RBNZ Meeting May Spark Kiwi Volatility – NZD/USD Charts & Levels - DailyFX

RBNZ Meeting May Spark Kiwi Volatility – NZD/USD Charts & Levels - DailyFX |

| RBNZ Meeting May Spark Kiwi Volatility – NZD/USD Charts & Levels - DailyFX Posted: 11 Feb 2020 02:32 PM PST NEW ZEALAND DOLLAR: RBNZ MONETARY POLICY STATEMENT ON TAP & WILL LIKELY STEER SPOT NZD/USD

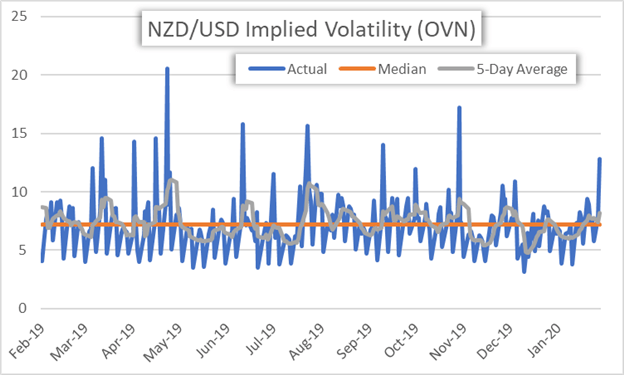

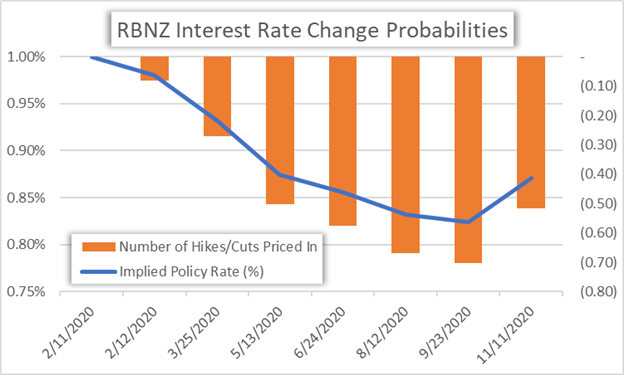

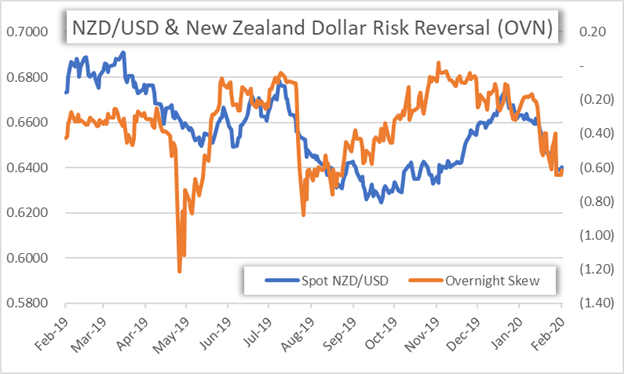

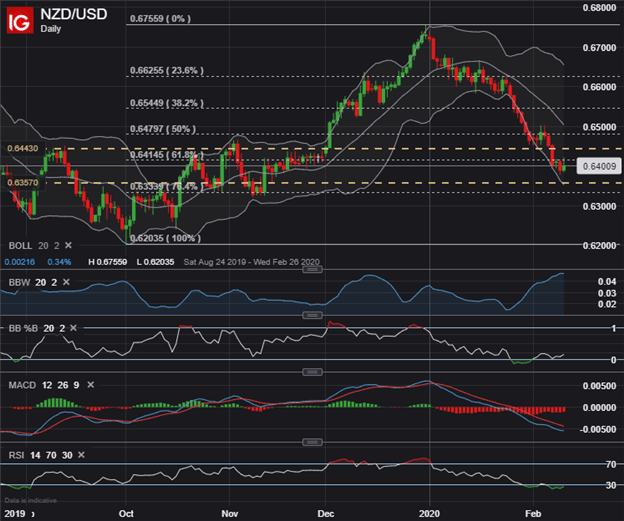

The New Zealand Dollar seems set for elevated currency volatility over the next 24-hours in light of high-impact event risk scheduled early during Wednesday's trading session. Specifically, the Reserve Bank of New Zealand (RBNZ) is due to release an interest rate decision and accompanying monetary policy statement February 12 at 1:00 GMT. Starts in: Live now: Feb 12 ( 10:02 GMT )  Recommended by Rich Dvorak Indices and Commodities for the Active Trader RBNZ Governor Orr is expected to provide additional commentary on the central bank's latest leaning and outlook for the New Zealand economy shortly after at 2:00 GMT. NZD/USD – NEW ZEALAND DOLLAR IMPLIED VOLATILITY CHART (OVERNIGHT) Correspondingly, overnight implied volatility readings on the New Zealand Dollar have skyrocketed as forex options traders gear up for this potentially market moving event. NZD/USD implied volatility for the overnight tenor was just clocked at 12.8%, which is the highest measurement in 3-months and compares to its 5-day average of 8.2% and 12-month median of 7.2%. RBNZ – RESERVE BANK OF NEW ZEALAND INTEREST RATE CUT PROBABILITIES CHART Markets overwhelmingly expect the RBNZ to leave its benchmark interest rate – the Official Cash Rate (OCR) – unchanged at a record-low 1.00% following 75-basis points of cuts last year. Nevertheless, traders are currently pricing a 70% probability that the central bank will cut the OCR again by the September 23 RBNZ meeting. The relatively hawkish or dovish guidance from RBNZ Governor Orr and the Monetary Policy Committee is expected to overwhelmingly steer the broader direction of NZD price action in turn. NZD/USD – NEW ZEALAND DOLLAR RISK REVERSAL CHART (OVERNIGHT) Looking to overnight risk reversals for the New Zealand Dollar we see that NZD/USD options traders have a bearish bias toward the Kiwi on balance. The latest overnight NZD/USD risk reversal reading of -0.62 is up slightly from the prior day's reading of -0.65, which marked a fresh 6-month low. A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection). NZD/USD – NEW ZEALAND DOLLAR PRICE CHART TECHNICAL ANALYSIS That said, spot NZD/USD is estimated to hold an 86-pip trading range in the wake of the RBNZ monetary policy update, which is calculated using the currency pair's overnight implied volatility of 12.8%.

Options-implied trading ranges are assumed to encompass spot price action over the specified time frame with a 68% statistical probability. As such, spot NZD/USD price action is likely to be contained within its 1-standard deviation trading range of 0.6357-0.6443. These derived support and resistance levels roughly align with technical confluence underpinned by the November 2019 lows and September 2019 highs respectively. Keep Reading: NZD/USD Looks Vulnerable - How Dovish will the RBNZ Turn? -- Written by Rich Dvorak, Junior Analyst for DailyFX.com Connect with @RichDvorakFX on Twitter for real-time market insight | ||||||||||||

| USD/CAD Forecast: Canadian Dollar Chart Ripe for a Reversal? - DailyFX Posted: 11 Feb 2020 10:34 AM PST CANADIAN DOLLAR FORECAST: USD/CAD PRICEACTION PRIMED FOR POTENTIAL REVERSAL

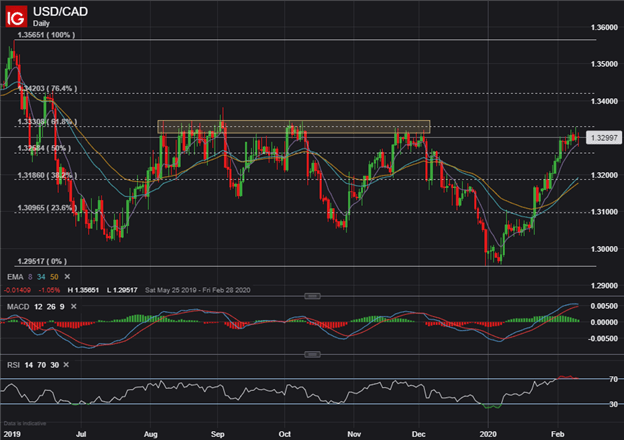

The Canadian Dollar has dropped significantly since the start of the year with USD/CAD prices spiking roughly 350-pips off of January lows. Spot USD/CAD is now trading slightly below the 1.3300 level – a major zone of technical resistance – that has potential to send the major currency pair ricocheting lower as it has previously. USD/CAD PRICE CHART: DAILY TIME FRAME (MAY 2019 TO FEBRUARY 2020) Confluent resistance around the 1.33 handle is also highlighted by the 61.8% Fibonacci retracement of last year's peak printed by USD/CAD. As the Canadian Dollar putters around this key technical obstacle, strength in spot USD/CAD could soon dissipate with upward momentum already appearing to wane as suggested by the MACD.

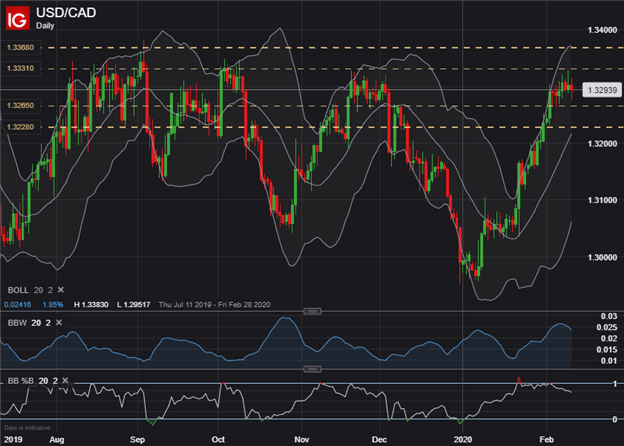

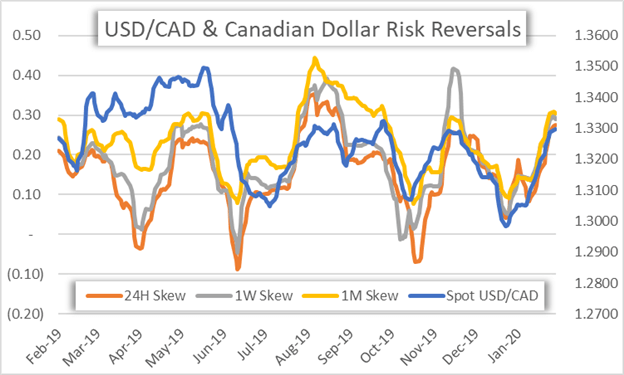

USD/CAD is still clinging onto its 8-day EMA, however, and may keep spot prices bolstered for the time being. If this technical level gives way, a reversal by the Canadian Dollar could accelerate and push USD/CAD down toward the 1.3200 area. USD/CAD PRICE CHART: DAILY TIME FRAME (JULY 2019 TO FEBRUARY 2020) Likewise, spot USD/CAD price action seems to be experiencing the start of a Bollinger Band ™ squeeze and is another encouraging technical development for Canadian Dollar bulls. Other major technical trade levels for the Canadian Dollar can be derived using implied volatility calculated from forex options contracts. Technical support and resistance levels can be estimated with a 1-standard deviation trading band, which is expected to contain underlying price action with a 68% statistical probability over the specified time frame.   Recommended by Rich Dvorak Forex for Beginners That said, spot USD/CAD is estimated to fluctuate between 1.3265-1.3310 over the next 24-hours judging by its overnight implied volatility reading of 4.9%. Meanwhile, spot prices might hold technical support of 1.3228 and resistance of 1.3368 as calculated using USD/CAD 1-week implied volatility of 3.8%. CHART OF CANADIAN DOLLAR RISK REVERSALS & SPOT USD/CAD Another technical signal Canadian Dollar currency traders may want to keep close tabs on are USD/CAD risk reversals. The chart above illustrates a rolling 5-day moving average of spot USD/CAD and its various risk reversal readings across the overnight, 1-week and 1-month tenors. A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection).   Recommended by Rich Dvorak Check out our Top Trading Opportunities for 2020 Nevertheless, downside risks faced by the Loonie remain. Uncertainty surrounding the ratification of the USMCA trade deal by Canadian Parliament still lingers despite formal legislative approval from the US and Mexico already. Moreover, the adverse impact from a plunge in oil prices may start weighing on key inflation indicators tracked by the Bank of Canada. If weakness in oil is sustained – perhaps due to ongoing coronavirus concerns – it could serve as a significant headwind to the Canadian economy and entice the BOC to capitulate to dovish market expectations as several other central banks did last year. Keep Reading – USD Forecast: US Dollar Hinges on Virus Fear, Sentiment & Powell -- Written by Rich Dvorak, Junior Analyst for DailyFX.com Connect with @RichDvorakFX on Twitter for real-time market insight |

| You are subscribed to email updates from "forex charts" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment