SwissKapitalInvest – Is it Safe or a... - ChainBits

SwissKapitalInvest – Is it Safe or a... - ChainBits |

- SwissKapitalInvest – Is it Safe or a... - ChainBits

- Why you should use the demo account - Stock Market Daily

- Markets Invest – It is a... - ChainBits

| SwissKapitalInvest – Is it Safe or a... - ChainBits Posted: 31 Dec 2019 12:26 AM PST Website URL: https://swisskapitalinvest.com/ Founded: N/A Regulations: Unregulated Languages: English, German Deposit Methods: Unknown Minimum Deposit: $250 Free Demo Account: No Number of Assets: N/A Types of Assets: Forex Trading Accounts and ConditionsSwissKapitalInvest claims to be a Forex broker that is registered in Switzerland. The broker also claims to provide its clients with the MT4 (MetaTrader 4) and MT5 (MetaTrader 5) trading platforms, along with a range of trading instruments. The leverage that the broker has extended is quite generous at 1:200, and it also offers a decent spread of about 1.4 pips on the benchmark Forex pair, the EURUSD. The minimum deposit required is at par with the average in the industry, $250. SwissKapitalInvest – AdvantagesWhile there are glaring disadvantages to trading with SwissKapitalInvest, we have tried to be fair to the broker and have listed the seeming advantages it has. Here they are:

On SwissKapitalInvest's website, it is mentioned that the broker offers a spread of 1.4 pips on the benchmark Forex pair, the EURUSD. This is a decent spread to have, even though it is in the upper ranges of what the industry average is.

The second plus that we notice as announced by this broker is its leverage. SwissKapitalInvest offers its clients a leverage of 1:200, which is a good level – high enough to suit the needs to most types of traders, but not so high that becomes a high-risk investment. SwissKapitalInvest – DisadvantagesThe two pluses we have mentioned are nowhere near enough to make up for the many red flags we have found with this broker. Here is the list:

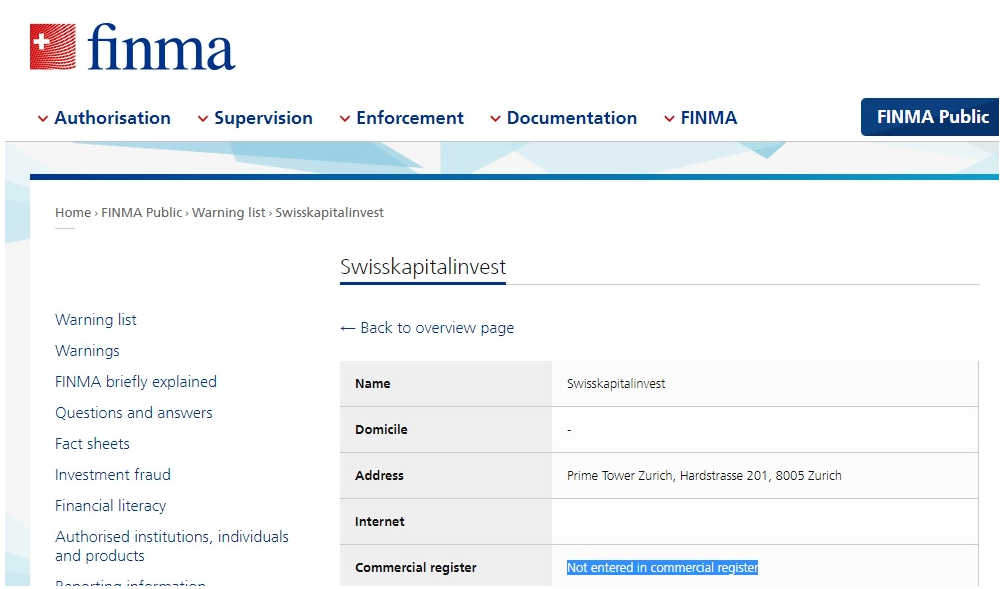

According to the corporate information given on SwissKapitalInvest's website, the broker is operated by a company called Swiss Investment Capital Group Ltd. The broker claims to be registered in Switzerland, however, there is no way to verify this claim, since there is only a Zurich contact address mentioned in website, and no other information is given. Added to that, the parent company, Swiss Investment Capital Group Ltd. Is actually incorporated under the Republic of Marshall Islands laws. Thus, this company is actually an offshore entity, incorporated in a country where Forex brokers are not overseen by any financial authority. Added to that, there is no mention of any license or registration nubmer from any regulatory authority, including the Swiss FINMA (the Financial Market Supervisory Authority of Switzerland), where the broker claims to be registered. This means that this broker is actually not allowed to operate in any financially regulated market – and that includes Switzerland.

$100Minimum DepositThe company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

$100Minimum Deposit76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

FINMA has put this broker on this blacklist for carrying out unauthorized trading activities in its country. FINMA is one of the most stringent regulators in the European Union, with extremely high capital requirements, which is why very few brokers are registered with this body. The agency also keeps a close eye on unregulated brokers and warns traders immediately when a brokerage is found to be claiming to be located in Switzerland or that it is regulated by FINMA. Thus, SwissKapitalInvest has been marked as a danger to traders since it is not entered in its commercial register.

The broker claims to provide the MT4 and the MT5 trading platforms. These are the two best trading platforms in the industry, since they are easy to use, and come loaded with features such as analytics tools, charting options and even automated trading bots. However, on SwissKapitalInvest, despite its claim, you will not be able to download either platform, which makes us wonder if the broker even has these platforms at all.

Another huge red flag is the fact that SwissKapitalInvest has no demo account, which means that you cannot even verify the broker's claims of having either the MT4 or the MT5 trading platforms. What this also means is that you cannot verify the trading conditions, trading fees, spreads or leverages. This unfortunately is a trademark strategy used by scammers. Regulated and above-board brokers offer free demo accounts so that you can test their services and understand their pricing.

Another sign that this a dangerous broker to deal with is the fact that there is absolutely no information about its deposit or withdrawal methods or fees. Even unregulated brokers will give information about deposit and withdrawal methods, even it is the traditional bank wire transfer and/or credit/debit card transactions. However, with SwissKapitalInvest, you get no information with regard to this critical factor. The only piece of information we could find was in the Terms and Conditions, which mentioned a dormancy fee. According to that condition, if an account has been dormant for more than 6 months, then you will be charged $25 per month. Besides, this, we do not know what deposit fees, withdrawal fees, or any other kind of transaction fees will be charged. ConclusionAt the end of our review, all we can say is that SwissKapitalInvest has all the signs of being a serious scam, and it would be best for you to stay as far away from this broker as possible. The fact that FINMA, one of the European Union's strongest financial regulatory bodies, has issued a warning against trading with this broker should be enough of a red flag for everyone. Added to that, it is not regulated by any known authority, nor does it give any information about how you can put in or take out money from a trading account, and it doesn't even have a downloadable platform. This is one broker that you should never trade with, or you will lose all your money. |

| Why you should use the demo account - Stock Market Daily Posted: 29 Dec 2019 10:16 PM PST Changing your life within a short period is not so hard. But for that, you must select the right platform and learn your trading skills. Before you start to trade the real market, you have to focus on your demo trading performance. But the concept of demo trading is not clear to many traders. The majority of the traders are losing money since they don't have any demo trading experience. After reading this article, you will understand the key benefits of demo trading accounts. Let's find the key reason for which everyone should start trading with the demo accounts. Focus on the market basicsTo learn about trading, you must learn about the market basics. Most of the time, the traders fail to get a clear idea of how this market work. Learning about the structure gives you a clear blueprint to trade the real market. Try to learn about the technical and fundamental factors of the market. To do that you must learn in a demo platform. The demo platform will give you the perfect opportunity to learn new things about the perfect strategy. Once you learn to analyze the market like the pro traders, you will never have trouble. Fine-tune your strategyYou must fine-tune your strategy to make a consistent profit. And to that, you must use the Forex demo account. Most of the time the traders get confused by after losing a few trades. They start taking aggressive steps to recover the loss. But if you wish to succeed, you must focus on the development of your trading strategy. At the initial stage, making some big profit is not so hard. But once you know the basics, you will get confused and make a mistake. The average learners don't make any profit since they don't have any idea to do the perfect market analysis. You can't change your life by giving an average effort. To become successful, you must be a pro trader. And for that, you must use the demo account to fine-tune strategy. Develop your patience levelPatience has always been the key to success in any profession. If you want to become successful you must develop your patience level. And to do that you have to use the demo account. Demo trading is extremely boring but once you get used to the demo account you can improve your skills gradually. Most of the time, the retail traders are making mistakes in real trading since they don't have the patience. But if you have patience, you can wait for the good signals. And the only way to develop your patience level without risking any real money is the demo account. Learn about fundamental analysisFundamental analysis should never be ignored by naive traders. Those who rely on technical data to execute high-quality trades are missing one of the most important aspects of trading. To find quality trades you blend technical and fundamental data. But mastering these two technologies is a very complicated task. But once you get used to the concept of trading with the demo account you can develop this skill. Use the demo account to see how the price reacts to different news. Most of the time, the high impact news is the major catalyst to change the trend. Having the ability to identify the major trend change gives you the perfect opportunity to learn new things about this market. Focus on the basic details and you won't have to lose any money. ConclusionDemo accounts are nothing but the blessings for the retail traders. Even professional traders rely on the demo account to develop their skills. You may think the demo trading platform is nothing but an eyewash for the traders but once you start to use it, you will understand why everyone should learn in the demo environment. So, think twice before you start to trade with real money. |

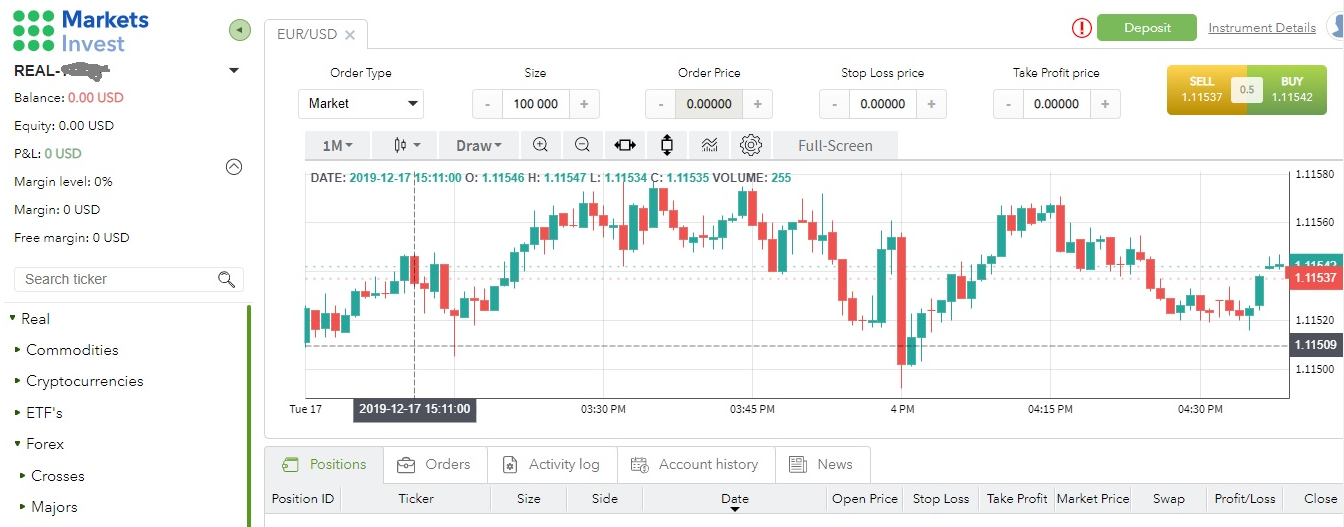

| Markets Invest – It is a... - ChainBits Posted: 30 Dec 2019 02:09 AM PST Website URL: https://markets-invest.com/ Founded: N/A Regulations: Unregulated Languages: English, Russian Deposit Methods: Credit/Debit Card via Web Money and Qiwi, Bitcoin, Wire Transfer Minimum Deposit: $250 Free Demo Account: No Number of Assets: N/A Types of Assets: Currency Pairs, Cryptocurrencies, Commodities, ETFs Trading Accounts and ConditionsThe only information we could find about the account types on Markets Invest is that it has a single Standard Account. The minimum deposit requirement for this account type is $250, with a maximum leverage of 1:500 and a spread of just 0.4 pips. This offshore broker offers its clients a web-based trading platform and trading conditions are no mentioned at all. Markets Invest – AdvantagesWhile there are many disadvantages with Markets Invest, we need to be fair and list out the advantages too:

When we were able to log into Markets Invest's trading platform, the EURUSD benchmark Forex pair showed a spread of just 0.4 pips, which is very favorable for traders. However, since the spread was really raw, we have to assume that there would be some kind of a commission that the broker would get from each deal, however, since the trading conditions have not been clearly stated, you would not know until you actually start trading.

The broker offers a maximum leverage of 1:500, which is also favorable for all types of traders, be they beginners or skilled traders. However, it should also be noted that leverages that high come with considerable risk, which is why many financial agencies have capped leverages for regulated brokers at much lower levels. So, while on the surface, it seems like a generous leverage, it is a double-edged sword and you could actually end up losing your money in minutes. Markets Invest – DisadvantagesBesides the two advantages we were able to scrape out of our investigation of Markets Invest, what we found was very alarming. Here's why:

Markets Invest claims that it is owned and operated by a company called Dragon Capital Limited. This company is incorporated and registered in St. Vincent and the Grenadines (SVG), which means that this is an offshore entity. Forex brokers do not come under regulatory scrutiny in this country, rather, all they need to do is register with the local FSA (Financial Services Authority). The process of registration is inexpensive, which is why many brokers register with such agencies. The challenge is that the SVG FSA clearly states that it does not regulate forex trading or broker that are involved in forex trading. Therefore, we can safely state that Markets Invest is not a regulated broker. This suspicion is further highlighted by the fact that nowhere on the broker's website does it actually say that Markets Invest holds a license to operate or is regulated by any financial authority. This means that your money is greatly at risk if you trade with them.

$100Minimum DepositThe company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

$100Minimum Deposit76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

As we mentioned earlier in this review, Markets Invest has given very little information about its trading conditions and pricing. There are no trading specifics besides the minimum deposit requirement. In fact, there is no section on Terms and Conditions anywhere on the broker's website. While we figured out the maximum leverage level, there are no further details about leverage given, and neither is there any information about the platform's trading costs, fees and so on. So, until clients actually invest money on the platform, they won't get to know how much they are paying for the brokerage services offered.

Markets Invest has no demo account, so the only way you will know what you are going to be charged, what the trading conditions are and what the spreads and leverage look like is when you actually open a live account and invest your money. This is typical of brokers that are unregulated, since it allows them to trap unsuspecting traders into putting investing their money on their platform.

Most legitimate brokers use the MetaTrader 4 or MetaTrader 5 trading platforms. This is because these are the best trading platforms in the world right now. They are easy to use, and have tons of added features such as charting options, bots for automated trading and analytics tools. Most unregulated brokers and outright scammers prefer to use web-based interfaces that are really basic, such as the one that Markets Invest is using. This platform can actually confuse the unseasoned trader, since it looks professional. It offers some charting options, but not enough to really benefit the trader. At the end of the day, when you really analyze the platform, it falls short of actually doing what a trading platform such as the MT4 or MT5 does.

Since we could not test the trading conditions through a demo account, we were forced to open a live account with Markets Invest. Upon doing so we found that we were being charged a 14% withdrawal fee, which is much higher than the market average. Added to that the broker only allows for a minimum withdrawal amount of $15. ConclusionAfter going through Market Invest's website and trading platform in detail, we can conclude that this is not a broker you should trust your money with. There are just too many glaring red flags for you to ignore. There is the issue of its licensing and regulation, the fact that it doesn't have any demo account or even any Terms and Conditions, and it has a simplistic web-based trading platform. It would be best if you avoid trading on Markets Invest as you stand to lose your hard-earned money. |

| You are subscribed to email updates from "forex demo account" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment