Forex - Dollar Weakens Further as Market Positions for Rate Cuts - Investing.com

Forex - Dollar Weakens Further as Market Positions for Rate Cuts - Investing.com |

- Forex - Dollar Weakens Further as Market Positions for Rate Cuts - Investing.com

- Forex - U.S. Dollar Struggles as Dallas Manufacturing Data Disappoints - Investing.com

- Forex - U.S. Dollar Edges Down; Yen Rises on Safe-Haven Demand - Investing.com

- Anti-dollar trade makes outlook for gold much more bullish - CNBC

| Forex - Dollar Weakens Further as Market Positions for Rate Cuts - Investing.com Posted: 25 Jun 2019 12:39 AM PDT  © Reuters. © Reuters.Investing.com -- The dollar continued its decline in early trading in Europe Tuesday, with the yen and euro strengthening as traders anticipate the erosion of the interest rate premium on dollar assets. Overnight, the dollar fell to a 14-month low of 106.79 against the , before recovering slightly to trade at 106.97 by 3.45 AM ET (0745 GMT). The , which measures the greenback against a basket of developed-market currencies, also hit a three-month low of 95.468 before bouncing to 95.488. The , meanwhile, hit a three-month high of $1.1413 before consolidating just under $1.1400, due partly to a weaker-than-expected in France. That follows a day after a similarly gloomy reading from the research institute on German business sentiment. Caution remains the watchword of the day after Iran responded to U.S. sanctions on its supreme leader Ayatollah Khamenei by saying that the diplomatic channel for communications had been "closed forever". Even so, the largely symbolic sanctions announced on Monday haven't been enough to trigger any major inflows into safe assets. There is little incentive for traders to take new positions ahead of the crucial G20 summit at the weekend, where U.S. President Donald Trump and his Chinese counterpart Xi Jinping are due to meet. A between the two sides' chief trade negotiators late Monday yielded no new detail but at least avoided a public breakdown of communication. The currency market's focus later Tuesday is likely to be on Federal Reserve Chairman , who is due to speak at 1 PM ET (1700 GMT). Powell came in for fresh criticism from Trump on Monday, who accused the Fed of acting like a "stubborn child" for not cutting interest rates at its meeting last week. Elsewhere, the continued its recent recovery on reports that Conservative Party lawmakers were making plans to from taking the U.K. out of the European Union without a deal on Oct. 31 if, as expected, Johnson wins the ongoing party leadership contest. In other news, the struggled to build on its sharp gains of Monday. It was little changed at 5.8197 to the dollar. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| Forex - U.S. Dollar Struggles as Dallas Manufacturing Data Disappoints - Investing.com Posted: 24 Jun 2019 07:45 AM PDT  © Reuters. © Reuters.Investing.com - The U.S. dollar was near three-month lows on Monday after disappointing regional data and rising tensions between Iran and the U.S. The , which measures the greenback's strength against a basket of six major currencies, was down 0.1% to 95.59 by 10:45 AM ET (14:45 GMT). The index for June came in weaker than expected at -12.1 compared to estimates for -1.0. The data confirm declining activity across other regions in the U.S., as the Philly Fed activity index and Empire manufacturing index were also weaker. The numbers boost the case for the Federal Reserve to cut rates this year, as economic activity across the U.S. slows. Meanwhile, U.S. Secretary of State Mike Pompeo warned that "significant" sanctions against Iran would be announced on Monday and added that he wants to build a "global coalition" to deal with the threat he says is posed by Iran. President Donald Trump ordered, but subsequently called off, a military strike last week in response to Iran shooting down an unmanned U.S. drone. Tensions between the two countries have been fragile since the White House decided to withdraw from the UN-backed 2015 Iran nuclear agreement. The dollar rose against the safe-haven Japanese yen, with up 0.1% to 107.40. Elsewhere, the euro was stronger on the weak dollar, with up 0.3% to 1.1394, while slipped 0.2% to 1.2721 and fell 0.1% to 1.3202. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| Forex - U.S. Dollar Edges Down; Yen Rises on Safe-Haven Demand - Investing.com Posted: 24 Jun 2019 10:42 PM PDT  © Reuters. © Reuters.Investing.com - The U.S. dollar edged down on Tuesday in Asia while the Japanese yen gained as heightening tension in the Middle East drew safe-haven demand. The that tracks the greenback against a basket of other currencies was down 0.1% to 95.428 by 1:35 AM ET (05:35 GMT). The index was under pressure by the prospects of monetary easing by the Federal Reserve, which signalled it was prepared to cut interest rates later this year to counter a global economic slowdown that was exacerbated by global trade tensions. Fed chairman Jerome Powell is due to speak later this week. The U.S. currency was pressured further against the yen, which often serves as a safe haven in times of political angst, as tensions grew between Iran and the U.S. On Monday, Washington announced new sanctions against Iran after the latter was accused of shooting down an unmanned drone. U.S. President Donald Trump ordered, but subsequently called off, a military strike last week in response to the incident, according to reports. Tensions between the two countries have been fragile since the White House decided to withdraw from the UN-backed 2015 Iran nuclear agreement. The pair last traded at 106.93, down 0.3%. On the Sino-U.S. trade front, Chinese leader Xi Jinping and Trump will meet at the G-20 summit in Japan this weekend. The two leaders will resume trade talks but a quick trade deal is not expected. Both China and the U.S. should make compromises in trade talks, Chinese Vice Commerce Minister Wang Shouwen said on Monday, adding that the U.S. needs to stop "inappropriate actions" against Chinese firms. The pair traded 0.1% higher to 6.8790. The pair was unchanged at 0.6959, while the pair jumped 0.4% to 0.6643. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

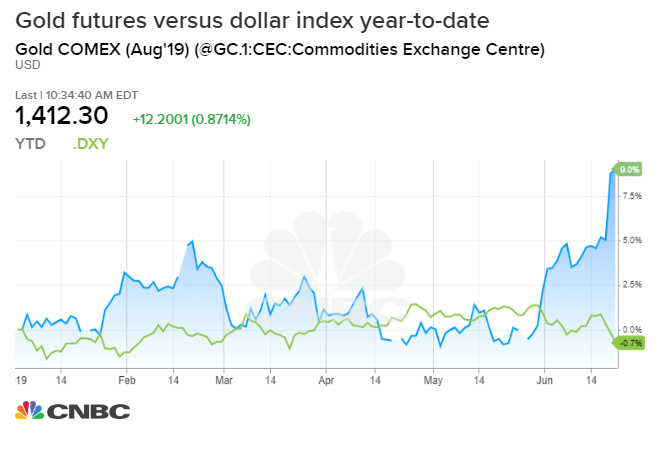

| Anti-dollar trade makes outlook for gold much more bullish - CNBC Posted: 24 Jun 2019 11:54 AM PDT  Ullstein Bild | Getty Images The strong dollar story could be over for now, and that's putting a shine on gold and other 'anti-dollar' trades. "I've been bullish the dollar, but I think the bigger, long-term dollar rally is over," said Marc Chandler, chief market strategist at Bannockburn Global Forex. "One reason is the policy mix in the U.S. has shifted. We had tighter monetary and looser fiscal policy. That's good for a currency, and now we have the opposite. The interest rate differentials have been moving against the U.S. U.S. interest rates have been moving faster than everybody else's." The Federal Reserve's has shifted over the past six months, from a hawkish stance of raising interest rates, to neutral, and now to so dovish it is expected to cut interest rates next month. That has changed sentiment on the dollar, and strategists now see the potential for a longer term weakening of the currency. The dollar also has been lagging. Since Tuesday afternoon, when the Fed was in the midst of its two-day meeting, the dollar index has lost 1.6%. But at the same time, gold futures for August in the past five sessions have gained 5.6% and gold has broken through a key area of resistance. Analysts said bitcoin was also benefitting from the weak dollar, and it was up 2% Monday. "There's a a lot more interest in gold on a widespread basis. It's not just tactical investors or ETF holders. it's broad based," said Suki Cooper, precious metals analyst at Standard Chartered Bank. "If we look at ETF flows, Friday we had the largest inflow since 2016."

Cooper said at 32.1 tons, it was the largest inflow into the physically backed gold ETFs since July, 2016, right after the U.K. 'Brexit' vote. Gold futures were trading at $1,418 per troy ounce, just below a resistance level of $1,425 and the highest level since August, 2013. Cooper expects a high of $1,440 for the year. Buying of gold by global central banks has also been a factor driving the price higher, Cooper said. She said the first real boost for gold came when President Donald Trump was threatening a tariffs on Mexico as well as China, and investors feared a global recession. Gold broke above the $1,360/$1,365 area last week, and now with a weak dollar, it has another catalyst. Strategists also said the tensions around Iran were driving investors into the safety of gold. The dollar index was at 96.04 Monday, down about 0.2%. Heavily weighted toward the euro, the U.S. dollar was also down about 0.2% against the euro, which was at $1.1391 Monday.

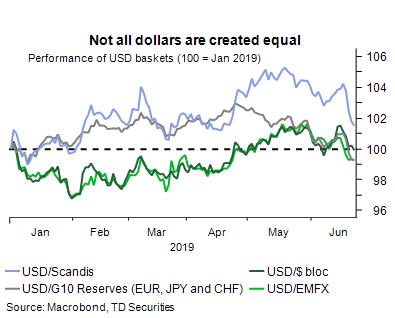

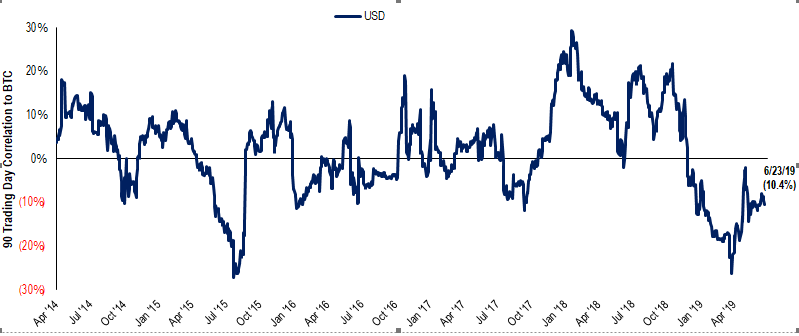

"If you think about the gold/dollar relationship, it's one of the first things people in the market look at as a cleaner version of the anti-dollar trade," said Mark McCormick, North American foreign exchange strategist at TD Securities. He said other anti-dollar trades would be the euro, yen, sterling and the CNH, the offshore Chinese Yuan. "They all kind of have dirt on their faces. None of them are clean anti-dollar trades." Both sterling and euro have issues with slow growth but also Brexit, which is still unresolved with no plan for the U.K. to leave the European Union, three years after the referendum. Chandler said the dollar's change in course could be significant, and gold move with it, reaching $1,700 per ounce. He said the current dollar rally started late in the Obama administration and as Trump was heading to the White House. He said the dollar is ending a significant bull run, which follows the one in the late 1990s when the Clinton administration promoted a strong dollar policy, and the one before that, during the Reagan era, when the Fed Chair Paul Volcker had raised interest rates sharply. Some traders noted the move in bitcoin could be viewed as an 'anti-dollar' trade of sorts. "I guess you could call bitcoin almost gold-on-steroids. It's got some of the same characteristics. It's not a fiat currency. It's got its own rhythms and moves too. It doesn't have a central bank," said McCormick. Bitcoin rose above $11,000 this past weekend and was higher Monday, and has been moving parallel to the decline in the dollar. "Bitcoin is negatively correlated to USD right now. So it is benefiting from the weaker dollar trade," notes Tom Lee, head of research and co-founder of Fundstrat Global. "I think bitcoin is regaining some legitimacy from macro and fx traders as it has staged a recovery to levels that prove 'bitcoin is not dead.'"

Source: Fundstrat McCormick said he too sees the tide turning for the U.S. dollar, and he sees an end for now for the "MAGA" trade, a play on the Trump campaign slogan, "Making America Great Again." "I do think we're at a turning point," said McCormick. The dollar had been benefiting last year from the affects of fiscal stimulus; the Fed continuing to raise interest rates and the trade war, as investors sought safety. "The ingredients were there," he said. "But it's not the reversal of the fundamentals that were bearish for the dollar. What you have right now which is clearly a big game changer, is the U.S. no longer has this growth dividend." Events in the next couple of days could be a big factor for both the dollar and gold. Cooper said the G-20 meeting in Osaka could reinforce or change the view that the Fed will cut interest rates. "With respect to G-20. We think it's going to be something that's a factor in rate cuts. We're expecting the Fed to cut in July. If we start to see a positive outcome, that could affect the outlook for a rate cut," said Cooper. I |

| You are subscribed to email updates from "investing forex" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment