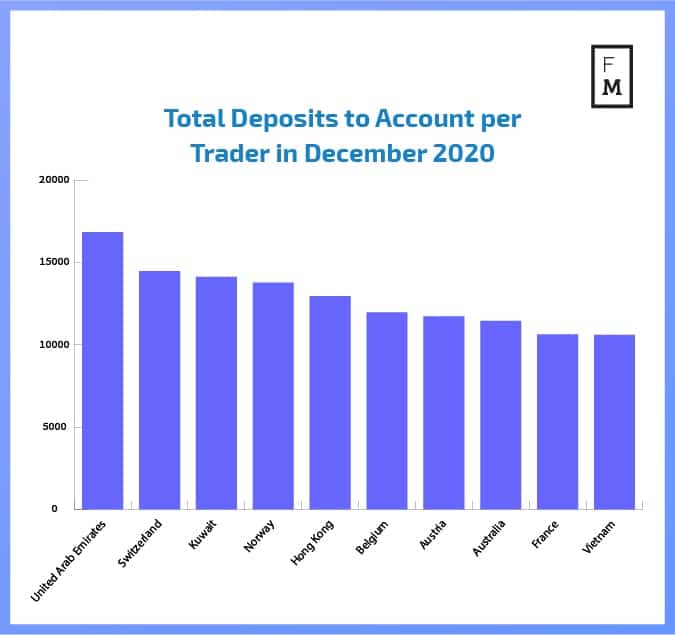

Suggested articlesMarket Outlook for Q2 2021Go to article >> Traditionally, the biggest total deposits made throughout the whole of December were made by traders from the United Arab Emirates. On average, these traders left $16,844.00 in their accounts and were closely followed by Swiss traders. Retail FX accounts in Switzerland were found with an average amount of $14,479.00 in December. Swiss Retail Forex Industry ReboundsIt is good to see retail forex trading improving in Switzerland. Recently, this country has caught the attention of the financial industry with developments in new technologies. Local broker Swissquote announced in December that it has partnered with the world's largest electric car manufacturer, Tesla to increase its services in the credit sector. The broker said it was launching a new digital leasing offering in cooperation with Tesla to help Swiss clients interested in purchasing new cars. This is the latest publication from the Finance Magnates Intelligence on key customer-related data. In today's business world, big-data analysis and access to objective information sources are crucial for success. Are you trying to understand the industry? Do you plan to expand your business to new markets? To get the bigger picture of the FX/CFD industry in chosen countries and metrics, contact our Intelligence Department. |

| Why Is Forex Trading So Popular? - NuWireInvestor - NuWire Investor Posted: 17 Mar 2021 02:56 PM PDT  Over the years, forex trading has become increasingly popular with people from all walks of life. There are many people who have been involved with this type of trading for many years, and others who are completely new to it. This is a global market and a type of trading that people participate in around the globe. There are also many resources to help those who want to trade such as demo accounts and forex brokers, which you can find out more about here. For those who are interested in finding a means of investing money, forex is often one of the first options. Even those who know little about forex often decide to invest after doing some research and trying it out for themselves using demo accounts. There are many benefits of forex trading and many reasons why it has become such a popular choice. In this article, we will look at why forex trading has become so popular. What Are the Benefits of This Type of Trading? There are many benefits that have made forex trading such a popular choice with investors from a wide range of backgrounds. Some of these are: Global Market with Plenty of Opportunities One of the reasons behind the popularity of forex trading is that it is a global market with people trading around the world. Each day, trillions of dollars are exchanged, and this can be done at all hours of the day or night. So, this means that there are plenty of opportunities for investors and lots of scope when it comes to making money and increasing wealth. Easy to Get Into Another benefit is that this is an easy type of trading for beginners to get into. First off, the initial costs are not high, so this means that you can try forex trading even if you do not have lots of spare cash that you can put at risk. In addition, you can get to learn all about forex trading with demo accounts that can be accessed with ease online. So, it is easy to enter forex trading, and you do not have to worry about huge investments. Around the Clock Trading Many people like the fact that forex trading is around the clock, and this is because it is a global market. This is ideal for those who want to get involved in trading but also want some level of flexibility. A lot of people like the fact that there are rolling hours where transactions can take place somewhere across the globe. Low Costs Involved The low costs involved in forex trading is another factor that many find appealing. You do not have to make huge transactions, and you can learn how to trade on demo accounts free of charge. In addition to this, the transaction costs on trades are pretty low, and this is another financial benefit that traders can look forward to. These are just a few of the reasons why forex trading has become so popular. |

| FOREX-Dollar finds footing on U.S. economy as euro falters - Investing.com India Posted: 28 Mar 2021 10:40 PM PDT  * Dollar inches higher in Asia; EUR and JPY near major lows * AUD, NZD begin to hand back small Friday gains * Graphic: World FX rates https://tmsnrt.rs/2RBWI5E By Tom Westbrook SINGAPORE, March 29 (Reuters) - The dollar began the week on a firm footing, inching toward a milestone peak against the euro on Monday, as a cautious market mood pushed investors to safety while U.S. economic strength and a rapid vaccine rollout also added to the greenback's shine. The euro was down 0.1% in the Asia session at $1.1783, not far above last week's four-and-a-half-month trough of $1.1762 and well below its 200-day moving average of about $1.1866. The common currency is headed for its worst month since mid-2019 as Europe's faltering vaccination programme runs into a wave of new infections, a bearish signal as positioning data shows investors remain heavily long euros. 0#NETUSDFX= "The euro has continued to fall ... even as long-term U.S. yields have lost some upward momentum," analysts at MUFG Bank said in a note. "It suggests euro weakness was driven more by concerns over the weakening outlook for growth in the eurozone in light of rising COVID cases." Virus-driven caution also helped the dollar higher against the Australian dollar, New Zealand dollar and sterling and it rose against oil-liked currencies as the re-floating of the ship blocking the Suez Canal pushed crude prices down by about 1.5%. Concern in equity markets at the widening fallout from a wave of liquidations linked to investment fund Archegos Capital also put investors in a careful mindset. Only the safe-haven Japanese yen made headway, scraping from a 10-month low it made on Friday to inch about 0.2% higher to 109.43 -- though along with the Swiss franc it remains at the bottom of the G10 leaderboard this year. Over the quarter, the dollar has posted a 0.7% loss on the pound, which has been supported by Britain's speedy vaccination rollout, a 0.8% gain on the Australian dollar and a 2.9% gain against the , which has been hit by housing market reforms. The yen, which is sensitive to gaps in returns on U.S. and Japanese government debt has fallen about 5.7%, its worst quarterly performance since late 2016, while the franc is down 5.8% for its worst performance since the third quarter of 2014. This year's 76-basis-point rise in benchmark 10-year Treasury yields - as the U.S. economy rebounds - has been a large driver, as the better returns offer carry for investors who can borrow the yen and franc very cheaply. The AUD=D3 was last down 0.3% at $0.7621 on Monday and the New Zealand dollar NZD=D3 had dropped 0.3% to $0.6978, while sterling slipped 0.2% to $1.3767. "The U.S. is also being helped on its own by some pretty good economic data, fantastic rollout of vaccines, good pace of vaccination and (positive) stock markets," said Westpac currency analyst Imre Speizer. "The domestic economy is doing better than expected and likely to be the case for the next few months, so that might hold the U.S. dollar up and that's what's caused the Aussie, kiwi and emerging-market currencies to pullback in March." U.S. jobless claims fell to a one-year low last week and President Joe Biden said he would double his vaccination goal, after surpassing 100 million shots 42 days ahead of schedule. In contrast, European inoculations have been hit by supply problems and safety concerns. Investors are looking ahead to Purchasing Managers Index figures due midweek and for some details of Biden's infrastructure spending plan. However the main data will be U.S. hiring figures due on Good Friday. "The distribution of forecasts range from 460,000 to 1 million (jobs), where the whisper number sits at the top end of the range," said Pepperstone's head of research, Chris Weston. "One million jobs would set the reflation trades alight ... and cause a solid sell-off in bond yields taking USD/JPY and higher," he said. "The euro should push through last weeks lows of 1.1761 and towards 1.1690." ======================================================== Currency bid prices at 0527 GMT Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid Previous Change Session Euro/Dollar EUR=EBS $1.1777 $1.1794 -0.14% -3.61% +1.1795 +1.1775 Dollar/Yen JPY=D3 109.4200 109.6650 -0.23% +5.93% +109.7950 +109.3950 Euro/Yen EURJPY= 128.86 129.33 -0.36% +1.53% +129.4200 +128.8500 Dollar/Swiss CHF=EBS 0.9395 0.9393 +0.03% +6.20% +0.9402 +0.9395 Sterling/Dollar GBP=D3 1.3768 1.3799 -0.23% +0.77% +1.3799 +1.3766 Dollar/Canadian CAD=D3 1.2621 1.2571 +0.41% -0.88% +1.2627 +1.2578 Aussie/Dollar AUD=D3 0.7623 0.7642 -0.25% -0.90% +0.7645 +0.7619 NZ NZD=D3 0.6979 0.7000 -0.29% -2.81% +0.6995 +0.6975 Dollar/Dollar All spots FX= Tokyo spots AFX= Europe spots EFX= Volatilities FXVOL= Tokyo Forex market info from BOJ TKYFX <^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ World FX rates https://tmsnrt.rs/2RBWI5E ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> |

| You are subscribed to email updates from "investing forex" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment