Does New Year Mean New Breakouts In FX? - Investing.com

Does New Year Mean New Breakouts In FX? - Investing.com |

- Does New Year Mean New Breakouts In FX? - Investing.com

- Forex – U.S. dollar Unchanged Ahead of Job Report - Investing.com

- FOREX-Dollar dented as risk appetite returns at year-end - Reuters

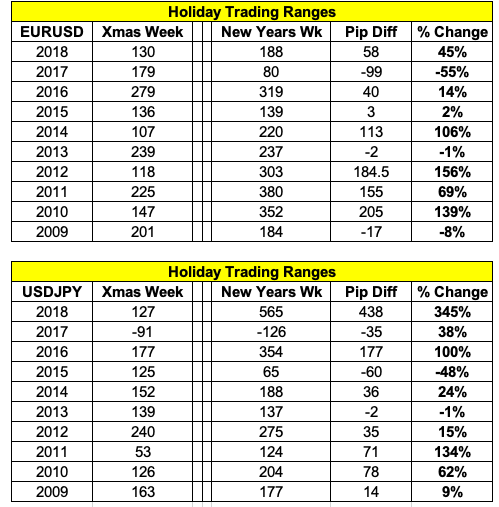

| Does New Year Mean New Breakouts In FX? - Investing.com Posted: 27 Dec 2019 12:14 PM PST Daily FX Market Roundup 12.27.19By Kathy Lien, Managing Director of FX Strategy for BK Asset ManagementIn this last full trading week of 2019, the pulled back against all of the major currencies. It has actually been a rough month for the greenback, but the declines come after a strong November. In general, 2019 has been a good year for the dollar but it peaked at the end of September with losses accelerating in December. The and dollars performed particularly well this month, enjoying the strongest gains as both currencies hit 4-month highs. The Reserve Bank of Australia has been one of the most accommodative central banks but after 3 rounds of easing including a cut in October, the Australian dollar finally bottomed. The weakest currency this month was the greenback, which fell victim to softer data and renewed caution from Federal Reserve Chairman Jerome Powell. However next to the dollar, the was also a poor performer, ending the month unchanged, which is surprising because USD/JPY typically has a strong correlation with U.S. stocks and risk appetite. The fact that the ended this week at a fresh record high and yet USD/JPY barely budged is either a red flag for U.S. equities or a precursor for USD/JPY strength and we think it's stocks that will lose momentum. Christmas week is typically a quiet, range-bound week in the forex market but this hasn't been completely true for 2019. broke out strongly on Friday on little news. This was a pure technical break higher after a series of higher lows and higher highs. Broad-based weakness also helped the pair but the comparatively stronger move can be attributed completely to technicals and risk appetite. Looking ahead, New Years week is typically a more eventful one for currencies. As shown in the table below, in most years, the trading ranges for and expand. You may even recall the flash crash on January 3, 2019 that took USD/JPY from 108.90 to 104.80 in a matter of minutes. Like the rally in EUR/USD on Friday, there was no specific catalyst outside of beginning-of-the-year position adjustments. Data wise, there's not much on the calendar to trigger a big move but surprising strength or weakness in Chinese PMIs, U.S. or German labor data could do the trick in a week of low liquidity. Investors are still in holiday mode in the front of the week and it won't be until after the New Year on Thursday that liquidity starts to normalize.  Trading Ranges All high-beta currencies like , and are vulnerable to profit taking. could pull back as well but will most likely hold above the 200-day SMA near 1.1150. We are looking for a bottom in USD/CAD and a stronger rally for . , and the are scheduled for release next week. While confidence may be bolstered by the overall strength of U.S. stocks, regional manufacturing activity has been weak, pointing to a drop in the ISM manufacturing index. The last time the Fed met, Jay Powell made it clear that rate hikes are not on the horizon. The central bank lowered their inflation forecasts while the dot plot shifted downward with most policymakers seeing no changes in rates next year. Powell in particular wants to see a move in inflation that is significant and persistent before raising interest rates. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| Forex – U.S. dollar Unchanged Ahead of Job Report - Investing.com Posted: 06 Dec 2019 12:00 AM PST  © Reuters. © Reuters.Investing.com – The U.S. dollar was unchanged on Friday in Asia as traders awaited the release of the latest U.S. job report, which is due at 8:30 AM ET (13:30 GMT). The that tracks the greenback against a basket of other currencies was unchanged at 97.380 by 1:30 AM ET (05:30 GMT). Analysts tracked by Investing.com expect the job report to show the economy added 186,000 jobs in November, up from 128,000 jobs in October and 155,00 jobs in November 2018. The unemployment rate is projected to hold steady at 3.6%, unchanged from October and down slightly from December 2018. Traders also kept an eye out for the latest development on the Sino-U.S. trade front as U.S. President Donald Trump said "something could happen" on whether the Washington will impose new tariffs on Chinese goods starting Dec. 15. Trump said on Thursday that negotiations with China are going "very well," just one day after he said an agreement to end the trade dispute may have to be delayed until after the American presidential election in November 2020. The pair traded 0.1% lower to 7.0417. The pair was little changed at 1.1102 as data on Thursday showed that German factory orders unexpectedly declined in October. The pair was also near flat at 1.3156. Reports this week suggested that U.K. Prime Minister Boris Johnson could win a majority at next week's election, paving the way for Britain to leave the European Union on Jan. 31. The pair slipped 0.1% to 108.68. Meanwhile, the pair and the pair both gained 0.2%. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| FOREX-Dollar dented as risk appetite returns at year-end - Reuters Posted: 27 Dec 2019 07:24 AM PST * Dollar index up less than 1% for the year * Australian dollar rises on U.S.-China trade optimism (Recasts throughout, updates rates, adds comments post-U.S. market open; new byline; previous LONDON) By Saqib Iqbal Ahmed NEW YORK, Dec 27 (Reuters) - The U.S. dollar slipped across the board on Friday as optimism about the outlook for a U.S.-China trade deal lifted investors' appetite for risk, sapping safe-haven demand for the greenback, in light end-year trading. The dollar index, which measures the greenback against six other major currencies, was 0.49% lower at 97.059. "The dollar has declined against a backdrop of coursing risk-on sentiment in global equity markets with investors anticipating the U.S.-China Phase 1 trade deal to be signed-off on soon, which will come amid a world of expansive monetary policy and benign inflation," analysts at Action Economics said in a note. Traders returned from their Christmas and Boxing Day break to digest comments from Beijing that it was in close contact with Washington about an initial trade agreement. Earlier, U.S. President Donald Trump had talked up a signing ceremony for the recently struck Phase 1 trade deal. With Friday's loss, the dollar index's gains for the year have shrunk to under 1%, putting it on pace for the smallest annual change in six years. On Friday, the euro rose 0.61% to hit a 10-day high. "The EURUSD is particularly sensitive to global growth upgrades, and with trade optimism swinging positively for global growth, the Euro's trend-following dynamics could start to argue for a push above," Stephen Innes, chief Asia market strategist at AxiTrader, said in a note. Bleak European economic data had prompted hedge funds to bet on a weaker euro during 2019, but some strength in recent Eurozone data, along with weakness in other currencies, has lifted the euro. The common currency has risen 2.3% against the greenback so far this quarter. On Friday, trade-sensitive currencies were stronger, with the Australian dollar rising 0.33% and the New Zealand dollar up 0.34%. The offshore yuan was about flat on the day against the U.S. currency at 6.9959 yuan per dollar. The Canadian dollar was trading 0.3% higher against the greenback at 1.3088 to the U.S. dollar, or 76.38 U.S. cents. The commodity linked currency has strengthened in recent sessions helped by higher oil prices. Sterling was 0.89% higher after European Commission President Ursula von der Leyen said the European Union may need to extend the deadline for talks about a new trade relationship with Britain. Even with the recent UK general election smoothing the path for Britain's exit from the European Union, Britain's ability to strike a new trading deal between the EU in a relatively short span of time remains a concern for some investors. "We anticipate that the Brexit rubber hitting the road will curtail the pound's upside potential in 2020," analysts at Action Economics said. Reporting by Saqib Iqbal Ahmed; additional reporting by Karen Brettell; Editing by Steve Orlofsky Our Standards:The Thomson Reuters Trust Principles. |

| You are subscribed to email updates from "investing forex" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment