Forex Trading: AUDUSD Reversed at $0.701, Targeting $0.711 - Inside Bitcoins

Forex Trading: AUDUSD Reversed at $0.701, Targeting $0.711 - Inside Bitcoins |

- Forex Trading: AUDUSD Reversed at $0.701, Targeting $0.711 - Inside Bitcoins

- Forex Trading Opportunities for the Week Ahead [Video] - FXStreet

- Forex Trading: BCOUSD Is Trending Upwards, and This May Continue - Inside Bitcoins

- Forex Trading: GBPUSD Technical Analysis - April 29, 2019 - FXDailyReport.com

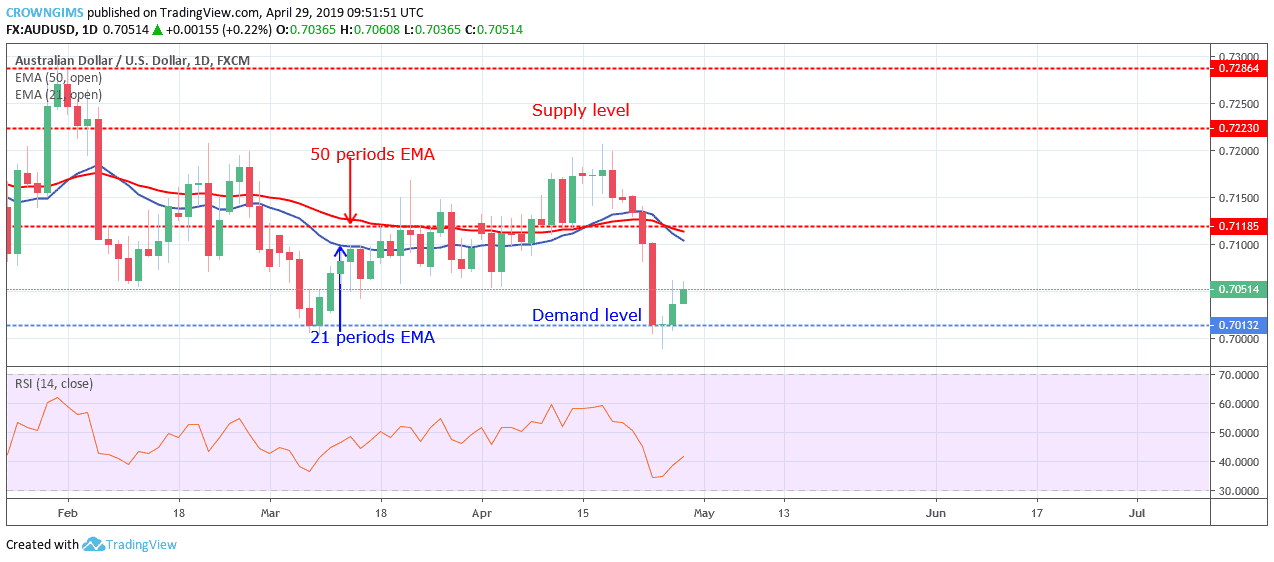

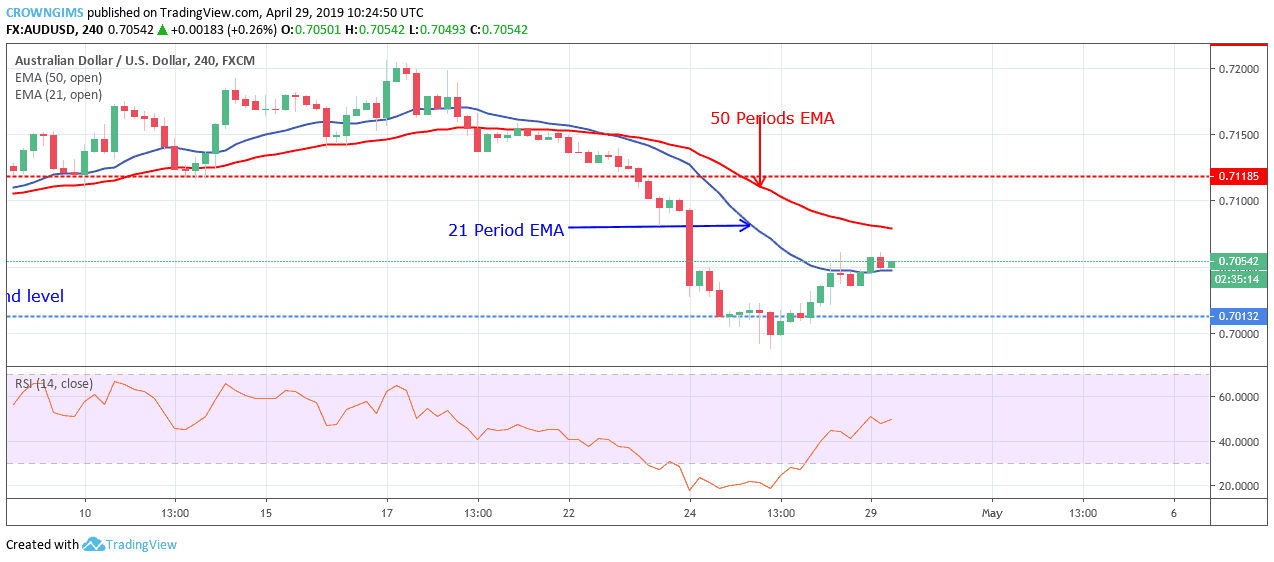

| Forex Trading: AUDUSD Reversed at $0.701, Targeting $0.711 - Inside Bitcoins Posted: 29 Apr 2019 04:56 AM PDT AUDUSD Price Analysis – April 22The demand level of $0.701 seems to be a bullish reversal point for the AUDUSD currency pair as it can be seen on the 4-hour chart, a pin bar candle formation at the demand level of $0.701. The bullish pressure may push the price of AUDUSD up to reach $0.711 level. AUD/USD MarketKey levels:Supply levels: $0.711, $0.722, $0.728 AUDUSD Long-term trend: BearishAUDUSD is on the downtrend on the daily chart. The Bears rejected further increase in AUDUSD price at $0.722 on April 17. They gained enough pressure and broke down the former demand level of $0.711. The price fell down to the low of $0.701 demand level with the formation of a strong massive bearish candle. On April 25, a Doji candle formed at the $0.701 demand level followed by bullish candles which indicate a bullish reversal at the mark.  The currency pair has crossed the two EMAs downside. The pair is trading below the 21 periods EMA and 50 periods EMA with the former crossed the later. However, the Relative Strength Index period 14 is at 40 levels and the signal line pointing up to indicate buy signal and increase in the Bulls' pressure. The bullish pressure may push the price of AUDUSD up to reach $0.711 level. AUDUSD medium-term Trend: BearishAUDUSD is bearish on the medium-term outlook. The demand level of $0.701 seems to be a bullish reversal point for the AUDUSD currency pair as it can be seen on the 4-hour chart, a pin bar candle formation at the demand level of $0.701.  AUDUSD price is currently crossing over the 21 periods EMA as a sign of an increase in the bullish momentum. The Relative strength index period 14 is above 50 levels with the signal line pointing up to connote buy signal. Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results. |

| Forex Trading Opportunities for the Week Ahead [Video] - FXStreet Posted: 27 Apr 2019 05:00 PM PDT  About the Author Sam Eder is a currency trader and author of "The Definitive Guide to Developing a Winning Forex Trading System" and "The Advanced Forex Course for Smart Traders". He also provides Forex signals from ex-bank and hedge fund traders. FX Renew Pty Ltd ABN 50 168 652 542 the holder of an Australian Financial Services Licence (AFSL) to carry on financial services business in Australia, limited to the financial services covered by its AFSL no.455388. Any advice or correspondence is general advice only and is based solely on consideration of the investment or trading merits of the financial products alone, without taking into account the investment objectives, financial situation or particular needs (i.e. financial circumstances) of any particular person. Before making an investment or trading decision based on the general advice, the recipient should carefully consider the appropriateness of the advice in light their financial circumstances and should carefully review FX Renew's FSG and terms and conditions. FX Renew is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Past results are not a guarantee of future performance. RISK DISCLOSURE Trading foreign exchange carries a high level of risk, and may not be suitable for all investors. The high degree of leverage available can magnify profits and as well as losses. You can lose more than your initial deposit. Before trading, please carefully consider the risks and inherent costs and seek independent advice as required. Please contact us, to discuss any questions or concerns you may have, we are here to help. |

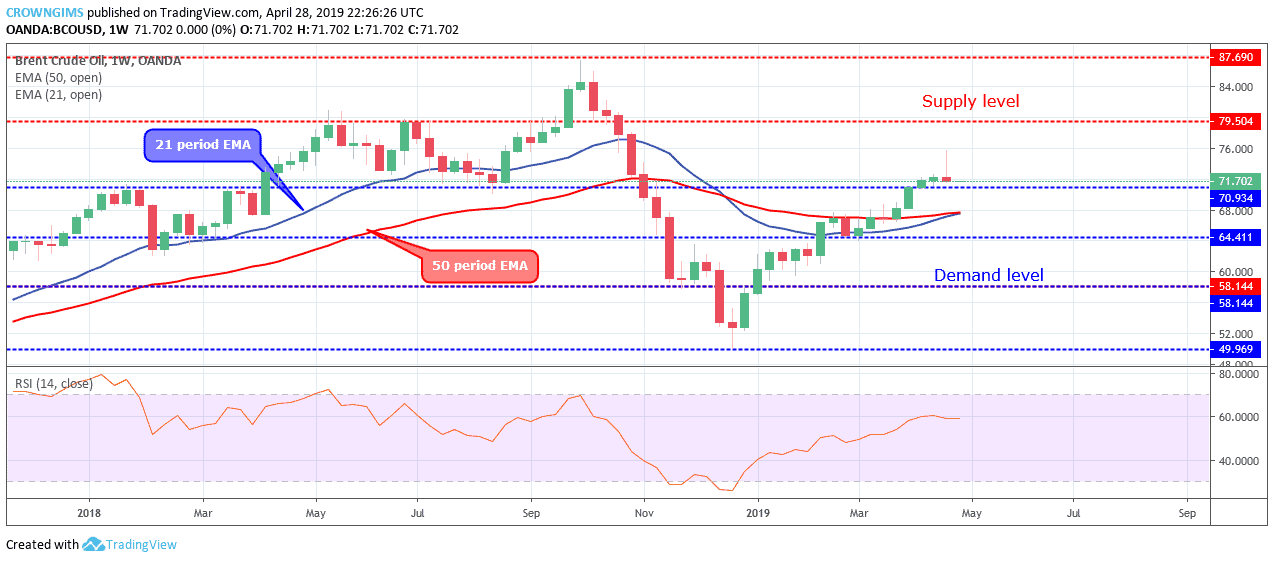

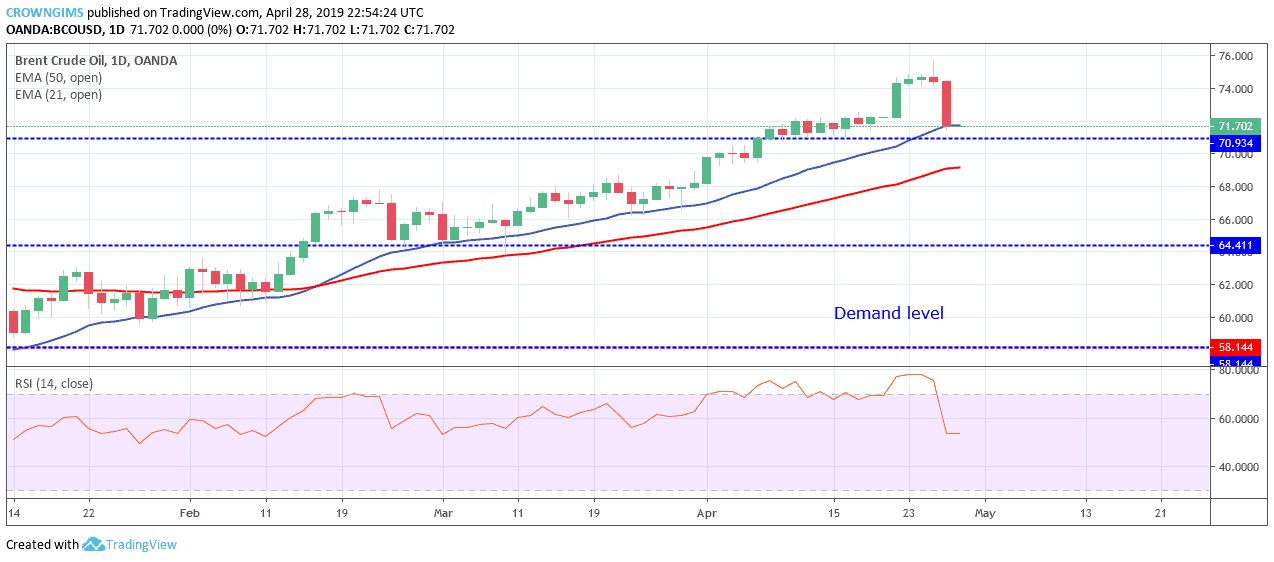

| Forex Trading: BCOUSD Is Trending Upwards, and This May Continue - Inside Bitcoins Posted: 28 Apr 2019 04:23 PM PDT BCOUSD Price Analysis – April 21In case the Bears exert a pressure to break down the $70 level, Brent crude oil price may target the $64 level. Should the demand level of $70 level holds, then, a bullish trend may continue. BCO/USD MarketKey levels:Supply levels: $79, $87, $98, $107 BCOUSD Long-term trend: BullishOn the long-term outlook, BCOUSD maintains its bullish trend. The Bulls maintain their momentum by keeping the price of Brent Crude Oil above the $70 last week. The Bulls initially pushed the price up towards the $79 level. The bears could not allow a further increase in price and exerted a bearish pressure on the Brent crude oil and the price fell; this is what made last week candle closed as an inverted hammer. The inverted hammer candle is a bearish reversal candle which may lead to price.  BCOUSD continue trading above the 50 periods EMA and 21 periods EMA in which the latter is trying to cross the former EMAs upside to confirm the bullish movement. The Relative strength index period 14 is at 60 levels parallel placed at the level without showing any direction which indicates that consolidation is ongoing in the Brent Crude oil market. In case the Bears exert a pressure to break down the $70 level, Brent crude oil price may target the $64 level. Should the demand level of $70 level holds, then, a bullish trend may continue. BCOUSD medium-term Trend: BullishBCOUSD is still on the bullish movement on the medium-term outlook. The Bulls were still in control in the BCOUSD market. The price was pushed up towards the $79 level but unable to reach the $79 level before the Bears opposed the increase in BCOUSD price. A bearish candle pattern formed called "evening star". The BCOUSD market closed last week with a daily bearish candle which is an indication that the Bears are preparing to take over the market.  The price still remains above 21 periods EMA and 50 periods EMA and the Relative Strength Index period 14 is at 50 with the signal lines pointing down to indicate sell signal. Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results. |

| Forex Trading: GBPUSD Technical Analysis - April 29, 2019 - FXDailyReport.com Posted: 28 Apr 2019 06:07 PM PDT The Great Britain Pound (GBP) inched higher against the US Dollar (USD) on Monday increasing the price of GBPUSD to more than 1.2900. The price of the pair increased after major economic news released. The technical bias may turn bullish because the pair's price marked a lower high in the recent downside move. GBP/USD Technical AnalysisAs of this writing, the pair is being traded around 1.2935, since the price is increasing, the price of the pair may encounter resistance around 1.2987 the horizontal level resistance. Another resistance level may come at 1.3061, the 38.2% Fib level resistance ahead of 1.3121, the high of April 05, 2019, which is likely to act as a strong resistance preventing the price of the pair from increasing above this level as demonstrated in the given below chart.

Related Articles:

United States ' ISMI Prices Paid NewsIn the United States, the figure concerning the price index of ISMI remained 60.7 in November, as compared to 60.3 during the month before, down beating the economist expectation which was 59.2. The data is taken from the news released by the US Institute for Supply Management. The data represents the prevailing condition of the manufacturing market of the country. The figure is derived after taking into account various elements of the market such as new orders placed, the estimated rate of production for the future, employment rate, available inventories, and deliveries made so far. The ISMI figure is usually considered as sensitive to the US economy and may instigate inflation in the future. Generally speaking, high reading in this regard is considered as a bullish trend for the US Dollar (USD) whereas a low reading suggests a bearish market for the US Dollar (USD). Trade IdeaConsidering the overall price behavior of the pair over the last couple of days, buying the GBPUSD around current levels can be a good decision in short to medium term. |

| You are subscribed to email updates from "forex trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment