ClickPort International – Is it a... - ChainBits

ClickPort International – Is it a... - ChainBits |

| ClickPort International – Is it a... - ChainBits Posted: 11 Jan 2020 09:24 AM PST Website URL: https://clickportint.com/ Founded:N/A Regulations:Unregulated Languages:English Deposit Methods:Bank Wire, Visa, MasterCard Minimum Deposit:Unknown Free Demo Account:No Number of Assets:Unknown Types of Assets: Forex, CFDs Trading Accounts and ConditionsClickPort International claims that it is a leading provider of online Forex, CFD, and other trading services. But when we looked through the so-called broker's website, we could not find anything about its trading conditions or even the account types it offered. ClickPort International – AdvantagesIn all our reviews, we try our best to be fair and list both advantages as well as disadvantages. However, for ClickPort International, despite trying our best, we just could not find a single advantage that could redeem this broker. ClickPort International – DisadvantagesWe were, unfortunately, able to find numerous extremely worrying disadvantages that would make it dangerous for traders to use this broker. Here's the list of concerns we have with ClickPort International:

We couldn't find any information about this broker. There is no company name given, so we don't know who owns and operates this broker. There are two addresses given on this broker's website. One points to a location in Panama City in Panama, and the other is in Warsaw in Poland. There are also two phone numbers given, and also an email address, but when we tried to contact the broker, we received no response. A broker that offers its services anonymously is clearly one that is not to be trusted.

$100Minimum DepositThe company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

$100Minimum Deposit76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

There is no licensing information on this broker's website. And since the company name is not mentioned we were unable to carry out research to check whether ClickPort International is, in fact, regulated in any way at all. Considering this to be the case, we can safely conclude that this broker is not regulated by any financial authority and so is not a Forex trading services provider to be trusted.

While we were doing our research to find out whether this broker was regulated, we discovered that ClickPort International has actually been blacklisted by the Ontario Securities Commission in Canada. The public warning issued by the Canadian financial watchdog is that ClickPort International is suspected to be carrying out scam operations and of also providing financial services without being authorized to do so. Basically, this broker is operating illegally.

Details about a broker's trading conditions is one of the most critical sets of information that a trader requires to be able to trade successfully with them. Without this data, a trader cannot make educated choices about investing money on a broker's platform. A regulated and reliable broker gives its clients all the information required for traders to execute trades successfully on its platform. On the other hand, an untrustworthy broker that is out to scam you will hide as many details as possible. The fact that ClickPort International has chosen not to provide any information on its trading conditions and available account types clearly shows that it is a scammer and that your money is not safe with this broker.

On its website, ClickPort International has stated that it offers its customers the MT4 (MetaTrader 4) trading platform. However, despite registering ourselves on ClickPort International's website, we were unable to access the platform. This can only make us conclude that the broker has made false claims of supporting the MT4 platform. If ClickPort International actually did have support for the MT4 platform, it would have been a huge positive. The MT4 platform is the world's most popular trading interface. It is not just easy to use, but it also has a wide range of features designed to help execute trades more effectively. This platform offers its users over 100 market indicators, bots to help with automated trading, customizable features, and many other features.

Another glaring feature of scammers is that lack of a demo account. Regulated brokers tend to offer their clients the opportunity to test their trading conditions in a safe environment before traders actually invest real money. That's what demo accounts are for. Not having a demo account usually indicates that a broker has something to hide – such as unfair trading conditions. And without a demo account, traders will have no choice but to open a live account with such brokers, which could put their money at risk.

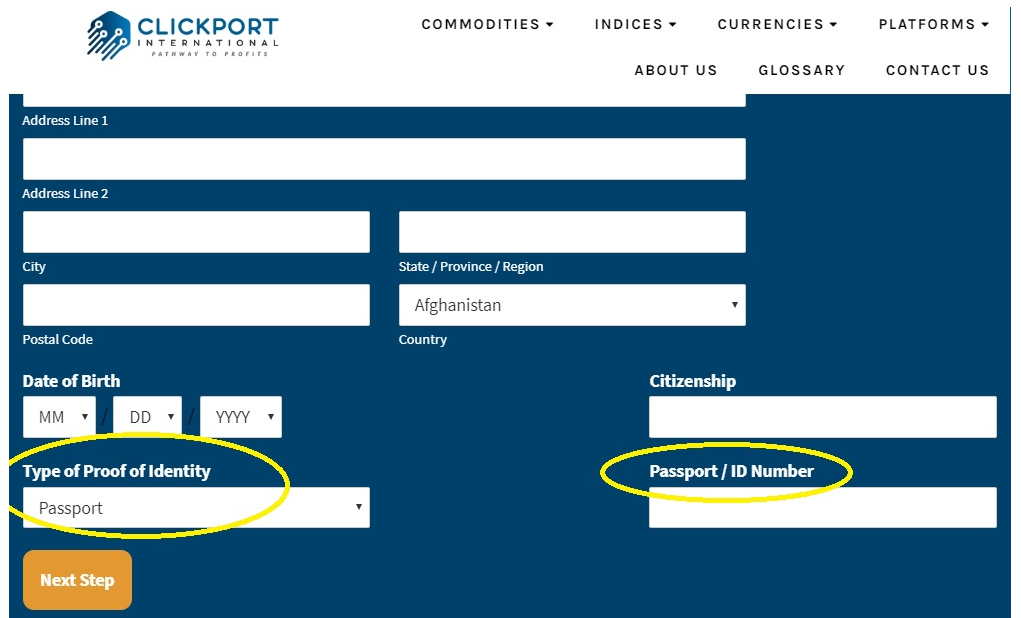

One of the biggest concerns we had with this broker was the number of personal details that it was demanding when we tried to register an account with it. As you can see, the first step itself asks you for your Proof of Identity. This is huge red flag that must not be ignored. Sharing your personal details with unregulated brokers leaves you vulnerable. Such brokers can hold your personal information against you if you attempt a charge back. Added to that, if you accuse the broker of unfair trading practices, these allegations can be easily refuted by them once they have your personal details.

ConclusionWe went through ClickPort International's website in great detail. What we found has convinced us that this broker is a scammer and that if you trade with it, you will definitely end up losing all the money you invest with it. The number of red flags on this broker's website are just too many to ignore – the legal issues of a lack of registration, being blacklisted by the Canadian authorities, the lack of information about its corporate entity, as well as the operational issues of not having a demo account and giving people no access to their platform without a trader first giving personal information. |

| Forex Trading: How to Get... - Coinspeaker Posted: 08 Jan 2020 11:27 AM PST  Forex trading is short for trading on the foreign exchange market. It's a market where anyone can buy one currency in exchange for another. It is considered the market with the highest liquidity in the world with a trading volume of $7 trillion each day. This is super-massive when compared to the daily trading volume of the New York Stock Exchange, the biggest stock exchange in the world, which is around $25 billion. Trading Forex is actually quite easy. If you think a particular currency would increase in value, you can buy it against another, preferably a weak currency. If you suppose a currency would decrease, you can sell it against another and still make a profit whether you're short or long. In order to become a retail Forex trader, you need to choose a broker to execute your trades for you. There are several Forex brokers out there offering practically the same services. However, some brokers are better than others and could be well-suited to you and your trading. How to Choose a Forex BrokerBefore choosing a broker you first need to consider the issue of security. You certainly don't want to make tens of thousands of dollars on trades and have to lose it all to a shady broker. The great thing about making certain your potential broker has a high trust level is that it's easy to do. Several regulatory agencies govern brokers. The United States has the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) as their regulatory bodies. Australia has the Australian Securities and Investment Commission (ASIC), Canada has the Investment Information Regulatory Organization of Canada (IIROC), and the United Kingdom has the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). If your broker is situated in any of these countries and is registered with any of these regulatory bodies, you can consider your broker secure. There are, however, other regulatory bodies for other countries and we advise to review them in advance. Also, it's wise to check the transaction cost level for your potential broker. Brokers require traders to pay through a commission or spread. Depending on your trading strategy, you'll want to choose brokers with a certain transaction cost level. Scalpers generally prefer brokers that offer very low spreads or commission. This is because they trade multiple times during the course of the day. Swing traders hold several trades over days and weeks and may not bother so much about transaction costs. You also have to check the conditions for deposits and withdrawals by your broker. Good brokers don't give users much trouble pertaining to the inflow and outflow of cash. You can also examine how quickly orders are filled and how good the customer service is. Forex Trading StrategyMany traders who trade Forex have a particular trading plan to consistently make money. Anyway, discipline is a core part of trading and one every trader should imbibe in their daily trading activities. A Once the strategy is back-tested and well-seasoned, with proper stop-losses and take-profits, one can be sure that a successful trading strategy has been developed. A good trading strategy helps traders develop confidence in themselves. Creating a Forex strategy in the real sense of it is the development of a specific trading method that is just a facet of an entire trading plan. A consistent strategy focuses on providing a perfect entry point but should also consider:

Developing a clear cut Forex trading strategy comes with many questions with no single answer. Most of the trusted strategies are developed to suit the trader and how the trader sees the market. This means that any strategy depends on the trader's personality and what the trader looks to get out of the market (remember, what works for one person might not work for another). Types of Trading StrategiesTrading styles are usually developed on the timeframe – either short or long and over the years, experienced traders have had to pick one of these timeframes for their trading strategies which have proven to be very efficient and successful based on any market condition they find themselves. Examples of these are: Scalping: These are short-term trades, usually executed and held for a couple of minutes, or even seconds. The trader here aims to quickly make a few points of profit by beating the bid/offer spread before closing the trade. This strategy works best with tick charts such as the ones found in MetaTrader 4 Supreme Edition. Scalpers aim to best the bid/ask spread of a broker, which is why one of their main priorities is finding a broker with low spreads. Scalpers that use ECN brokers (brokers that use electronic communication networks that help clients directly access currency markets) look for brokers with low commissions. They typically use high amounts of lots in risky trades to help cushion the small amounts of pips gained on trades. Quite often scalpers are considered gamblers. Day Trading: As the name suggests, day trading involves trades that are usually exited before the end of each trading day. This removes the possibility of the trades being affected by large pip moves overnight. Day trading strategies are usually considered best for beginners as it is said to eliminate 'noise' while reading the charts. Day traders typically aim for a certain pip level to be reached before closing trades. Several traders make use of take profit levels to get out of trades with a set profit. They mostly do not pay transaction fees for swap, which is the payment made for holding a trade overnight. Swing Trading: This strategy involves holding positions for several days while the trader aims to profit from short-term patterns. Swing traders hold their trades for days and possibly weeks depending on their preset risk-reward level or the use of the trailing stop loss to lock in profits in trending markets. Most swing traders use indicators and price action patterns to guide them before executing trades. They typically view charts at the end of a trading day before taking a decision. Positional Trading: This strategy follows long term trends, seeking to make a profit from major price shifts. Positional traders hold trades for very long periods of time running into months or years. They are considered the most educated and seasoned traders because they use several amounts of fundamental and economic data to make their decisions. Before a big move in a market direction is started, positional traders are ready to lock in a trade. They usually use big amounts of money to sufficiently get compensated on the very few trades they make. Conclusion, or Some Things to RememberThis piece cannot be complete without certain crucial points to remember. 1. Demo Trade and Paper Trade until Your Profit is Consistent A lot of people jump into the live Forex trading market quickly before perfecting their strategy and most importantly, testing it on a demo account. Apart from that, using too much leverage on a live account is common among newbies looking to cash out big from the "goldmine" Forex market. It is pertinent for every trader to take time out to learn the workings of the market before committing capital to it. 2. Trade without Emotion The mental capacity to see setups and execute them isn't enough to have a successful Forex trading journey. Emotional strength and maturity are also needed to ensure that a big win or a big loss doesn't drive the trader into greed. Setting mental stop-losses are also not advisable if they can't be executed as at when due. 3. The Trend Could be a Friend or Foe Many times, traders tend to go with the trend of the market – either uptrend or downtrend because more profits come in when trades are executed at the perfect entry point to move on with a trend. If for any reason a trader has to go against a trend, the reason must be solid: at times trends can be just what they are and sometimes could be a preparation for a move in the opposite direction. share this: |

| You are subscribed to email updates from "metatrader 4" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment