Best platform for Forex trading - Augusta Free Press

Best platform for Forex trading - Augusta Free Press |

- Best platform for Forex trading - Augusta Free Press

- Why You Should Trade Cryptocurrency On Forex - Crypto Disrupt

- Best Forex Broker 2019 Overall - Emirates Business 24/7

- Bump in the night: FX flash crashes put regulators on alert - Reuters

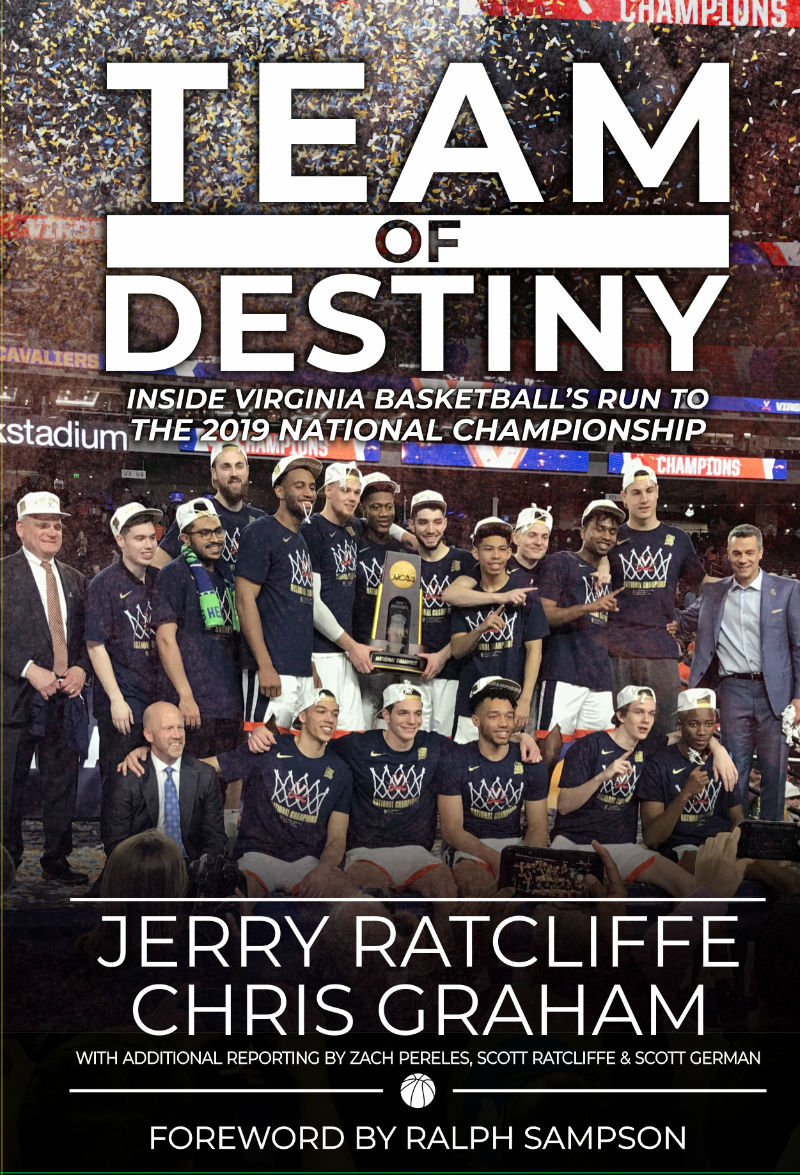

| Best platform for Forex trading - Augusta Free Press Posted: 30 May 2019 06:56 AM PDT What is Forex?Forex or as most people know it, foreign exchange, is a decentralized world market where people can trade, buy or sell currencies. It is also the biggest market in the world for currency trading. The average money that people and companies spend on this market is well above $5 trillion each day which is a huge number. It is bigger than all the stock markets combined. Every time someone goes to a foreign country and exchanges his or hers local currency to another currency, they use Forex. The point of ForexTo simplify it, Forex is a change between two currencies. The biggest companies in the world are using Forex every minute. One euro could be worth 1.06 dollars and in the next minute it could be worth as much as 1.10 dollars. These companies or people then sell their euros for the bigger price and that is how they pay off their workers. The amounts of money they use in these transactions are huge. Even if the difference is small (0.04), when they convert a lot of money it makes a big difference. This system isn't just used by companies but by a lot of people. It can get you very rich in a short period of time but can also make you broke. When people see a currency that is going down in value (example USD) they then sell that currency against other currencies (example Euro). The more the USD goes down in value against the Euro the bigger the profit people make. Some people have even made this their job and spend more than 10 hours a day watching and following the worth of different worldwide currencies. A lot of banks and companies lend money to people that start trading and the most important thing is leverage. The bigger the leverage ratios the more money you can gain or lose. What is the best platform for Forex trading?There is a variety of websites and platforms that offer people Forex trading. One of the best platforms on the market is called Metatrader 4 Forex trading platform. They have been working since 2006 as a platform. The trading volumes of this company are well above $60 billion each month. They don't charge any money for the download but you do have to invest some funds into your account after you register on their platform. The offer a variety of trading possibilities from currency trading to Forex trading and CFD trading. They even offer education on how to start trading and get good at it. It's the most flexible and fastest trading platform there is. They have expert advisors for algorithmic trading and they also offer trading signals from the best supporters in the world. People can access their platform from their PC, Mobile or the web. You can also trade with ofer 50+ Forex pairs, which include the biggest currencies in the world and they even offer trading with Bitcoin and othey crypto values.  Pre-order for $20: click here. The book, with additional reporting by Zach Pereles, Scott Ratcliffe and Scott German, will take you from the aftermath of the stunning first-round loss to UMBC in 2018, and how coach Tony Bennett and his team used that loss as the source of strength, through to the ACC regular-season championship, the run to the Final Four, and the thrilling overtime win over Texas Tech to win the 2019 national title, the first in school history. |

| Why You Should Trade Cryptocurrency On Forex - Crypto Disrupt Posted: 29 May 2019 10:41 PM PDT  Main navigation |

| Best Forex Broker 2019 Overall - Emirates Business 24/7 Posted: 29 May 2019 02:57 AM PDT Our selection of the best forex brokers of 2019 is the result of comparing only the most trusted brokers with long standing traditions and flawless financial backgrounds which makes all of them a safe choice. We tried to find the best forex broker overall although this choice will often be a question of individual trading preference. We have compared brokers based on several factors which we think are most important from a traders perspective.This factors are: trading fees and spreads, trading platforms, charting and analysis tools, assets and regulators. Best Forex Broker 2019

All of the brokers we took into comparison are considered as safe as they are all regulated by the top tier regulators like the FCA and ASIC and also have a long standing trading tradition. Considering all of the many factors, we think that the most important ones are trading fees and a user friendly platform. The trading fee's should be reasonable and the trading platform should be easy to understand and use. What all of the compared brokers also have in common are the free demo trading accounts. If you are just starting out with forex trading we highly recommend you to start trading with a demo account where you can't loose any money – as you probably know, forex trading is highly risky and you can loose money in matter of seconds. All of the brokers also enable CFD trades. This are high risky and complex contracts and are not suitable for beginners traders – you can loose all of your investment in seconds. Taking all of the above information into consideration this are our favourite brokers in overview: 1. IQ Option (Best Binary Options Trading Company)

With almost 16 million accounts and 3,6 million trades per day IQ Options is a legit and transparent trading platform following the latest financial regulations, which enables users to trade a variety of different instruments and assets like forex, stocks binary options, cryptocurrencies etc. The trading experience is pretty smooth. Based on the high level functionality the platform is a good fit for professional traders, but it is also a good fit for beginners as it is really easy to understand and navigate. If you sign up you can be sure to interact with an intuitive platform that enables access to a a big amount of resources, and trading options. The platforms comes with a few drawback as well. The customer support is still being upgraded and at this time it can happen that you will need to wait for more than 24 minutes in order to have your queries processed. If you are just starting out and you will need to interact with a customer support agent on a daily basis, than you need to pay an fee of $3000 in order to secure a consistent communication. USA, Japan and Canada based traders are not allowed to register with IQ options RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK 2. eToro (Best Social Trading Platform)

eToro is an established social trading company, operating since 2007. It is an FCA regulated entity when operating in the UK, an Australian entity in Australia, and a Cypriot entity for international customers. eToro is considered to be a trustworthy platform as it is regulated by an established regulator while being a well-recognized startup as well. Its main operation is based around CFDs. CFDs are complex instruments that include leverage, so they come with a higher risk. eToro has been awarded as the best social trading platform – social trading means you can follow other traders and copy their investment strategies.

3. Forex.com ( Great all-around offer)

FOREX.com is a forex and CFD broker offering over 84 currency pairs and 230 CFD's across major asset classes. The brand is part of the GAIN capital holdings which operates in multiple countries holding licenses from many different regulatory hubs including UK, US, CA, Japan and Australia. We would recommend this platform to active and mid active traders as they will benefit from slightly lower trading fees and spreads. + Forex.com is an overall solid forex broker with a high level of trustworthiness. With over 145.000 clients and nearly $1 billion in assets you can't do anything wrong. As a beginner you can open a demo account depositing a minimum of $250, before investing real money. On the other side advanced traders can access a premium account by depositing $25.000 or by trading $25million in monthly national value. – There are no major downsides on this platform. What we could lay out as a downside is the fact that the MT5 trader did not rolled out yet. In a nutshell, as a trustworthy global player, Forex.com offers plenty of trading options for Forex and CFD traders. With all of the major trading platforms, diverse trading tools and research tools FOREX.com is suitable for almost all traders at all experience levels. 4. Plus 500 (Recommended for experienced traders looking for an easy-to-use platform, with great user experience)

Plus 500 is a quality CFD's provider and operates around the world via its subsidiaries: Plus500AU, AFSL #417727 issued by ASIC, Derivatives issuer licence in New Zealand for NZ clients, FSP No. 486026; Financial Services Provider # 47546 in South Africa. Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909). Plus500 CY Ltd authorised and regulated by the Cyprus Securities and Exchange Commission (Licence No. 250/14). Client Money is held on trust, separated from Business Money. Should Plus500 go into liquidation client money would attract all the legal protections afforded to trust money. Plus 500 has one of the most user-friendly platforms that allow instant access to variousmarkets, including commodities, indices, shares, andoptions. Every asset is availableto buy or sell as CFD's, with leverage up to 1:300, commission-free. Many other featuressuch as stop, limit, andtrailing stop are all present on the platform. Customers can also enjoy trading in a free unrestricted demo account that imitates real action. The platform has a lot of news, market information, training tools and comes with solid customer support. Everything is available in the Arabiclanguage, including customersupport.

[/dropshadowbox] 5. OandA (Most user friendly trading platform + best API)

OandA has won many awards this year as the best overall pick for forex and CFD's trading. It is a well trusted company regulated by the top tier regulators like FCA and ASIC. We would recommend this platform to users who are looking for a user friendly trading platform including high end research tools.

+ On the positive side OandA offers one of the most user friendly and easy to use platforms including fully digitalised account opening and powerful research tools including the best API in the industry. – On the flip side you can only trade forex and CFD's with a pretty high withdrawal rates. Their support would need some improvement as well.. Forex trading for new investors – what you need to know and how to choose your broker. 6. FXCM (Best Technical Tools)

FXCM is a UK based forex broker which offers some CFD's as well and is regulated by some top tier regulators like FCA and ASIC. We would recommend this platform to users looking for great technical research tools.

+ What we found best on this platform is the fast account opening options, low trading and finance fees and the high end technical research tools. – On the downside, FXCM only offers forex, CFD's and some crypto trading options. Their platform needs and update as it is outdated and not user friendly. No minimum deposit required so feel free to give it a shot – inactivity fees charged only after a year. 7. XTB (Best Fx and CFD Broker)

XTB is primarily a CFD and forex broker regulated by the most trusted financial regulators including the FCA and is also listed on the Warsaw stock exchange. We would recommend this platform to users looking for fast deposit and withdrawal + great research tools.

+ What we found best about this platform are the fast deposits and withdrawals and also the hassle free account opening. The platform is easy to use and has a lot of research tools as well. – On the negative side trading assets are limited to forex, CFD's and real stocks in some limited countries. The support is a standard solution, but the employees can be a bit pushy some times. In a nutshell, XTB is recommendable for clients who want to trade forex and CFD's and are looking for a hassle free account opening, low withdrawal fees and great research tools. Demo account option available. Our Top Picks For DayTradingWhat are the most important criteria to look for when choosing a forex broker? There are lots of them but we can simply split them into this three categories:

Almost all of the Brokers listed above offer a large selection of currency pairs available to trade, almost all have pretty low account minimums and the highest legal leverage ratio of 50:1. They also provide the choice between commission accounts and spread markup accounts. Commission accounts have a fixed commission fee but will in turn offer lower bid-ask spreads. |

| Bump in the night: FX flash crashes put regulators on alert - Reuters Posted: 29 May 2019 11:09 PM PDT LONDON/NEW YORK (Reuters) - The increasing frequency of flash crashes in the $5.1 trillion-a-day foreign exchange market has regulators scrambling for answers. FILE PHOTO: A currency dealer works in front of electronic boards showing the Korea Composite Stock Price Index (KOSPI) (C), the exchange rates between the Chinese yuan and South Korean won (L), and the exchange rate between U.S. dollar and South Korean won (R), at a dealing room of a bank in Seoul, South Korea, August 25, 2015. REUTERS/Kim Hong-Ji/File Photo Sudden, violent and often quickly reversed price moves are now a regular occurrence in world currency markets — often during the so-called 'witching hour', a period of thin trading between 5-6 pm in New York when currency dealers there have powered off and colleagues in Tokyo have yet to sign on. Two big crashes this year separately pummeled the yen and the Swiss franc and, given the importance of currency pricing for trade, investment flows and the global economy, policymakers are concerned a major fracturing could threaten financial stability. "The question is, is this a new normal, or is it a canary in the coalmine sort of thing?" said Fabio Natalucci, deputy director of the Monetary and Capital Markets Department at the International Monetary Fund (IMF). "We have seen the frequency of these events increase so this may be pointing to a major liquidity stress event coming at some point in the future." Natalucci said liquidity strains — market lingo for an insufficient number of buy and sell orders — were evident days ahead of a big crash and the IMF was creating a monitoring tool that might be able to predict when the next one was coming. Reflecting official disquiet, flash crashes have been a regular topic of discussion this year at the Federal Reserve Bank of New York's FX market liaison committee, a forum for central bankers and market players. Bankers and policymakers agree that an industry-wide switch to machine-trading in FX markets is behind the frequency and severity of the price moves, meaning that further crashes are likely. "Our pessimistic view is that this technology is going to become an increasing part of the FX market and we need to step up our monitoring," a G10 central bank official said, declining to be named because he is not authorized to speak publicly. Regulators aren't pressing the panic button yet. Natalucci said there was no evidence that flash crashes so far had raised funding costs for firms or households and it made sense to study the problem before "rushing into enacting any regulatory responses". Mini-crashes already occur roughly every two weeks in the FX market according to a study by Pragma, a company which creates computer trading models. In these incidences, a currency's price will shift dramatically followed by a swift reversal, along with a sudden and significant widening of the spread between prices quoted to buy and sell it. The spread usually narrows after a few minutes. (GRAPHIC: Flash crashes in the past (RBA) - tmsnrt.rs/2Wcbxy3) KILL SWITCHESComputer models known as algorithms, or algos, have largely replaced humans in currency trading, helping banks to cut costs and boost the speed at which deals are done. The models are designed to execute trades smoothly by breaking down orders into small pieces and searching for platforms where liquidity is plentiful. But problems arise when market conditions change, for instance, when trading volumes suddenly collapse or volatility spikes as has been the case during Britain's protracted attempt to extricate itself from the European Union. At such times, algos are often programmed to shut down. Two senior central banking officials, speaking on condition of anonymity, said such "kill switches" drained liquidity. And, because fragmented forex markets depend on algos for a constant stream of price quotes — by one estimate there are 70-odd trading platforms — a widespread shutdown causes volumes to nosedive, making the price moves more dramatic. The first of this year's notable crashes came on January 3 when the yen spiked suddenly against the dollar after Tokyo markets closed. It jumped 8% within the space of seven minutes against the Australian dollar and 10% to the Turkish lira. The second was on February 11 when the Swiss franc gyrated frantically, with an unexplained and brief jump against the euro and dollar. A Reserve Bank of Australia (RBA) report noted that several flash episodes have been recorded during the witching hour. It was also during this illiquid period on October 7, 2016 that sterling collapsed 9% in early Asian trading, falling to around $1.14 from $1.26 within minutes. The RBA's analysis of all these flash crashes concluded algorithmic trading strategies likely acted as "amplifiers". (GRAPHIC: Japan Yen Flash crash Jan 3 - tmsnrt.rs/2WiSDWn) Human traders would be able to spot an opportunity from the market turmoil — buying a currency in free fall - which would help to defuse it. But these days there are far less of them around. Upto 70% of all FX orders on platform EBS, one of two top venues for currency trading, now originate from algorithms. In 2004, all trading was undertaken by humans. With banks under constant pressure to cut costs and post-financial-crisis rules making it ever more expensive to trade, there is no sign of firms hiring extra staff or deploying existing employees onto a graveyard shift. Instead, some try to avoid trading when they know volumes will be light such as major holidays. Machines, meanwhile, are expected to become even more dominant. Pragma has just launched an algorithm to trade non-deliverable forwards, derivatives used to hedge exposure to illiquid currencies, especially in emerging markets, according to Curtis Pfeiffer, chief business officer at the firm. Trading in illiquid, emerging market currencies was previously the mainstay of voice traders. "FX trading in banks is a tough business because spot trading is so commoditized and revenues are squeezed," said John Marley, a senior currency consultant at Smart Currency Business. "Moreover, banks have rolled back their proprietary trading desks due to the extra capital required and lower risk appetite." (GRAPHIC: G10 FX traders - tmsnrt.rs/2Elpkvq) TALKING POINTSPolicymakers' ability to understand and affect currency moves are hampered by the freewheeling nature of the FX market, which is unregulated, private and decentralized. The 'FX Global Code' was developed by central banks and private sector participants to promote a fair and open FX market but it is not legally binding. In comparison to equity markets, where regulators have been able to introduce measures to try and tame wild price swings, policymakers in the FX space are still at the discussion stage. Flash crashes were on the agenda of two recent meetings of the Foreign Exchange Committee, an industry group sponsored by the Federal Reserve Bank of New York, and a gathering of the Global Foreign Exchange Committee (GFXC) this month. "It's important for us to use this forum to understand flash events, their causes, and how the principles of the Global Code can be applied to promote a fair and efficient FX market," Simon Potter, executive vice president of the Federal Reserve Bank of New York and the chair of the GFXC, told Reuters. Central banks could potentially intervene to smooth out significant and prolonged gyrations in currency markets but that would be controversial. "The primary mandate for most central banks is price stability and the secondary mandate is financial stability," said Nikolay Markov, senior economist at Pictet Asset Management. "As long as these intraday big moves do not impinge on financial stability or drain interbank liquidity, central banks will monitor these developments and are not supposed to react to intraday moves." It could also be costly — Britain's failed defense of sterling in 1992 cost it around 3.3 billion pounds according to Treasury calculations — and potentially futile. "I doubt that central banks can do much to prevent the occurrences of these flash crashes as previous incidents have been a result of a complete drying up of market liquidity, resulting in some big moves," said Neil Mellor, senior FX strategist at BNY Mellon in New York. "Unless those problems are addressed, we will continue to see such price swings." Editing by Sujata Rao and Carmel Crimmins Our Standards:The Thomson Reuters Trust Principles. |

| You are subscribed to email updates from "forex trading platforms" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment