The Ascending Triangle: What is it & How to Trade it? - DailyFX

The Ascending Triangle: What is it & How to Trade it? - DailyFX |

- The Ascending Triangle: What is it & How to Trade it? - DailyFX

- ForexLive Americas FX news wrap: Trade winds continue to blow positively - ForexLive

- US Dollar Outlook: Euro, DXY Charts & More - DailyFX

| The Ascending Triangle: What is it & How to Trade it? - DailyFX Posted: 15 Nov 2019 12:00 AM PST The ascending triangle, often referred to as the 'rising triangle', is one of the top continuation patterns that appears mid-trend. Traders anticipate the market to continue in the direction of the larger trend and develop trading setups accordingly. Learn to Trade the Ascending Triangle Pattern: Main Talking Points

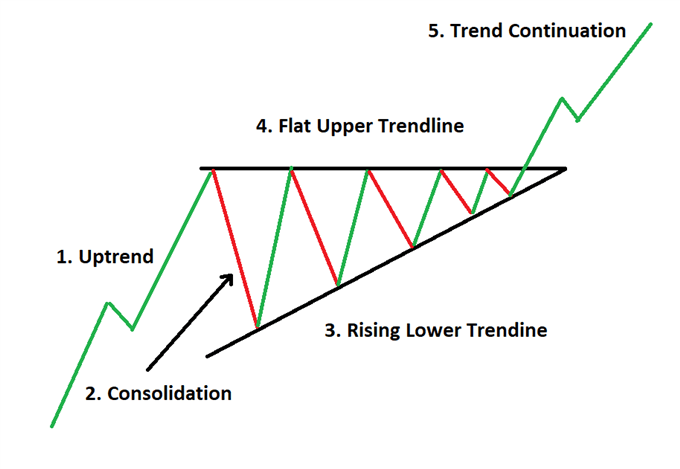

Test your knowledge of forex patterns with our interactive Forex Trading Patternsquiz What is an Ascending Triangle?The ascending triangle is a bullish continuation pattern and is characterized by a rising lower trendline and a flat upper trendline that acts as support. This pattern indicates that buyers are more aggressive than sellers as price continues to make higher lows. The pattern completes itself when price breaks out of the triangle in the direction of the overall trend.  The Ascending Triangle as a Bottoming Pattern The location of the ascending triangle in relation to the trend will determine whether a reversal or continuation of the trend is more likely to occur. It is possible for the ascending triangle to appear at the bottom of a downtrend, indicating that the downward momentum is fading before potentially changing direction. Therefore, the location the pattern appears in is crucially important. How to identify an Ascending Triangle Pattern on Forex ChartsThe ascending triangle is fairly easy to spot on forex charts once traders know what to look for.

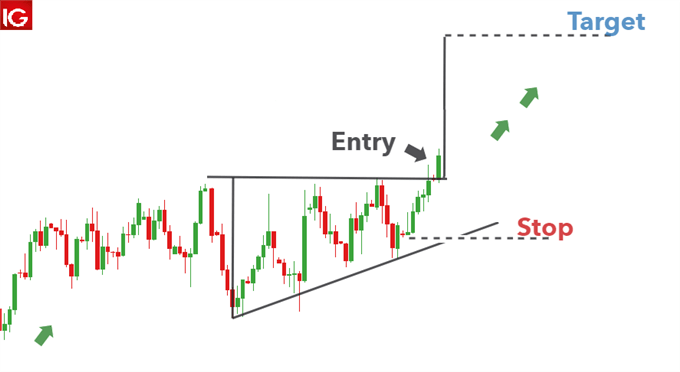

Ascending Triangle Measuring TechniqueThe ascending triangle has an inherent measuring technique that can be applied to the pattern to gauge likely take profit targets. For the ascending triangle,traders can measure the distance from the start of the pattern, at the lowest point of the rising trendline to the flat support line. That same distance can be transposed later on, starting from the breakout point and ending at the potential take profit level. The illustration below shows the distance from A to B can be transferred higher up, from C to D, in order to project a possible take profit level.  How to Trade the Ascending TriangleWhen trading the ascending triangle, traders need to identify the uptrend and this can be seen in the USD/CAD chart below. Thereafter, the ascending triangle appears as the forex candlesticks start to consolidate. The measuring technique can be applied once the triangle forms, as traders anticipate the breakout. After viewing a strong break above resistance, traders can enter a long position, setting a stop at the recent swing low and take profit target in line with the measuring technique.  Advantages and Limitations of the Ascending TriangleThe ascending triangle is an incredibly helpful pattern when assessing potential trend continuations. It does, however, have its shortcomings and traders ought to be aware of both.

Further Reading on Forex Trading Patterns

| ||||||||

| ForexLive Americas FX news wrap: Trade winds continue to blow positively - ForexLive Posted: 26 Nov 2019 01:46 PM PST [unable to retrieve full-text content]ForexLive Americas FX news wrap: Trade winds continue to blow positively ForexLive | ||||||||

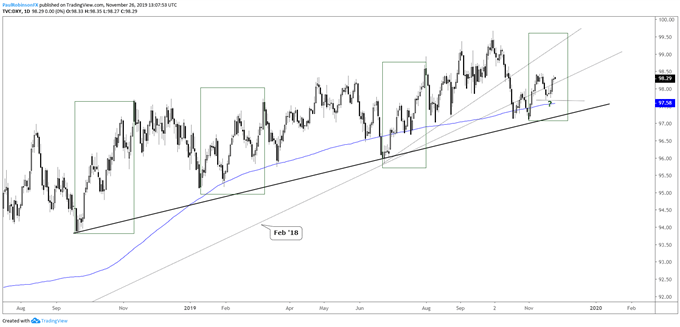

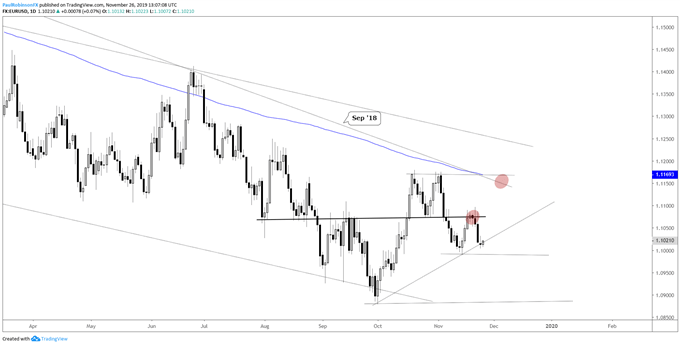

| US Dollar Outlook: Euro, DXY Charts & More - DailyFX Posted: 26 Nov 2019 05:16 AM PST The US Dollar Index (DXY) is continues to act as it has over the past year+ since it began grinding its way higher ever so slowly. So slowly, that barring a major breakout the yearly range will be the smallest since 1976. With that said, though, that doesn't mean there isn't still opportunities out there. They will just be fewer and smaller. The DXY pattern as mentioned is playing out similar to other times in the cycle. The surge to start the month was met with a retracement, which has not turned back into another leg higher so far. If the DXY follows the script then another run towards 99 or better should soon be in the works. . DXY Daily Chart (looking for continuation rally) US Dollar Index (DXY) Chart by TradingView EUR/USD will be the key driver here for the DXY as it stands as the largest constituent in the index at a hefty 57% weighting. Currently it is sitting on a minor form of trend support off the October 1 low. A breakdown below 10989 should get the ball rolling towards the cycle low at 10879. EUR/USD Daily Chart (path of least resistance lower) For the full set of technical details and charts, check out the video above… Resources for Index & Commodity TradersWhether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance. We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper. ---Written by Paul Robinson, Market Analyst You can follow Paul on Twitter at @PaulRobinsonFX |

| You are subscribed to email updates from "forex charts" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment