USD/JPY extends gains after break of the November high - ForexLive

USD/JPY extends gains after break of the November high - ForexLive |

- USD/JPY extends gains after break of the November high - ForexLive

- ASB says the RBNZ will cut rates just one more time (forecasts May of 2020 rate cut) - ForexLive

- Bitcoin Price Chart Turns Bullish, What Does This Mean for BTC/USD? - DailyFX

| USD/JPY extends gains after break of the November high - ForexLive Posted: 27 Nov 2019 11:46 AM PST [unable to retrieve full-text content]USD/JPY extends gains after break of the November high ForexLive |

| ASB says the RBNZ will cut rates just one more time (forecasts May of 2020 rate cut) - ForexLive Posted: 27 Nov 2019 06:30 PM PST [unable to retrieve full-text content]ASB says the RBNZ will cut rates just one more time (forecasts May of 2020 rate cut) ForexLive |

| Bitcoin Price Chart Turns Bullish, What Does This Mean for BTC/USD? - DailyFX Posted: 27 Nov 2019 11:31 AM PST Bitcoin (BTC) Price Chart Forecast:

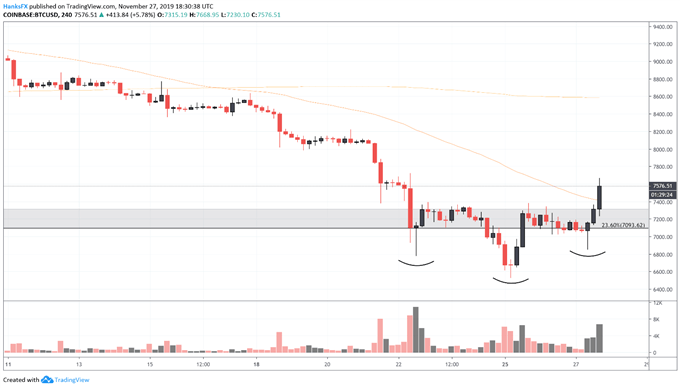

Bitcoin Price Chart Turns Bullish, What Does This Mean for BTC/USD?After suffering weeks of losses, the outlook for Bitcoin may have just turned bullish with the formation of an inverse head and shoulders pattern. Employing a band of support from May as the neckline, brief probes beneath $7,000 have created two shoulders and a head – creating an almost textbook formation of the bullish indicator. Since inverse head and shoulder patterns typically denote a bottom, Bitcoin could enjoy a brief respite from its longer-term downtrend, but it becomes a question of how far, and for how long, Bitcoin bulls will push the cryptocurrency – if at all. Bitcoin Price Chart: 4 - Hour Time Frame (November 11 – November 27) (Chart 1) Given the distance between the top of the neckline and the head, it could be argued the formation may drive Bitcoin as high as $8,100 – but this is far from certain. Further still, traders typically look for a surge in volume to accompany the initial break above the neckline, an aspect that could have been stronger in this particular instance. Still, amidst a bleak outlook, the formation should be a welcome sign for believers in the largest cryptocurrency by market cap. That being said, I still maintain my bearish bias for the coin's medium-term outlook. To that end, Bitcoin's presence beneath support that I previously highlighted at $7,000 and $6,500 – albeit brief – speaks to the continued strength of bears. While bears and bulls battle it out, follow @PeterHanksFX on Twitter for Bitcoin news and analysis. --Written by Peter Hanks, Junior Analyst for DailyFX.com Contact and follow Peter on Twitter @PeterHanksFX Read more:Top Retail Stocks to Watch Ahead of Black Friday |

| You are subscribed to email updates from "forex charts" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment