6 Best MT5 Brokers in September 2023 - Techopedia

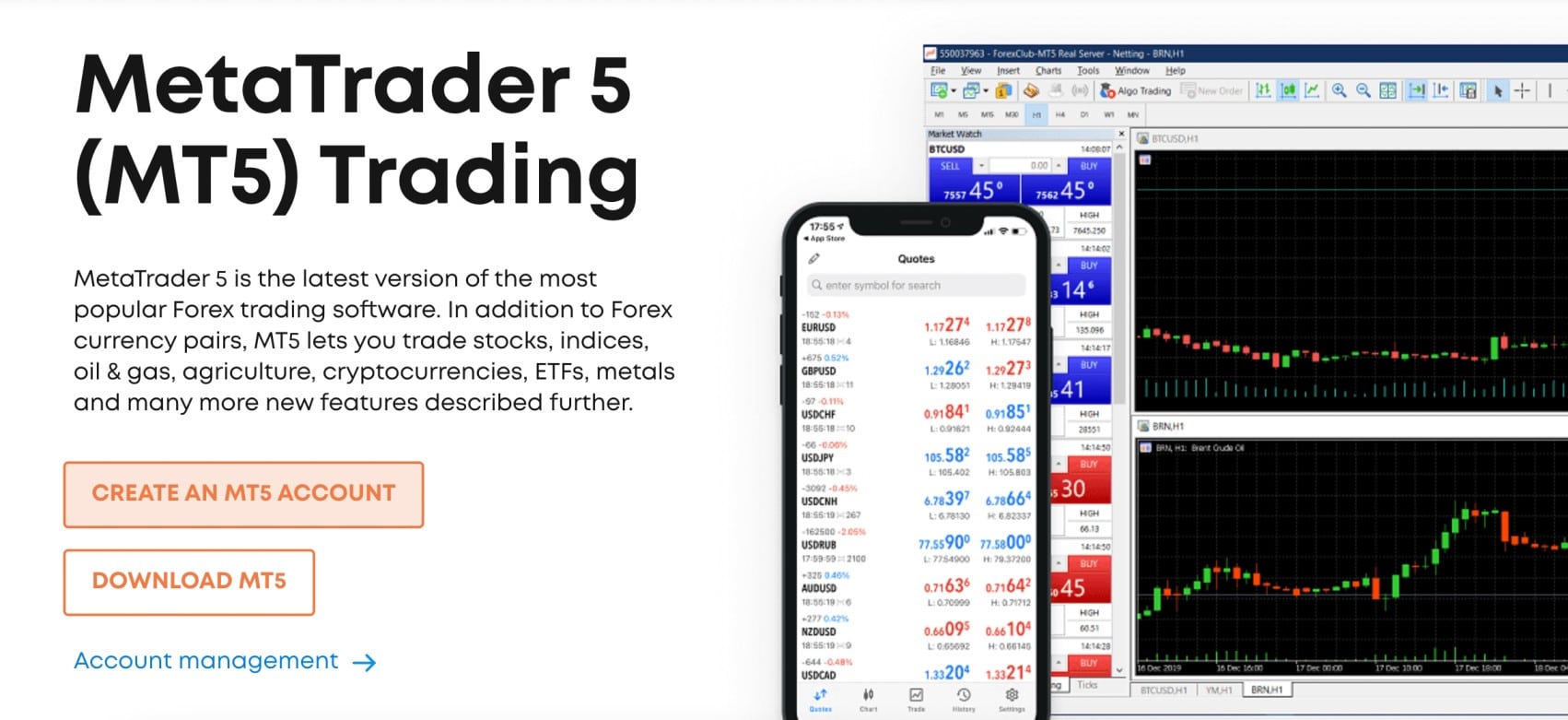

MT5 is the newest and more feature-rich version of the MetaTrader series. While fewer brokers support MT5 when compared to MT4, it comes packed with additional analysis tools that will appeal to seasoned traders.

In this comparison guide, we reveal the 6 best MT5 brokers for 2023. Read on to choose an MT5 broker that offers tight spreads, low fees, and support for your preferred markets.

The Top MT5 Brokers Ranked

Below, you'll find the 6 best MT5 brokers in the market today:

- Libertex: Our top pick for the best MT5 broker in 2023. This regulated and established trading platform has over 25 years of experience. It supports forex, cryptocurrencies, stocks, indices, and commodities. You'll be able to trade commission-free and forex spreads start from just 0.2 pips. The minimum deposit is just $10. Libertex offers leverage of up to 1:999.

- AvaTrade: Another established and trusted MT5 broker is AvaTrade. Founded in 2016, AvaTrade offers super-low trading fees. No commissions are charged and forex spreads start from 0.9 pips. You can also trade forex options, stocks, indices, commodities, cryptocurrencies, and bonds. The minimum deposit is $100. AvaTrade offers leverage of up to 1:400.

- Pepperstone: This MT5 broker is popular for its wide range of supported markets – which includes forex, stocks, and commodities. You can choose from a commission-free or zero-spread account, depending on your preferred strategy. There is no minimum deposit requirement at Pepperstone. In addition to MT5, Pepperstone also supports MT4 and cTrader.

- Forex.com: If you're based in the US and want to trade on MT5, Forex.com is a good option. You can trade over 80 currency pairs and there are no account types to choose from. This includes a commission-free and a razor spread account. No minimum deposit requirements apply. US clients can also trade gold and silver. Non-US clients will have access to leveraged CFDs, including stocks and indices.

- FP Markets: This MT5 broker was launched in 2005 and is regulated by multiple licensing bodies – including ASIC and CySEC. You'll have access to forex spreads of 0.0 pips when opening a raw account. This attracts a small commission of $3 per traded lot. FP Markets also offers a commission-free account, where fees are built into the spread.

- BlackBull Markets: This MT5 broker supports more than 26,000 tradable instruments including everything from forex, stocks, and commodities to cryptocurrencies, indices, and futures. Both MT4 and MT5 are supported. The commission-free account offers spreads from 0.8 pips on major forex pairs. The prime account offers spreads from 0.1 pips, with a $6 commission per traded lot.

This MetaTrader 5 brokers list contains the best providers in the market. But you should do your own research before selecting a broker.

Reviewing the Best Brokers for MT5

We'll now dive into our reviews of the best MT5 brokers for 2023.

1. Libertex – Overall Best Broker for MT5 in with Low Fees

Our top pick is Libertex, the overall best MT5 broker in the market today. First and foremost, Libertex is one of the most established brokers around – it was launched more than 25 years ago. It now has more than three million active traders, highlighting its ability to retain clients long-term. Moreover, Libertex is a global broker that accepts traders from over 120 countries.

Not only is Libertex the best MT5 broker for safety, but it offers some of the lowest fees in the industry. All of the markets available on Libertex can be traded without paying any commissions. You will also find that Libertex spreads are ultra-tight. For example, major forex pairs can be traded from just 0.2 pips. Spreads this low usually attract a flat commission – but not with Libertex.

Furthermore, not only does Libertex support forex but many other asset classes too. For example, you can trade stocks from multiple markets, including the NYSE, NASDAQ, and LSE. You can also trade commodities, including gold, silver, oil, and natural gas. Agricultural products can also be traded, such as coffee, sugar, cocoa, corn, and wheat. We also found that Libertex is the best MT5 broker for trading cryptocurrencies.

You can trade Bitcoin and some of the best altcoins – including Tezos, Aave, Compound, Ethereum, Bitcoin Cash, and Ripple. Libertex also supports a selection of ETFs and indices. We also like how easy it is to set up a new Libertex account. It takes seconds to register and you only need to meet a $10 minimum deposit. You can find your account with a debit/credit card, Skrill, Neteller, bank wire, and even USDT.

If you want to take Libertex for a test drive before making a deposit, you can open a free demo account. You can connect this to MT5 and it comes with $50,000 in paper trading funds. This is also a great way to get a feel for the MT5 platform before risking any money. Libertex is also offering a welcome bonus for first-time customers. You'll receive a 100% deposit boost of up to $10,000. The bonus is released in 10% increments, based on your trading volumes.

We also found that Libertex is one of the best high-leverage brokers. In fact, Libertex offers leverage of up to 1:999 on major forex pairs. This means that you can turn a $10 account balance into $9,990 worth of trading capital. Finally, Libertex is also a great option if you're a complete trading beginner. It offers lots of educational guides, allowing you to trade and learn at the same time.

| Broker | FX Pairs | Other Assets | EUR/USD Spread | Account Types | Account Fees | Max. Leverage |

| Libertex | 50 | Stocks, ETFs, indices, cryptocurrencies, commodities | From 0.2 pips | Standard – 0% commission trading | 2.5% on debit/credit card payments. E-wallet payments are charged between 1.9% and 4%. | 1:999 |

Pros

- Overall best MT5 for 2023

- Trade forex, stocks, cryptocurrencies, indices, and much more

- No commissions charged

- Spreads on EUR/USD start at 0.2 pips

- Free MT5 demo account with $50,000 in paper funds

- Trade with leverage of up to 1:999

Cons

- E-wallet deposits cost up to 4%

Trading in financial instruments is a risky activity and can bring not only profits, but also losses.

2. AvaTrade – Commission-Free Trading on Over 1,000 Leveraged Markets

AvaTrade is also an established MetaTrader 5 broker with a solid track record. It was launched in 2006 and is now regulated in nine different jurisdictions. Japan, South Africa, Ireland, Canada, Cyprus, Israel, the UAE, Australia, and the British Virgin Islands. Therefore, it goes without saying that AvaTrade offers fair and transparent trading conditions.

AvaTrade supports a wide range of assets, all backed by leveraged CFDs. In the forex department, you'll be able to trade 53 currency pairs. Major pairs come with very competitive spreads, starting at 0.9 pips. If you're looking for exposure to the best cryptocurrencies, AvaTrade has you covered. Some of its most popular cryptocurrency markets include Bitcoin, Stellar, Dash, Chainlink, EOS, and Solana.

AvaTrade also offers a comprehensive selection of commodities. This includes energies, agricultural products, and precious metals like gold and silver. AvaTrade also supports currency options. However, you won't be able to trade options on MT5. Instead, AvaTrade has its own proprietary platform for this. What's more, you can also trade ETFs, bonds, and indices.

Each and every market supported by AvaTrade can be traded commission-free. Moreover, you won't be charged any deposit or withdrawal fees. You can deposit funds instantly with a debit/credit card or e-wallet. Bank wires are also supported but this will delay the deposit process by several days. The minimum deposit is $100 or the local currency equivalent.

As a specialist CFD broker, AvaTrade supports long and short positions. It also offers leverage on all supported markets. Depending on your location, leverage of up to 1:400 is available. This will be reduced to 1:30 if you're based in the UK, as per FCA leverage limits. Nevertheless, AvaTrade also offers a free demo account. You can connect this to MT5, allowing you to try AvaTrade without risking any money.

| Broker | FX Pairs | Other Assets | EUR/USD Spread | Account Types | Account Fees | Max. Leverage |

| AvaTrade | 53 | Stocks, ETFs, indices, cryptocurrencies, commodities, bonds, options | From 0.9 pips | Standard – 0% commission trading | $50/quarter inactivity fee after 3 months | 1:400 |

Pros

- Trade more than 1,000 CFD markets at 0% commission

- Regulated in nine different jurisdictions

- Maximum leverage of up to 1:400 for eligible clients

- No deposit or withdrawal fees

- Free demo account that connects to MT5

Cons

- Bank wire deposits can take several days to process

Trading CFDs and FX Options entails risk and could result in the loss of your capital.

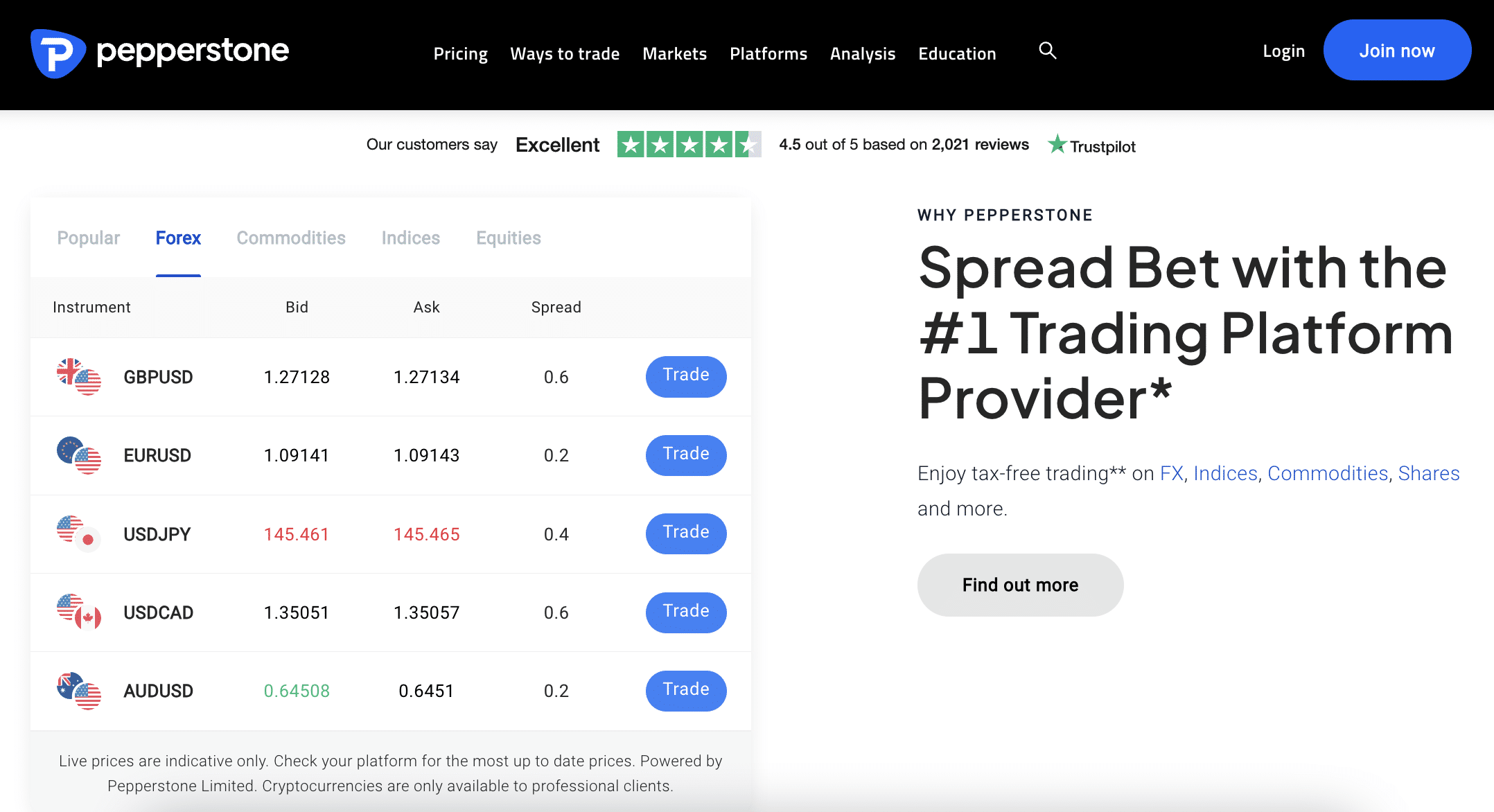

3. Pepperstone – Top-Rated MT5 Broker for Low Trading Fees

Pepperstone is one of the best MT5 brokers for low trading fees. It offers two account types to choose from, both enabling you to buy and sell assets without breaking the bank. First, there is the standard Pepperstone account. This offers commission-free trading on all supported markets. This account offers spreads from 0.7 pips when trading EUR/USD and AUD/USD. You'll pay 0.9 pips to trade GBP/USD and 1.1 pip on USD/CAD.

If you're planning to trade larger amounts, the razor account will be more suitable. In most cases, you can trade EUR/USD, GBP/USD, and other major forex pairs at 0.0 pips. You'll pay a flat commission per slide, which varies depending on the account currency. For instance, $3.50, £2.25, or €2.60. This is charged for every 1 FX lot traded.

Pepperstone supports plenty of other assets too. For example, you can trade dozens of commodity markets, ranging from gold, wheat, and corn to natural gas and crude oil. Commodity prices are supplied by tier-one banks and gold spreads start from just 0.05 points. You can also trade global indices from both large and small-cap markets. In the US, this includes the Dow Jones, S&P 500, NASDAQ 100, and Russell 2000.

You can also trade indices from Asia, including Japan, Hong Kong, China, and Singapore. European indices are also supported, such as the FTSE 100 France 40. In addition, you can also trade individual stocks. Pepperstone supports stocks from the UK, US, Australia, Hong Kong, and Germany. The main drawback is that Pepperstone doesn't support options or bonds.

Nevertheless, we like that Pepperstone is suitable for all budgets. There are no minimum deposit requirements and there is also a free demo account. This connects to MT5 and comes with $50,000 in paper funds. Moreover, you can use the Pepperstone demo account for 60 days. We also like that Pepperstone accepts multiple payment methods. This includes bank wires, PayPal, Skrill, Neteller, and debit/credit cards.

Pepperstone is also one of the best MT5 brokers for safety. It is heavily regulated, including licenses from the FCA, CySEC, ASIC, and DFSA. It keeps client-owned funds in segregated bank accounts as an additional layer of security. Pepperstone offers high leverage limits of up to 1:200, but regional restrictions apply. For example, UK, EU, and Australian traders are capped at 1:30. Finally, Pepperstone also supports MT4 and cTrader.

| Broker | FX Pairs | Other Assets | EUR/USD Spread | Account Types | Account Fees | Max. Leverage |

| Pepperstone | 60+ | Stocks, ETFs, indices, cryptocurrencies, commodities | From 0.0 pips | Standard – 0% commission trading / Razor – $3.50 per lot | None | 1:200 |

Pros

- Heavily regulated MT5 broker with multiple tier-one licenses

- Open a free demo account in seconds ($50,000 in virtual funds)

- Trade forex from 0.0 pips on the razor account

- Also offers a commission-free account for casual traders

- Leverage of up to 1:200 for eligible clients

Cons

- Does not support options or bonds

87.2% of retail investor accounts lose money when trading CFDs with this provider.

4. Forex.com – US-Friendly MT5 Broker Supporting Over 80 Currency Pairs

If you're based in the US, Forex.com could be the best MT5 broker for you. This established online broker offers three account types, but only two are suitable for trading on MT5. The first option is the standard account This account type allows you to trade forex on a commission-free basis while paying slightly higher spreads.

Alternatively, the raw spread account offers some of the tightest bid and ask prices in the industry. In turn, you'll pay a small commission for every FX lot traded. There is no minimum deposit requirement on either account, but $1,000 is recommended by Forex.com. Moreover, both account types offer access to over 80 currency pairs. You'll also be able to trade gold and silver.

However, US clients will not have access to CFDs, meaning no cryptocurrencies, stocks, indices, or ETFs. Non-US clients can access CFD markets without paying commission. In terms of leverage, limits depend on the trader's country of residence.

For instance, US clients can trade major pairs with leverage of up to 1:50. While UK, EU, and Australian clients are capped at 1:30. Professional clients will be offered much higher limits.

| Broker | FX Pairs | Other Assets | EUR/USD Spread | Account Types | Account Fees | Max. Leverage |

| Forex.com | 82 | Gold and silver (US) | From 0.0 pips | Standard – 0% commission / Raw Spread – $5 commission per $100,000 traded | $10/month inactivity fee after 1 year | 1:50 (US) |

Pros

- Best broker for MetaTrader 5 users in the US

- Trade over 80 forex pairs with competitive fees

- No minimum deposit requirement

- Established in 2001

Cons

- US clients can only trade forex, gold, and silver

Please note that foreign exchange and other leveraged trading involves significant risk of loss.

5. FP Markets – Trade Major Forex Pairs From 0.0 Pips and a Commission of $3 per Slide

FP Markets is a top-rated online broker that supports MT4 and MT5. It was founded in 2005 and has a great reputation for safety. If you're an active trader, you might consider opening a raw account. In doing so, you'll be able to trade forex with spreads of 0.0 pips. There is a commission of $3 per traded lot, payable per slide.

The raw account also offers access to institutional-grade liquidity, not to mention average execution speeds of under 40 milliseconds. If you're planning to trade smaller amounts, the standard account will be more suitable. This is commission-free, so all fees are built into the spread. Spreads start from 1 pip on major pairs and more on minors and exotics.

Both account types also offer access to stocks, bonds, ETFs, indices, and commodities. Cryptocurrencies are not supported. We also like that FP Markets offers customer support 24/7. This can be accessed via the live chat box. There is a minimum deposit requirement of $100. You can also open a free demo account, which can be used for 30 days.

| Broker | FX Pairs | Other Assets | EUR/USD Spread | Account Types | Account Fees | Max. Leverage |

| FP Markets | 60+ | Stocks, bonds, ETFs, indices, and commodities | From 0.0 pips | Standard – 0% commission / Raw – $3 commission per $100,000 traded | None |

Image © Adobe Stock The British Pound should remain supported says Goldman Sachs in an analysis of the currency's outlook that follows last week's Bank of England's decision to raise interest rates by 50 basis points. It was "time for the hawks to screech," says Michael Cahill, a strategist at Goldman Sachs in London, "it seems the Bank of England did just that." The Bank has long been accused by financial market analysts as being too slow to wake up to the threats posed by rising inflation, often arguing that in-house forecasts revealed it would fall as quickly as it had risen. The reticent stance has been attributed by analysts to contributing to currency weakness for much of 2022. But the Bank of England itself acknowledged last week that "the second-round effects in domestic price and wage developments generated by external cost shocks were likely to take longer to unwind than they had done to emerge." Above: GBPEUR and ...

5 Best Forex Screeners for 2020 • Trade Forex • Benzinga - Benzinga

5 Best Forex Screeners for 2020 • Trade Forex • Benzinga - Benzinga 5 Best Forex Screeners for 2020 • Trade Forex • Benzinga - Benzinga Posted: 10 Jun 2020 08:17 AM PDT Benzinga Money is a reader-supported publication. We may earn a commission when you click on links in this article. Learn more. If you've ever traded actively in any market, you probably know how important getting in on the best trades can be to your bottom line. A forex screener helps you find viable trades in the forex market. If you trade forex and want to learn more about forex screeners, read on. What You Want in a Forex Screener A forex screener basically scans the entire forex market to find trades based on a set of parameters. A default set of parameters for trade setups generally comes with the screener software that you can customize depending on the screener you choose to use. A good forex screener will let you monitor the market for ...

Position Sizer Expert Advisor for MT4/MT5 - EarnForex News

Position Sizer (MetaTrader expert advisor) calculates how many lots to trade based on: Entry and stop-loss levels Risk tolerance Account size (balance, equity, or even your savings account) Account currency Currency exchange rates Its main features include: Works with any trading instruments — currency pairs, CFDs, equities, indices, commodities, futures, cryptocurrencies. Calculation inputs and results are displayed in a graphical panel. The panel can be moved freely across the chart. You can easily close or minimize it. All calculation parameters can be adjusted inside the panel in one or two mouse clicks. Entry, stop-loss, and take-profit lines can be dragged directly on the chart. You can choose to set stop-loss and take-profit as distance in points. Alternatively, you can set them as multiples of ATR (Average True Range). If a take-profit is given, the calculator shows the potential reward level and the risk-...

Budget 2022: Brace for Austerity - CADTM.org

More importantly, most Sri Lankans evinced little interest Interest An amount paid in remuneration of an investment or received by a lender. Interest is calculated on the amount of the capital invested or borrowed, the duration of the operation and the rate that has been set. and even less confidence of any reversal of the relentless assault by the ongoing economic crisis on their living standards, following the Budget Speech on 12 th November. During a global public health emergency, to which Sri Lanka is not immune, government spending on health services is only marginally increased in comparison to 2021. The Ministry of Health's allocation is LKR153.5 billion (1 USD ≍ 202.54 LKR/1 Euro ≍ 230.09 LKR), which is significantly less than that for highways (LKR250.2 billion) [1] . 12 years after the end of the internal war, the 'defence' budget is the largest single head of expenditure, allocated the equivalent of LKR15 [2] out of every LKR10...

Hong Kong Launches New Virtual Asset Trading Platform Licensing ... - omm.com

Hong Kong Launches New Virtual Asset Trading Platform Licensing Regime June 9, 2023 Introduction The trading of virtual assets just got a bit easier—and a lot clearer for all participants in Hong Kong. On May 23, 2023, the SFC published its Consultation Conclusions on the Consultation Paper on the proposed regulatory requirements for virtual asset trading platform operators (" VATPs "). Notably, the SFC will now allow retail access to service provided by VATPs, subject to various investor protection measures. The new regime has come into effect on June 1, 2023 and has a number of stipulations, covering onboarding, trading, custody, token admission, insurance and compensation arrangements, anti-money laundering (" AML ") and counter-financing of terrorism (" CFT ") matters, corporate governance, internal controls, dual licensing, discipline and fines, and transitional arrangements. VATPs will generally be governed...

Fair Value Gaps Mitigation Oscillator [LuxAlgo] — Indicator by LuxAlgo - TradingView

The Fair Value Gaps Mitigation Oscillator is an oscillator based on the traditional Fair Value Gaps (FVGs) imbalances. The oscillator displays the current total un-mitigated values for the number of FVGs chosen by the user. The indicator also displays each New FVG as a bar representing the current ratio of the New FVG in relation to the current un-mitigated total for its direction. 🔶 USAGE When an FVG forms, it is often interpreted as strong market sentiment in the direction of the gap. For example, an upward FVG during an uptrend is typically seen as a confirmation of the strength and continuation of the trend, as it indicates that buyers are willing to purchase at higher prices without much resistance, suggesting strong demand and positive sentiment. By analyzing the mitigation (or lack thereof), we can visualize the increase of directional strength in a trend. This is where the proposed oscillator is useful. 🔶 DETAILS The ...

|