Anti-dollar trade makes outlook for gold much more bullish - CNBC

Anti-dollar trade makes outlook for gold much more bullish - CNBC |

- Anti-dollar trade makes outlook for gold much more bullish - CNBC

- Chinese markets tumble; investors await Trump-Xi meeting - CNBC

- Apply "the secret" to forex trading success - ForexLive

- Zimbabwe Central Bank Abolishes Use of Foreign Currencies - Bloomberg

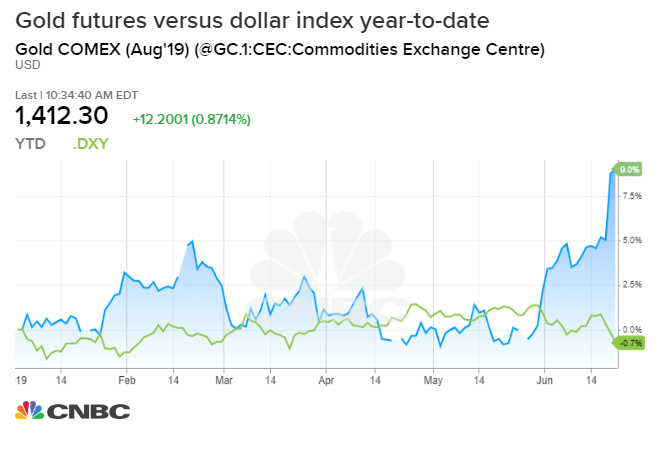

| Anti-dollar trade makes outlook for gold much more bullish - CNBC Posted: 24 Jun 2019 11:54 AM PDT  Ullstein Bild | Getty Images The strong dollar story could be over for now, and that's putting a shine on gold and other 'anti-dollar' trades. "I've been bullish the dollar, but I think the bigger, long-term dollar rally is over," said Marc Chandler, chief market strategist at Bannockburn Global Forex. "One reason is the policy mix in the U.S. has shifted. We had tighter monetary and looser fiscal policy. That's good for a currency, and now we have the opposite. The interest rate differentials have been moving against the U.S. U.S. interest rates have been moving faster than everybody else's." The Federal Reserve's has shifted over the past six months, from a hawkish stance of raising interest rates, to neutral, and now to so dovish it is expected to cut interest rates next month. That has changed sentiment on the dollar, and strategists now see the potential for a longer term weakening of the currency. The dollar also has been lagging. Since Tuesday afternoon, when the Fed was in the midst of its two-day meeting, the dollar index has lost 1.6%. But at the same time, gold futures for August in the past five sessions have gained 5.6% and gold has broken through a key area of resistance. Analysts said bitcoin was also benefitting from the weak dollar, and it was up 2% Monday. "There's a a lot more interest in gold on a widespread basis. It's not just tactical investors or ETF holders. it's broad based," said Suki Cooper, precious metals analyst at Standard Chartered Bank. "If we look at ETF flows, Friday we had the largest inflow since 2016."

Cooper said at 32.1 tons, it was the largest inflow into the physically backed gold ETFs since July, 2016, right after the U.K. 'Brexit' vote. Gold futures were trading at $1,418 per troy ounce, just below a resistance level of $1,425 and the highest level since August, 2013. Cooper expects a high of $1,440 for the year. Buying of gold by global central banks has also been a factor driving the price higher, Cooper said. She said the first real boost for gold came when President Donald Trump was threatening a tariffs on Mexico as well as China, and investors feared a global recession. Gold broke above the $1,360/$1,365 area last week, and now with a weak dollar, it has another catalyst. Strategists also said the tensions around Iran were driving investors into the safety of gold. The dollar index was at 96.04 Monday, down about 0.2%. Heavily weighted toward the euro, the U.S. dollar was also down about 0.2% against the euro, which was at $1.1391 Monday.

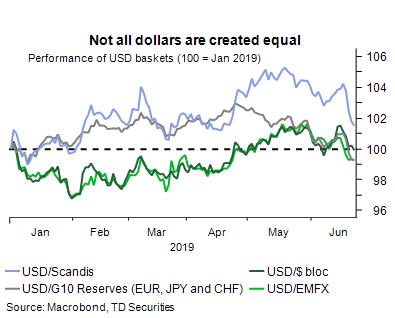

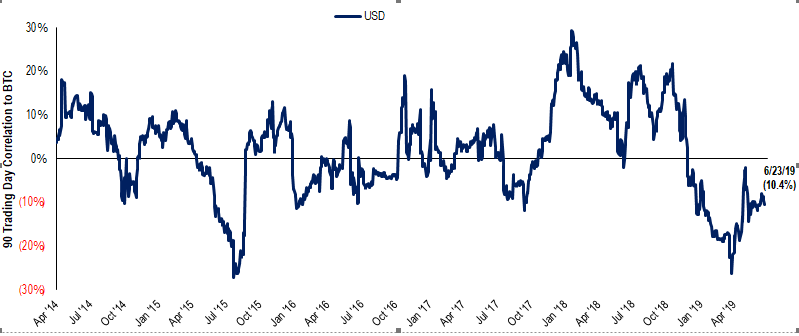

"If you think about the gold/dollar relationship, it's one of the first things people in the market look at as a cleaner version of the anti-dollar trade," said Mark McCormick, North American foreign exchange strategist at TD Securities. He said other anti-dollar trades would be the euro, yen, sterling and the CNH, the offshore Chinese Yuan. "They all kind of have dirt on their faces. None of them are clean anti-dollar trades." Both sterling and euro have issues with slow growth but also Brexit, which is still unresolved with no plan for the U.K. to leave the European Union, three years after the referendum. Chandler said the dollar's change in course could be significant, and gold move with it, reaching $1,700 per ounce. He said the current dollar rally started late in the Obama administration and as Trump was heading to the White House. He said the dollar is ending a significant bull run, which follows the one in the late 1990s when the Clinton administration promoted a strong dollar policy, and the one before that, during the Reagan era, when the Fed Chair Paul Volcker had raised interest rates sharply. Some traders noted the move in bitcoin could be viewed as an 'anti-dollar' trade of sorts. "I guess you could call bitcoin almost gold-on-steroids. It's got some of the same characteristics. It's not a fiat currency. It's got its own rhythms and moves too. It doesn't have a central bank," said McCormick. Bitcoin rose above $11,000 this past weekend and was higher Monday, and has been moving parallel to the decline in the dollar. "Bitcoin is negatively correlated to USD right now. So it is benefiting from the weaker dollar trade," notes Tom Lee, head of research and co-founder of Fundstrat Global. "I think bitcoin is regaining some legitimacy from macro and fx traders as it has staged a recovery to levels that prove 'bitcoin is not dead.'"

Source: Fundstrat McCormick said he too sees the tide turning for the U.S. dollar, and he sees an end for now for the "MAGA" trade, a play on the Trump campaign slogan, "Making America Great Again." "I do think we're at a turning point," said McCormick. The dollar had been benefiting last year from the affects of fiscal stimulus; the Fed continuing to raise interest rates and the trade war, as investors sought safety. "The ingredients were there," he said. "But it's not the reversal of the fundamentals that were bearish for the dollar. What you have right now which is clearly a big game changer, is the U.S. no longer has this growth dividend." Events in the next couple of days could be a big factor for both the dollar and gold. Cooper said the G-20 meeting in Osaka could reinforce or change the view that the Fed will cut interest rates. "With respect to G-20. We think it's going to be something that's a factor in rate cuts. We're expecting the Fed to cut in July. If we start to see a positive outcome, that could affect the outlook for a rate cut," said Cooper. I |

| Chinese markets tumble; investors await Trump-Xi meeting - CNBC Posted: 24 Jun 2019 04:46 PM PDT  Stocks in Asia slipped on Tuesday, while investors looked toward a meeting between U.S. President Donald Trump and Chinese President Xi Jinping set to happen later in the week. Mainland Chinese stocks recovered partially from their earlier tumble but still slipped on the day: The Shanghai composite shed 0.87% to 2,982.07 and Shenzhen component fell 1.02% to 9,118.10. The Shenzhen composite also declined 0.992% to 1,560.46. In Hong Kong, the Hang Seng index slipped 1.21%, as of its final hour of trading. China-listed bank shares tumbled amid concerns over increased lending to small firms. Bank of Communications dropped 3.02% and China Construction Bank fell 1.34%. Their Hong Kong-listed counterparts shed 3.87% and 1.37%, respectively. The Nikkei 225 in Japan slipped 0.43% to close at 21,193.81, while the Topix shed 0.27% to finish its trading day at 1,543.49. Over in South Korea, the Kospi ended its trading day 0.22% lower at 2,121.64, while Australia's S&P/ASX 200 closed 0.11% lower at 6,658.00. The Japanese yen, widely viewed as a safe-haven currency, traded at 107.01 against the dollar after touching lows around 107.5 yesterday. The Australian dollar changed hands at $0.6959 after seeing an earlier high of $0.6972. Asia-Pacific Market Indexes ChartTrump-Xi meeting awaited Investors await a highly-anticipated meeting between Trump and Xi at the upcoming G-20 summit in Japan. The two leaders are expected to discuss the protracted trade fight between their two countries. China and the U.S. have already slapped tariffs on billions of dollars worth of each other's goods over the past year. In May, the two economic powerhouses hiked tariffs targeting some goods. The Trump administration has said previously that Trump is ready to raise tariffs on all Chinese imports into the U.S. if the two countries fail to arrive at a deal. China's Ministry of Commerce said in a statement on Tuesday that the country's Vice Premier Liu He had a phone call with U.S. Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer on Monday. They discussed trade and agreed to maintain communications, according to the statement. Overnight on Wall Street, the Dow Jones Industrial Average closed 8.41 points higher at 26,727.54, while the S&P 500 declined 0.2% to finish its trading day stateside at 2,945.35. The Nasdaq Composite closed 0.3% lower at 8,005.70. There appeared to be a "consensus building" in the U.S. markets that Trump and Xi are set to "agree to not only resume talks but hold off on tariffs for a defined amount of time," according to Hannah Anderson, global market strategist at J.P. Morgan Asset Management. She, however, sounded a note of caution to CNBC: "I think that might be getting a little bit ahead of where negotiations are likely to come out." The potential U.S.-China developments come as expectations have risen for an interest rate cut from the U.S. Federal Reserve. The central bank opened the door to that possibility last week. "A July cut is very likely, whether there (is) a truce or not. I think the key difference that a truce means for the Fed is that if there is a truce, it could be one cut. It could be a 25 basis point cut. If there is actually no truce, it could be a 50 basis point cut," Tan Teck Leng, Asia Pacific foreign exchange analyst at UBS Global Wealth Management, told CNBC on Tuesday. The U.S. dollar index, which tracks the greenback against a basket of its peers, last traded at 95.937 as it continued to slide from levels above 97.2 seen last week. Tan, for his part, said the dollar is "already in a structural drift lower" for the next six to 12 months. "Even if the Fed doesn't cut as much as market expectations in July, the fact is that the economy is slowing very sharply," he said. "This year, U.S. GDP is growing at about 2.8 to 3%, next year we are looking at 2% of GDP growth. So, it is a tremendous slowdown." "Even if the Fed might be cutting once or twice, we can't rule out that, going into next year, they might actually need to ease more than that. So, that is the context where the dollar index could easily go below 95," the analyst said. US-Iran tensions Markets are also keeping an eye on the latest developments after the U.S. on Monday imposed sanctions on Iran over last week's shooting down of an unmanned American drone. Tensions between the two countries have remained high since a recent attack on oil tankers near the Strait of Hormuz, sending crude prices higher. The latest sanctions by Washington on Tehran "appear to be more gloss than substance" given that the current restrictions are "already very harsh," Tapas Strickland, markets strategist at National Australia Bank, wrote in a note. Oil prices were lower in the afternoon of Asian trading hours, with the international benchmark Brent crude futures contract slipping 0.46% to $64.56 per barrel. U.S crude futures were 0.31% lower at $57.72 per barrel. — Reuters and CNBC's Fred Imbert contributed to this report. |

| Apply "the secret" to forex trading success - ForexLive Posted: 19 Jun 2019 04:25 AM PDT What's "the secret" behind successful traders?

Each of these currencies is exchanged with the currency of other nations at different exchange rates-which are always in a state of flux because the market trades around the clock (Sunday through Friday). The volatility and sheer size of the market means that there is ample fluctuation to produce big profits-and losses. The challenge for the investor, as always, is to predict which direction the rates of currency pairs will fluctuate. The beginning point in any investment strategy is determining what type of analysis will be used to help guide enter and exit decisions. Investors who use fundamental analysis look at a nation's interest rates and other economic indicators when deciding to enter or exit a position. Fundamental investors tend to trade based upon news releases and economic data from the nations involved in the currency pair. Briefly, technical analysis involves the interpretation of price performance and chart patterns-all historical data. Some technical indicators used in this type of analysis include:

Technical traders do not believe that the past necessarily predicts the future-but that long- and short-term trends can be identified and exploited to help guide current decisions on entry and exit points on positions. Technical traders try to identify current trends in the Forex market to determine entry and exit points. If they are correct, they can ride a trend (in either direction) for a profit until an exit point is reached (when the trend is ending). The most successful traders on the Forex tend to look for long-term trends and favor technical analysis. Fundamental traders have to enter and exit positions very quickly in order to capitalize in price fluctuations caused by news events (interest rate changes, release of economic data, etc.) and are therefore more vulnerable due to excessive trading. If there truly was "a secret" to trading success on the Forex, the top investors all tend to agree on the following:

If there really is a secret to trading success on the Forex it has to be patience. Trading strategies are never perfect because the market will never be predictable 100% of the time. There will be times when any strategy fails and stop points are reached before profits are realized. Continuous back testing, remaining patient, and setting stops are the true secrets of Forex success. This article was submitted by UBCFX. |

| Zimbabwe Central Bank Abolishes Use of Foreign Currencies - Bloomberg Posted: 24 Jun 2019 02:40 AM PDT [unable to retrieve full-text content]Zimbabwe Central Bank Abolishes Use of Foreign Currencies Bloomberg Zimbabwe's central bank abolished the use of multiple currencies as it tries to curb black-market currency trade that's contributed to surging inflation. |

| You are subscribed to email updates from "currency trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment