Rupee vs Dollar Today: Rupee falls to 80/dollar — why is it happening, and where will it end? - The Indian Express

The Indian rupee breached the psychologically significant exchange rate level of 80 to a US dollar in early trade on Tuesday. It recovered some ground to close at 79.90. Since the war in Ukraine began, and crude oil prices started going up, the rupee has steadily lost value against the dollar. There are growing concerns about how a weaker rupee affects the broader economy and what challenges it presents to policymakers, especially since India is already grappling with high inflation and weak growth.

What is the rupee exchange rate?

The rupee's exchange rate vis-à-vis the dollar is essentially the number of rupees one needs to buy $1. This is an important metric to buy not just US goods but also other goods and services (say crude oil) trade in which happens in US dollars.

Broadly speaking, when the rupee depreciates, importing goods and service becomes costlier. But if one is trying to export goods and services to other countries, especially to the United States, India's products become more competitive because depreciation makes these products cheaper for foreign buyers.

How bad is it for the rupee?

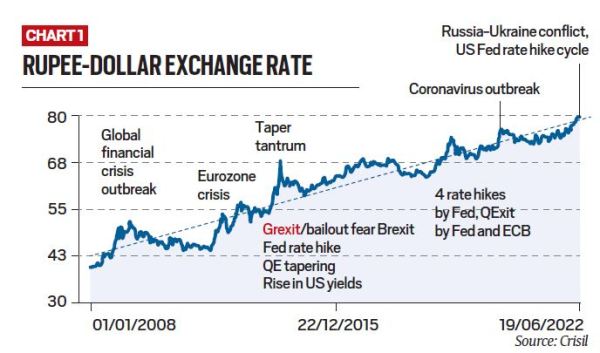

Chart 1 shows the rupee's exchange rate against the dollar. The dotted line shows the long-term trend of depreciation. If the rupee depreciates at a rate faster than the long-term average, it goes above the dotted line, and vice versa. In the last couple of years, the rupee has been more resilient than the long-term trend. The current fall has brought about a correction.

Subscriber Only Stories

Rupee's exchange rate against the dollar

Rupee's exchange rate against the dollar Another thing to note is that, at least as of now, the rupee is still more resilient (that is, it has remained relatively strong against the dollar) than it was in some of the previous crises such as the Global Financial Crisis of 2008 and the Taper Tantrum of 2013.

Moreover, the US dollar is just one of the currencies Indians need to trade. If one looks at a whole basket of currencies, then data suggests the rupee has become stronger (or appreciated against that basket). In other words, while the US dollar has become stronger against all other major currencies including the rupee, the rupee, in turn, has become stronger than many other currencies such as the euro.

"It is important to remember that it is more of a story of the dollar strengthening than the rupee weakening," said Pronab Sen, former Chief Statistician of India.

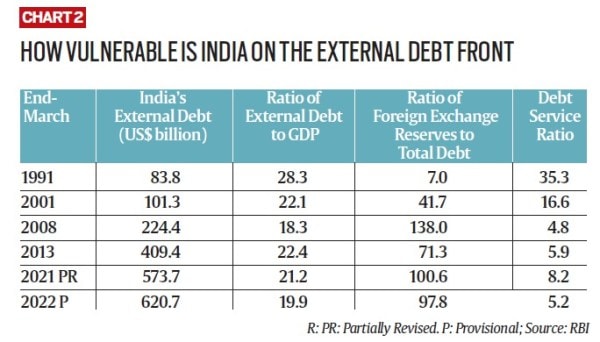

This suggests that as things stand, India is still not facing an external crisis. Take for instance the issue of external debt. Long-term data shows that India is in a relatively comfortable position.

This does not mean there is nothing to worry about. While India is fine as of now, trends suggest things are getting worse. For instance, forex reserves have fallen by over $50 billion between September 2021 and now. In these 10 months, the rupee's exchange rate with the dollar has fallen 8.7%, from 73.6 to 80. For context, historically the rupee depreciates by about 3% to 3.5% in a year. What's worse, many experts expect the rupee to weaken further in the coming 3-4 months and fall to as low as 82 to a dollar.

Why are the rupee-dollar exchange rate and forex reserves falling?

To understand movements on these variables, one must understand India's Balance of Payment (BoP) statement. The BoP is essentially a ledger of all monetary transactions between Indians and foreigners. Here it is shown in US dollar terms. If a transaction leads to dollars coming into India, it is shown with a positive sign; if a transaction means dollars leaving India, it is shown with a minus sign.

The BoP has two broad subheads (also called "accounts") — current and capital — to slot different types of transactions. The current account is further divided into the trade account (for export and import of goods) and the invisibles account (for export and import of services). So if an Indian buys an American car, dollars will flow out of BoP, and it will be accounted for in the trade account within the current account. If an American invests in Indian stock markets, dollars will come into the BoP table and it will be accounted for under FPI within the capital account. The important thing about the BoP is that it always "balances".

India's vulnerability on the external debt front

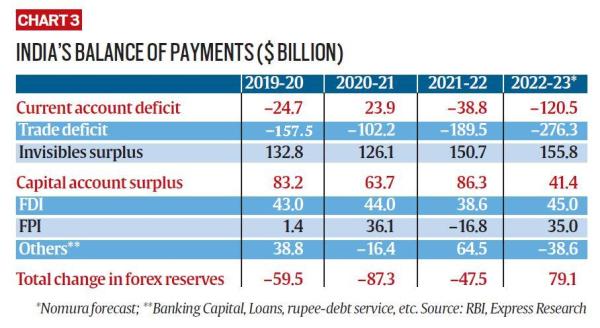

India's vulnerability on the external debt front In 2021-22, India had a trade deficit of $189.5 billion. That is, the country imported more goods (such as crude oil) than it exported, and the net effect was negative. But the Invisibles account showed a surplus of $150.7 billion. As a result, the current account, which was in surplus in the previous year, went into a deficit of $38.8 billion.

On the capital account, however, there was a surplus of $86.3 billion, thanks largely to foreign direct investments (FDI) providing more dollars in the shape of loans etc. Foreign portfolio investors (FPI) pulled out $16.8 billion.

At the end of the year, the BoP was at a surplus of $47.5 billion — that is, the net effect of all transactions on current and capital accounts was that $47.5 billion came into India.

Now, two things can happen from here. If nothing is done, such a huge surplus would lead to the rupee appreciating against the dollar. That will bring about a change in people's buying and investing preferences. For instance, India's exports will become costlier and import cheaper. Over time, the trade deficit will alter (will reduce or turn into a surplus) to "balance" the BoP.

The other thing that can happen is that the RBI swoops in and removes all the surplus dollars from the market and uses them to increase its forex reserves. It does so by buying dollars and replacing them with rupees. In 2021-22, for instance, India's forex reserves went up by $47.5 billion.

In fact, both these things happen through the year. The RBI keeps monitoring the BoP every week and keeps intervening in such a manner which ensures that the rupee's exchange rate does not fluctuate too much. In other words, the rupee's exchange rate and forex reserves levels are two sides of the same coin.

What will be the effect on the economy?

Since a large proportion of India's imports are dollar-denominated, these imports will get costlier. A good example is the crude oil import bill. Costlier imports, in turn, will widen the trade deficit as well as the current account defict, which, in turn, will put pressure on the exchange rate.

On the exports front, however, Sen noted that it is less straightforward. For one, in bilateral trade, the rupee has become stronger than many currencies. In exports that happen via the dollar, "since rupee is not the only currency weakening against the dollar, the net effect will depend on how much has the other currency lost to the dollar", Sen said. "If the other currency has lost more than the rupee, the net effect could be negative."

India's balance of payments

India's balance of payments Sen said that under normal circumstances, rupee depreciation is good for the current account deficit because it leads to higher exports. But at present, India is already facing high inflation and continued depreciation may be making matters worse. "Costlier imports (because of a weaker rupee) add to the cost-push inflation and bump up domestic inflationary process," Sen said.

Sudipto Mundle, Chairman, Centre for Development Studies, pointed to another complication. "A weakening rupee hurts foreign investors, who came looking for a good return, as well as Indians, who have loans abroad," he said.

Should policymakers prevent the fall?

Mundle said it is neither wise nor possible for the RBI to prevent the rupee from falling indefinitely. Defending the rupee will simply result in India exhausting its forex reserves over time because global investors have much bigger financial clout. Most analysts believe that the better strategy is to let the rupee depreciate and act as a natural shock absorber to the adverse terms of trade.

What should policymakers do?

Mundle's prescription is that "the RBI (which is in charge of monetary policy) should focus on containing inflation, as it is legally mandated to do, and the government (which is in charge of the fiscal policy) should contain its borrowings". Higher borrowings (fiscal deficit) by the government eat up domestic savings and force the rest of the economic agents to borrow from abroad.

Sen said policymakers (both in the government and the RBI) have to choose what their priority is: containing inflation or being hung up on exchange rate and forex levels. "If they choose to contain inflation (that is, by raising interest rates) then it will require sacrificing economic growth. So be prepared for that," he said.

Comments

Post a Comment