Australian Forex Brokers: ASIC Regulated 'Best Of The Best' - The Canberra Times

This is sponsored content for PropCompanies.

If you're an Australian forex trader searching for the ideal broker, look no further. We've sifted through data from over 40 brokers to present you with a list of the top 10 forex brokers specifically curated for traders in Australia.

- Eightcap - Best Australian Broker

- Pepperstone - Best for Automated Forex Trading

- IC Markets - Forex Broker with the Lowest Spreads

- eToro - Best Copy Trading Forex Broker

- Fusion Markets - Low Commission Forex Broker

- OANDA - Best Forex Broker for Beginner Traders

- IG - Australia's Largest Retail Forex Broker

- FP Markets - Best MetaTrader 4 Broker

- CMC Markets - Best for Forex and Share Trading

- Plus500 - Best Mobile Trading App

Who are the Best Forex Brokers in Australia?

Speaking from our collective experience as Australian traders we think there are a number of key features to look for in a broker. These features should include tight spreads, fast execution speeds, and access to top analytical and automation tools.

In this guide, we'll also be laying out the benefits and weaknesses of each ASIC-regulated broker we cover. This allows us to give you a balanced view to facilitate your decision when choosing a broker. Whether it's trading fees, spreads, or fast execution, you'll know what each broker excels in and where they may fall short.

1. Eightcap - Best Australian Forex Broker

Eightcap carves out its own lane with ultra-competitive spreads, the tried-and-true MetaTrader platforms, and a vast selection of CFDs.

Eightcap benefits

- Average spreads that outpace the market by 70%

- Access to MetaTrader 4 and MetaTrader 5 and TradingView Platforms

- A comprehensive range of CFD products featuring over 40 forex pairs and 87 cryptocurrencies

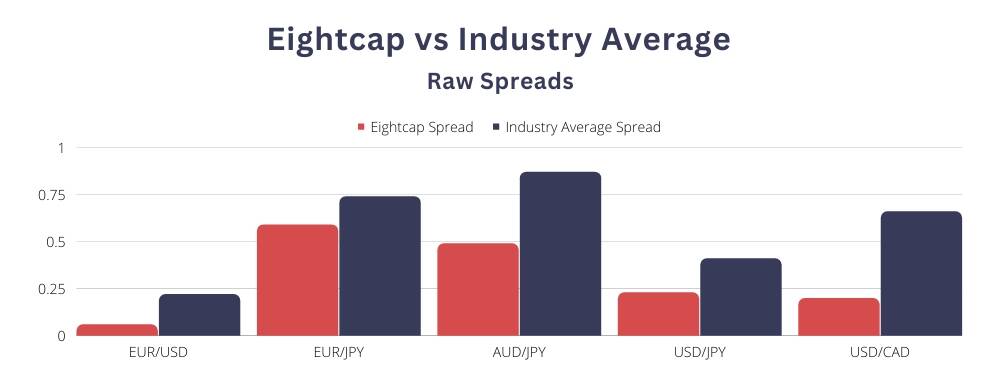

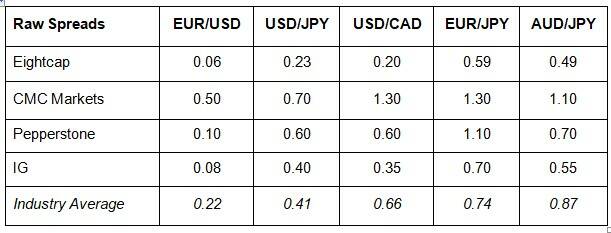

Eightcap's competitive low spreads

From our exhaustive research, after examining over 40 brokers, Eightcap's Raw Account stands out as a frontrunner if you are after tight spreads.

Whether your focus is on the Euro vs US Dollar (EUR/USD) or the Australian Dollar vs Japanese Yen (AUD/JPY), Eightcap spreads beat the competition. On average, you will find its spreads are 70% better than the industry standard for major currency pairs.

To give a bit more detail, for the EUR/USD spread, Eightcap boasts a mere 0.06 pips. That's a 72.7% improvement over the industry average of 0.22 pips. At 0.2 pips, the USD/CAD spread is also close to 70% times lower than the industry average, while the AUD/JPY and USD/JPY are both over 40% tighter than industry average spreads.

The Raw Account: Optimised for experienced traders

Catering to traders who have moved beyond the beginner phase and are keen on enhancing their cost efficiency, the Raw account allows you to fully capitalise on the aforementioned tight spreads. Minimum spreads start at 0.0, however you will pay a $7 AUD round-turn commission for each trading lot.

"As an account perfectly tailored for seasoned traders, the Raw Account offers a trade-off between commission fees and ultra-competitive spreads," says Justin Grossbard from CompareForexBrokers.com.

MetaTrader 4, MetaTrader 5 and TradingView trading tools

While Eightcap has yet to invest in a proprietary platform, its MetaTrader 4 and MetaTrader 5 offerings don't disappoint when it comes to features. The broker also features TradingView as a platform add-on.

- MT4 includes a comprehensive set of tools for automated trading, an array of charting options, and real-time pricing.

- MT5 widens the scope beyond forex for those interested in exchange-traded products. It also offers 21 timeframes, six types of pending orders, and provides real-time market updates.

- TradingView comes with over 100 charting options and ability to share trading ideas from its community of 50 million users.

Eightcap's financial products

Eightcap isn't limited to Forex products; its range of CFD products is impressively diverse.

- Forex: A selection of over 40 currency pairs.

- Commodities: More than just gold and oil, you can diversify into silver, natural gas, and agricultural commodities like wheat.

- Indices and Stocks: Access to both global indices and individual shares.

- Cryptocurrencies: 87 cryptos vs USD, including Bitcoin, Ethereum and Cardano.

Eightcap weaknesses

- Limited educational resources

While Eightcap is exceptional in many areas, no broker is perfect. Their educational content could be more extensive.

Eightcap verdict

With spreads that exceed industry standards by over 70 per cent, Eightcap is designed for traders who truly understand the value of each pip.

- Spreads that exceed industry averages

- MetaTrader 4, 5 and TradingView support

- Extensive CFD offerings across various markets

Regulated by the Australian Securities and Investments Commission (ASIC), Eightcap offers a trading environment that's both secure and transparent.

2. Pepperstone - Best broker for automated trading

Pepperstone is our pick as the leading choice for those of us relying on automated trading. Their setup and foundational infrastructure are distinctly crafted to support this trading approach, thanks to MetaTrader EAs, Capitalise.ai and social or copy trading with Myfxbook, DupliTrade and MetaTrader Signals.

Pepperstone benefits

- Expert Advisors on MetaTrader 4 and MetaTrader 5

- Trading costs are low, mimicking ECN environments

- Execution is speedy, with minimal slippage

ECN environment for automated trading

Pepperstone's excellent tech infrastructure means you benefit from fast execution speeds - a must for effective scalping strategies and high-volume trading.

By collaborating with Equinix and leveraging their NY4 (New York) and LD3 (London) data centres, Pepperstone reduces the lag time between when you place your order and when its servers complete the transaction. This is crucial in automated trading, where even the smallest of time delays can influence the spread you will pay.

The Razor account is designed for high-volume traders, featuring interbank pricing and a fixed commission of just $3.50 AUD per side. For those with more hefty portfolios, the Active Traders Program is worth a glance.

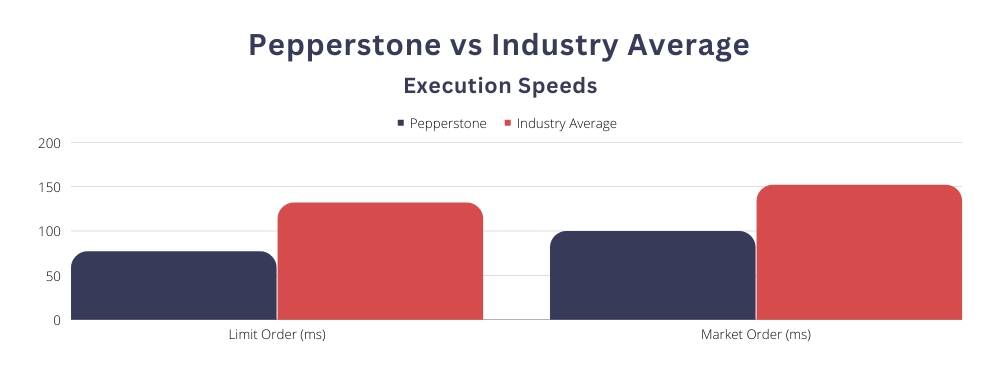

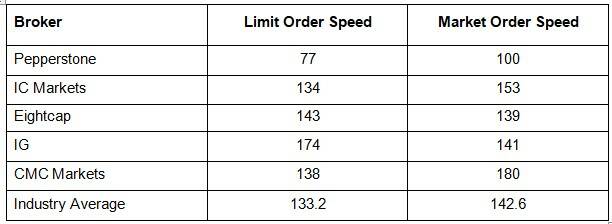

Execution speeds: The data

When we compared Pepperstone alongside 20 other brokers, they consistently excelled in the execution speed category.

Pepperstone topped the list for limit order execution speeds at 77 milliseconds, which is 42.3% faster than the industry average. Its market orders averaged 100 milliseconds.

Trading Platforms Tailored for Automated Trading

Pepperstone offers a range of platforms tailored to different trading strategies:

- MetaTrader 4: A staple for automated forex trading, fully supporting Expert Advisors.

- MetaTrader 5: Suitable for automated CFD trading with more advanced charting features.

- cTrader: Ideal for experienced traders, offering in-depth market information and quick order execution.

- Capitalise.ai: A no-code solution for automated trading.

- TradingView: A community-driven platform that excels in advanced charting.

Automated trading tools

If you live and breathe Expert Advisors and all things algorithmic trading, Pepperstone's Smart Trader Tools make a welcome add-on to your preferred Metatrader platform. A suite of 28 smart trading apps, the Smart Trader Tools are designed to expand your EA's capabilities.You can also use Capitalise.ai with an MT4 account for trading with no code knowledge and copy other traders via Myfxbook or Duplitrade.

Ross Collins from CompareForexBrokers.com liked the Trade Simulator EA that comes with MetaTrader. "The Trade Simulator for backtesting EAs on the MT4 platform is invaluable. The execution speeds further boost the performance of EAs that focus on scalping or high-frequency strategies".

Pepperstone weaknesses

- Less competitive Standard Account pricing

Pepperstone's Standard Account spreads start from 1 pip, which isn't the most competitive, especially when compared to some of the best brokers offering commission-free account types.

Pepperstone verdict

If you prioritise swift execution and an EcN-like trading environment, Pepperstone ticks all the boxes.

- ECN-Like Pricing

- Support for MetaTrader 4, MetaTrader 5, cTrader and TradingView

- Robust Options for Automated Trading

Regulated by both ASIC in Australia and the Financial Conduct Authority (FCA) in the UK, Pepperstone provides a trading platform that you can trust to be both transparent and secure.

3. IC markets - Lowest no commission spreads

IC Markets distinguishes itself with notably low spreads and commission-free trading. After analysing data from 40 brokers, it's clear: this online broker offers value.

IC Markets Benefits

- Commission-free trading with lower spreads than industry averages

- Minimal trading fees

- MetaTrader 4 for commission-free forex trading

Tight spreads with no commission

In a marketplace where minor variations in spreads can make a major difference, IC Markets stands out.

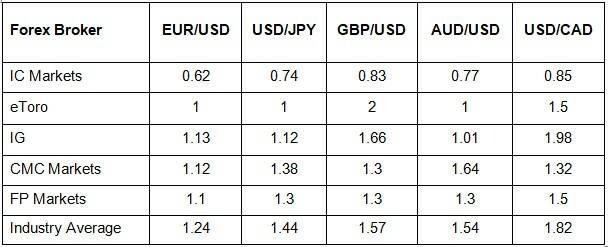

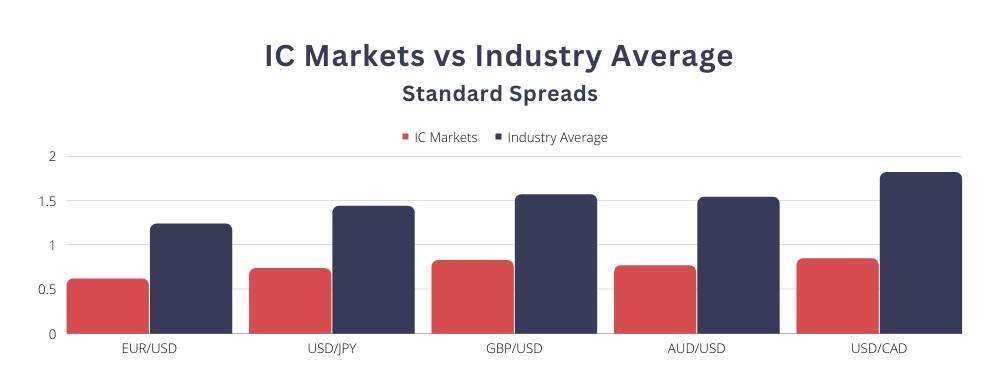

Take the EUR/USD pair as an example. IC Markets spreads average 0.62 pips, a 50% reduction from the industry's standard of 1.24 pips.

It's not just the EUR/USD; the USD/JPY also stands at a spread of 0.74 pips with IC Markets. The broker's spread is about 49 per cent less than the industry standard of 1.44 pips.

The GBP/USD and AUD/USD pairs also follow this pattern, offering notably lower spreads when compared to industry averages.

Standard account for commission-free spreads

The Standard Account from IC Markets is our pick as a solid all-around trading account. Spreads can be as low as 0.6 pips, and you can choose between AUD or USD for your account currency. It may also help to know that there are no inactivity fees, and it's available as a swap-free account for Islamic traders.

Additionally, IC Markets presents a broad spectrum of payment avenues to fund your account, from your standard credit and debit cards to bank transfers and even a range of e-wallets such as PayPal and Skrill. This variety ensures you have ample choices when it comes to fund management.

MetaTrader 4 and 5 and testing trading strategies

IC Markets offers both Metatrader 4 and 5 platforms. Balancing user-friendliness and advanced technical capabilities, the MetaQuotes family of platforms successfully caters to traders of all skill levels. With the vast suite of technical indicators and analytical objects, these platforms are our pick as they provide you with the market analysis tools you need to make trading decisions.

You will also get unlimited access to their demo accounts to test out the broker or practice trading. These demo accounts mirror real-time market dynamics,allowing you to test out your trading strategies before using your own funds.

In our experience, the combination of MetaTrader 4 and 5 along with the use of demo accounts from IC Markets provides a comprehensive, user-oriented trading backdrop that will allow you to better familiarise yourself with trading and refine your trading strategies.

IC markets weaknesses

- No proprietary mobile app

- Limited market research tools in some areas

While IC Markets doesn't offer a proprietary mobile app, its compatibility with established third-party platforms compensates for this. On the front of market research tools, while they do extend certain resources, the scope isn't as extensive as some other online brokers out there. This might warrant further attention for those leaning heavily on intricate market analyses.

IC markets verdict

IC Markets stands as a great choice if you prioritise low-cost, commission-free trading.

- Exceptionally low spreads across key currency pairs

- User-friendly and accessible Standard Account type

- The reliability of MetaTrader 4 for both newcomers and algorithmic traders

IC Markets operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC) for Australian traders along with the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC) for traders in Europe and other countries.

4. eToro - Best Copy Trading CFD Broker

eToro is an online brokerage that has managed to differentiate itself in the crowded forex market with a game-ified approach to social and copy trading.

eToro Benefits

- A global user base spanning over 140 countries

- Innovative CopyTrader and CopyPortfolio functionalities

- Financial rewards for savvy traders

Global leader in social trading

eToro didn't just join the social trading movement - they were at the forefront of its evolution. The platform is built from scratch with social trading as its primary focus. This shift transformed how traders communicate, share knowledge, and even replicate each other's investment choices.

With the brokers extensive user base spanning over 140 countries and useful filtering tools, we were able to find exactly the type of signals or traders we wanted to follow and copy.

Filters available include location, risk metrics, and trading performance, all features which help us to select traders that resonate with our investment objectives. This is the pinnacle of social trading, giving us a gateway to connect with a global assembly of traders and stay updated when our favourite traders share fresh insights.

Moreover, eToro goes beyond the basic premise of copy trading. Their platform is enriched with social feeds that foster interaction, allowing you to share and gain insights or trade opinions. The built-in alert system for pertinent market shifts or asset variances ensures that you remain well-informed and proactive.

Copytrader and copyportfolio features

At the core of eToro's copy trading mechanism are its proprietary features: CopyTrader and CopyPortfolio.

CopyTrader allows you to emulate the investment patterns of traders we like seamlessly, CopyPortfolio lets you broaden our investment scope by replicating a diverse array of traders or assets. These features can be instrumental in widening your investment perspective and drawing inspiration from market experts.

Incentives for top traders

eToro takes a unique approach to rewarding skilled traders for sharing their strategies. Suppose you find yourself among the top-performing traders, in that case, there's potential to accrue additional earnings - up to 2 per cent of your supervised assets - solely for being a model for other traders to copy. This win-win setup not only motivates seasoned traders but also assures newcomers of access to vetted and reliable strategies.

eToro weaknesses

- Spreads are on the higher side

- Customer service lags behind local Australian forex and CFD brokers

eToro adopts a fee structure that revolves around wider spreads, kicking off at 1 pip. If you are looking for the tightest spreads in the market, you might find eToro a bit steep. Additionally, the absence of direct phone support and personalised account management makes the broker less appealing if you prefer a more hands-on service approach.

eToro verdict

eToro is the go-to platform for you if you find the prospect of copy trading appealing and like the idea of using the eToro community to share and get trading ideas.

- Excellent ecosystem for real-time social trading and knowledge sharing

- Financial bonuses that encourage participation from both beginner traders and veterans

eToro is regulated by multiple high-tier financial authorities including ASIC, CySEC, FCA, and FinCEN.

5. Fusion markets - Forex broker with the lowest commission

Fusion Markets is our preferred platform when prioritising costs. It's not the sleekest or sppediest of brokers, but does offer a solid, no-frills experience at low cost.

Fusion markets benefits

- Commission fees 26-35% lower than industry standards

- No fees for deposits and withdrawals

- No minimum deposit

Unbeatably low fees

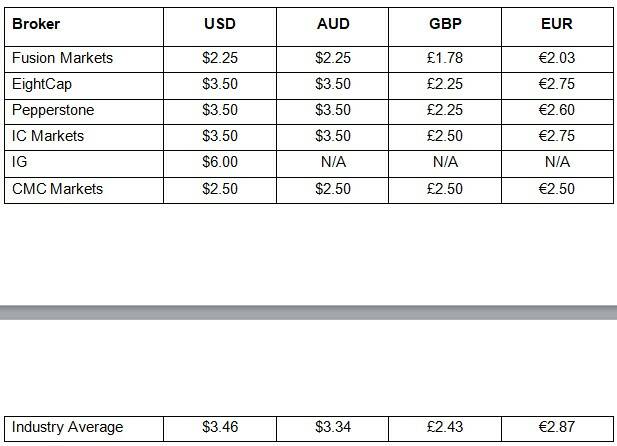

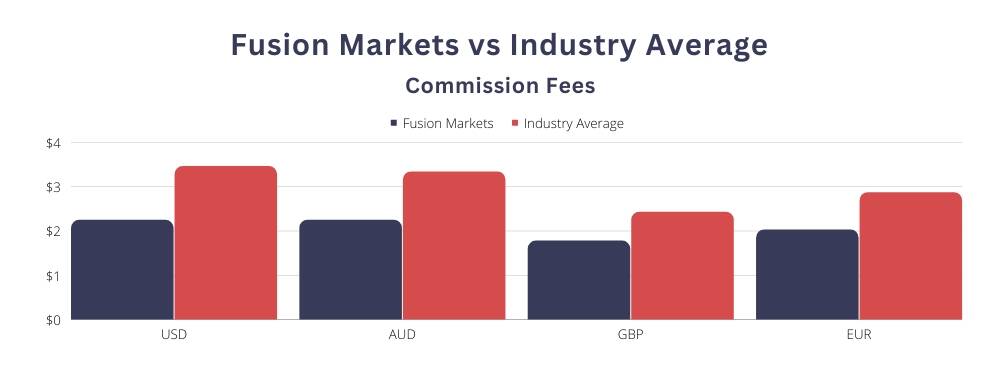

In a market teeming with competition, Fusion Markets has marked its territory with the most competitive commission rates. This broker only charges $2.25 AUD per trade, significantly lower than the overall average industry rate (from the brokers we collected) of $3.34 AUD, representing a savings of 32.6%.

Comparing Fusion Markets to other top forex brokers reveals their competitiveness. Pepperstone, IC Markets and Eightcap all charge $3.50 AUD.

"As someone who's spent years analysing forex brokers, these figures caught my eye. With commission fees as low as $2.25 AUD per trade, Fusion Markets undercuts the industry average by over 30%. It's a quantifiable advantage that gives traders an immediate edge in cost efficiency," says Justin Grossbard from CompareForexBrokers.com.

With this commitment to low costs, Fusion Markets has a lot to offer if you're a cost-conscious trader, either in Australia or globally.

Easy deposits and a range of funding methods

In our experience, Fusion Markets truly excels in the realm of cost-effectiveness. This online broker charges no deposit or withdrawal fees, although international wire transfers may incur third-party fees. With no initial deposit required to begin trading, the entry hurdles are incredibly low.

We've taken advantage of their diverse deposit and withdrawal methods, from standard bank transfers to the convenience of credit cards, debit cards, and e-wallets such as Skrill and Neteller.

MetaTrader 4 & 5 and cTraderPlatforms

Fusion Markets offer the ever-dependable MetaTrader 4 and 5, as well as cTrader for Depth of Market (DoM) trading.

With three trading platforms from which to choose, each with different features, Fusion Markets aspires to cater to a wide variety of traders, ensuring there's a platform tailored to align with individual trading approaches.

Fusion ...

Comments

Post a Comment