Forex Trading Platform Market Global Outlook 2021 – Reviews.com,LLC, eToro Social Trading, AvaTrade, cTrader – The Manomet Current - The Manomet Current

Forex Trading Platform Market Global Outlook 2021 – Reviews.com,LLC, eToro Social Trading, AvaTrade, cTrader – The Manomet Current - The Manomet Current |

- Forex Trading Platform Market Global Outlook 2021 – Reviews.com,LLC, eToro Social Trading, AvaTrade, cTrader – The Manomet Current - The Manomet Current

- AvaTradeGo Review - Best Trading App of the year - TopRatedForexBrokers News

- CFD Trading UK - 2021 Market Outlook - Trading Authority Study - Yahoo Finance Australia

| Posted: 31 May 2021 05:46 AM PDT The Market Research on the "Forex Trading Platform Market 2021-2025", now available with Market Insights Reports, Introduces systematic details in terms of market valuation, market size, revenue estimation, and geographical spectrum of the business vertical. The Forex Trading Platform market report offers an overview of top company profiles with business value and demand status of the industry. The report also helps the user to understand the market in terms of its definition, segmentation, market potential, influential trends, and therefore the challenges that the market is facing. The impact of the COVID-19, and also forecasts its recovery post-COVID-19. The report also presents forecasts for Forex Trading Platform investments from 2021 till 2025. The Global Forex Trading Platform Market is expected to reach approximate CAGR of 5.4% by 2025. Click Here to Get Free Sample PDF Copy of Latest Research on Forex Trading Platform Market 2021 Before Purchase: The prominent players in the Global Forex Trading Platform Market: Millennium Alpha, Reviews.com,LLC, eToro Social Trading, AvaTrade, cTrader, MetaQuotes Software Corp., … and Others. Based on Types, The Forex Trading Platform Market is segmented into: Web-Based Cloud-Based Based on Application, The Forex Trading Platform Market is segmented into: Enterprise Individual Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), and market share and growth rate of Forex Trading Platform Market these regions, from 2021 to 2025 (forecast), covering North America, Europe, China, Japan, Southeast Asia, India, North America (USA, Canada, and Mexico) Europe (Germany, France, UK, Russia, and Italy) Asia–Pacific (China, Japan, Korea, India, and Southeast). SPECIAL OFFER: AVAIL UPTO 20% DISCOUNT ON THIS REPORT: Significant Features that are under Offering and Key Highlights of the Reports:– Detailed overview of Forex Trading Platform Market Major Highlights of TOC Chapter 1: Report Overview Click the link to buy This Full Report @: https://www.marketinsightsreports.com/report/purchase/04061951889?mode=su?Mode=18 Customization of the Report: This report will be customized as per your needs for extra data up to 3 companies or 3 countries or nearly 40 analyst hours. Contact Us: Irfan Tamboli (Head of Sales) – Market Insights Reports Phone: +1704 266 3234 | +91-750-707-8687 sales@marketinsightsreports.com irfan@marketinsightsreports.com |

| AvaTradeGo Review - Best Trading App of the year - TopRatedForexBrokers News Posted: 31 May 2021 06:55 AM PDT

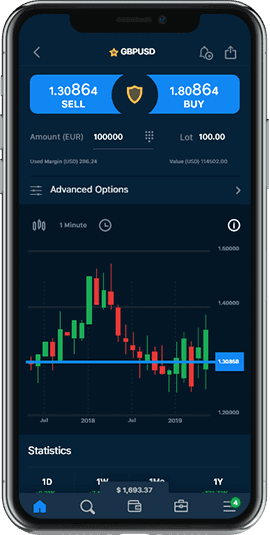

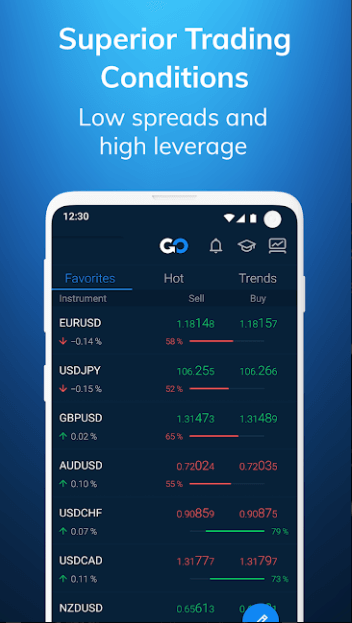

AvaTrade is a global leader in providing consumers with a variety of services, including foreign exchange, indices, commodities. The broker is fully supervised and provides all of the requisite tools for a trader. AvaTrade is active in many countries.AvaTrade broker regulated and has multiple qualifications. They can meet all of your needs and specifications, regardless of the type of trader you are. AvaTrade mobile trading is a definite possibility. AvaTradeGo is the name of the mobile application of Avatrade Forex Broker. AvaTrade Go was developed to improve the quality and accessibility of the trading process for the customer. The app simplifies and streamlines the trading process. The user-friendly app is easy to use. The industry dynamics can be observed in real-time as they emerge. Inside the AvaTrade group of traders, one can even see what others are buying and selling. AvaTrade Go aims to provide you with unique opportunities. You can make your lists and see some real-time prices. Hundreds of instruments, including the world's top Forex pairs, commodities, stocks, cryptocurrencies, and many more, can be traded virtually anytime and anywhere with the app. What Does AvaTradeGo App Look Like?According to our AvaTradeGo review, the developers of the AvaTradeGo have done their research and have utilized many features to advantage the AvaTrade FX Broker. The app enables its user to open and close trades momentarily and with ease. Traders of AvaTrade brokers already know how efficiently and smoothly the website operates. The app is just as great in this regard if not better. After downloading and installing the app there were no technical issues and we were able to use all the features with ease and comfort. The app itself has a unique design, it's very minimalistic. The interface is very simple to use and navigating it is easy to do. The app has the same color pallet of light blue and white which makes for a great combination as it's easy to navigate through. Are You A Mobile Trader? Visit AvaTrade! If you trade with mobile on AvaTrade you can make the most of the accounts features l with the low account fees and commissions on the platform. This is a great app not only for experienced traders but for novice users as well. Who are eager to learn about advanced trading strategies. One can try all of them with this app very smoothly.

AvaTradeGo Trading FeaturesAvaTradeGo offers a one-of-a-kind range of features and benefits. It runs on all major operating systems, including iOS and Android. It is never a problem to use the preferred operating system because it is always available. Another advantage of AvaTradeGO is its multifunctionality. You can trade on several devices; for example, you can open a place on a desktop and close it on your smartphone. What is the AvaTradeGo account type? There is only one professional trading account type on the app which can be used in multiple ways. One needs to meet certain requirements in order to have a trading account on the AvaTrade forex broker platform. One needs to have a background and experience in the financial sector, one needs to be an active trader and the instrument portfolio of a trader needs to be over 500,000 euros. Trading InstrumentsThere are many trading instruments available on the site and to the app as well. The main three categories on each version of the platform are Forex Trading, CFD trading, and cryptocurrencies. Forex Trading has never been easier and more accessible as it is with AvaTraderGo, They have Major pairs, Minor pairs, and Exotic pairs available on the AvaTrade mobile trading app. The list of available cryptocurrencies on the app is quite extensive. In total there are 8 different digital currencies available for trade on AvaTradeGo. These currencies are Bitcoin, Bitcoin Cash, Bitcoin Gold, Litecoin, Ethreum, Ripple, EOS, and Dash. CFD trading is very diverse on AvaTraderGo. Notable before unmentioned trading instruments on the app include Stocks, indices, Commodities, ETFs, FXoptions, and Bonds. Overall more than 250 trading instruments are available on the app including the fact that one can trade with the available cryptocurrencies 24/7.

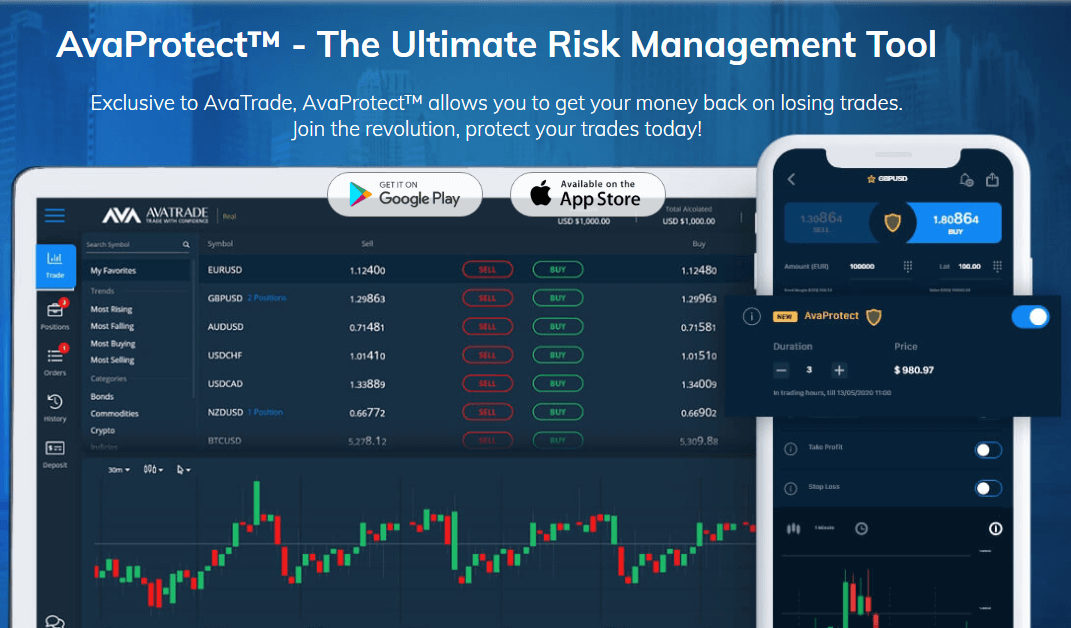

Available LeverageThe available leverage on any Forex broker platform is a defying and important feature of the site. The same goes for AvaTrade. One needs to know everything about this topic before making the decision to start trading with any forex brokers. There is only one AvaTrade mobile trading account type on the platform which is the professional trading account. Professional traders are well aware of the importance of a good leverage ratio. This is why they are always very cautious with their strategies. The leverage available for traders on AvaTradeGo is 400:1, which means that a thousand dollar profit is generated by a 1% positive price shift in the market. Spreads RangeSpread range, otherwise known as margin trading, is an important tool that all professional traders use. With AvaTradeGo spread betting trading is available with over 200 instruments including FX, indices, equities, bonds, commodities, and ETFs. The minimum trade size starts from 0.01 per lot, which means that on Forex trading and most other instruments, the spread is ten percent. GBP is the account currency that is perfectly suited for margin trading on this platform which provides tax-free profits. If you trade with mobile on AvaTrade you can use this for your benefit. Spread betting is a form of trading that is similar to other forms of trading. Instead of purchasing a specific amount or lot size of an available instrument, a spread bettor wagers on the movement of each pip or point of the instrument. Pros & Cons of AvaTradeGoA great way to get to know a forex broker and its features is to compile a list of advantages and disadvantages it can provide. We find it extremely useful to do so. In this section of our guide, we will give you the list of pros and cons of AvaTraderGo ProsThe multifunctionality of the platform is a defining feature of the site with its easy acceptability. There are many other features that are beneficial to AvaTrade mobile trading users. These are fast transaction speed, great visual stimuli regarding graphs, and overall an immersive experience with the trading instruments. In fact, the platform has a diverse set of trading tools that are available on both mobile and desktop versions of the site. Islamic AccountsOther than the standard professional accounts one can also open an Islamic account on AvaTrade. This account allows those who follow the Riba principles of Sharia law to make trades with a variety of different trading instruments – Forex, commodities, bonds, cryptocurrencies, and many more. The Islamic trading account is not charged with daily swaps. The swap fees are completely transferred into regular administration fees on all Forex trading items across the MT4 network. AvaProtectAvaProtect is an exclusive risk management tool only available for the users of AvaTradeGo.It allows one to recover losses from losing trades. This is a very innovative feature that the AvaTrade mobile trading site possesses. Investing still carries the risk of losing money, but AvaProtect makes it simple to protect yourself. Trades can be protected and danger can be managed. During a time of low liquidity, this method may be extremely useful.

Trading PlatformsThere are many available trading platforms with AvaTrader forex broker. Mobile Trading is one of the defying features of the site as the AvaTradeGo is very popular among traders. MetaTader4 and MetaTrader5 are available on the platform alongside with WebTrader. All of the trading platforms are optimized for each operating system including IOS, windows, and android. 24/7 Customer ServiceAvaTradeGo is accustomed to the same treatment as the desktop version of the platform. Therefore it's no surprise that mobile app users can have access to the 24/7 customer service that is also multilingual. What is AvaTradeGo if not an incredibly user-oriented platform? One can get in touch with the incredibly professional customer service team via live chat or a phone call. The site also has a comprehensive FAQ section where one can find answers to general or specific questions alongside other educational materials. ConsPerfection doesn't exist. This is accurate with even slime of the best trading apps. AvaTradeGo has many advantages that we have already mentioned in great detail. However, it doesn't function without a few faults that can be improved on with late updates of the mobile app. This Forex broker is eager to know the customer response to their products. Can't Be CustomizedAvaTradeGo is a powerful tool, it's a great platform for those who want to trade on the go, hence the name of the mobile app itself. Is AvaTradeGo good for mobile traders? Yes, it is, however, we do have to be cautious on how to properly use it. Mobile trading is not for beginners. It's important to mention that this app can't be customized to one's will. Unlike other available trading platforms on AvaTrade forex broker, one can not add other tools or indicators to this mobile app. What we have already discussed is pretty much what you get with AvaTradeGo. Smaller MediumThere is no doubt in our mind that AvaTarderGo is an efficient, fast, and innovative platform. However, don't forget the fact that any financial mobile app should be used with the desktop version of the same platform. Using AvaTraderGo Independently without ever checking out the desktop dashboard can be reckless as one needs to see each activity on a large scale as well. The smaller medium of the AvaTrade mobile trading app can be useful to do one's trading on the go however it can also be compromising for one's trades if it's not used wisely. VolatilityThe mobile app gives you 24/7 access to the Forex market. This means that the volatility can be off the roofs. For example, if some invested over a billion dollars in a particular stock. This market will definitely have a strong reaction to this process. AvaTradeGo allows its users to see what other traders of the community are doing, therefore in our hypothetical scenario many traders will be able to see this and some might even begin to buy the upper mentioned stock. Once the unknown user doubles his wealth, he or she can easily sell that share and withdraw the revenue, causing the share price to plummet at twice the rate. FAQ on AvaTradeGoDoes AvaTrade have an app?Yes. AvaTrade mobile trading app is available. The app version of their site can be found on application stores on both IOS and Android devices. Each of the applications was made by some of the best and experienced developers and it shows. The app has critical acclaim among the users and has been awarded by the "Global Forex Awards 2020" for "Best Forex mobile trading app" on the global market. What is Ava Trade Go?AvaTradeGo is the name of the IOS and Android application version of the beloved Forex broker platform. Each of the available features on the site is also available in the app as well. The distinction between the desktop and mobile versions is acceptability. One can use the app virtually anywhere anytime. Does AvaTradeGo consume a lot of data?According to the customer and AvaTradeGo review of AvaTradeGo, it seems that it doesn't consume a lot of data. While doing our research on this very topic we have found that this notion to be true. Indeed the mobile app doesn't consume much data. It's incredibly sufficient. It won't even take much storage on your device, on android smartphones it only takes 18MB. If you do experience any problems with data consumption most likely your phone might be outdated. On the Google app store, AvaTradeGo has a 4.4-star review made by over 4000 users. On the Apple store, it's even higher, with a 4.6 out of a 5. Needless to say, it has a great perception among the users. |

| CFD Trading UK - 2021 Market Outlook - Trading Authority Study - Yahoo Finance Australia Posted: 01 Jun 2021 01:12 AM PDT  STOCKHOLM, June 1, 2021 /PRNewswire/ -- CFD Trading has grown by 33% with 550,000 active users in 2020, meme stocks crypto currencies e.g. GME and Dogecoin has boosted the interest. Skilling, eToro and Plus500 are leading the way in the UK CFD market. About CFD Trading CFD trading is defined as 'the buying and selling of CFD's, with "CFD" meaning "contract for difference". CFDs act as an instrument allowing the investor to speculate on the price of underlying assets without taking actual ownership in the shares, FX, ETFs or crypto. The online trading platforms are giving retail traders access to a way of investing only exclusive to professionals before. Fastest Growing UK CFD Brokers 2021

CFD Trading in the UK The United Kingdom are now considered mature markets in the CFD- & FX- trading space. The UK population has had access to CFDs since the end of the 90s but it was truly popularized in the last few years. By Q1 2022, GDP could have completely recovered to pre-COVID-19 values. Along with which the outlook for growth from 2023 to 2025 seems to be more optimistic for markets.

Why has CFD trading surged? "The main reason is Covid has provoked volatility in the markets. CFD trading present an opportunity to generate profits in both swings of the market. From the beginning of last year when many shares sunk 60-70% to the impressive recovery where growth shares and crypto currencies saw a surge of up to 6x, traders have been able to profit both ways. Adrian Reading, Head of Research, Trading Authority Product reasons for the rise of CFD trading:

New Generation of traders – "meme stocks" "The quarantines and increasing popularity of tech and "meme" stocks fueled the popularity of short-term speculation, often accelerated by the power of social media and forums such as reddit. Twitter has been a useful tool for detecting sentiments in the markets but now platforms such as reddit.com and Discord has emerged as new trading information hubs for retail traders." "Communities such as wallstreetbets, popularized by traders on RobinHood (US online broker), drove the surge Gamestop (GME) up to never previously seen levels, by crowdsourced investment theses, memes and print screens of extraordinary profits. As many other trends nowadays, they originate in the US to then be quickly spread across global borders. Leveraged retail trading is just one of them" Europe and the UK has long been serviced by the traditional banks and trading houses online platforms, but we can since the beginning of the new millennia see a new generation of online platforms that are native in the digital space, platforms such as Skilling, eToro and Plus500 have emerged with platforms premiering convenience, new UX and portfolio of trend sensitive underlying assets. These platforms have been natural destination for a new generation of traders, used to sophisticated digital products. New destination for retail investors, CFD trading for the masses By the other end of the spectrum, the older generations have found CFD trading after being restricted to a limited range of investment opportunities provided by traditional banks. The new marketing reach and familiarity of CFDs have diversified portfolio and shifted capital away from the banks. Low interest rates have been an additional factor to the search for new investments. The new retail traders are well protected by the FCA, the increasing level of regulations to mitigate the high loss percentage, around 70% of retail accounts lose money, but there is still a need for education of the average trader. Ban on Crypto-derivatives in the UK The FCA banned the sale of crypto-derivatives in the end of 2020 due to unreliability of the valuations of crypto currencies. "The FCA considers these products to be ill-suited for retail consumers due to the harm they pose." In detail the FCA reasoned:

Protection of investors led by the FCA It's important to remember that all forms of trading offer risk as well as potential reward. So, before you start exploring the world of CFDs, be sure to do thorough research.

The last few years of CFD trading in the UK CFD brokers differentiate on available markets and instruments, rates, fees, trading app capabilities, and customer support. Following all the market activities from 2008 to 2018, investors came to see CDFs as a strong investment option in 2019. The pattern has been accelerating in 2020, so hopes for 2021 are high. Traders can undertake trades in all market climates, allowing you to forecast price that follows the fundamental research in both bear and bull markets. Contracts for difference or CFDs were introduced to the market in 1990s but have gained increasing popularity in 2020. CFD trading is a beneficial instrument to investors, they allow them to take long and short positions without holding the underlying asset. You are speculating on the increasing or decreasing price of an asset – without owning it. Trading on margin or leveraged trading require less capital investment than buying shares. CFD trading can be used for short term trading profits on trends and movements in the market or to hedge/offset losses on your share portfolio. The CFDs are offered for a wide range of financial assets e.g., shares, ETFs, FX, ETFs, commodities, Bitcoin, Dogecoin, Ethereum, and many other. The financial regulations enforced by the FCA, have limited the leverage and risk for traders by putting a ceiling on leverage and providing negative balance protection. The equation behind the profit from your position is based on the difference between the buy and sell prices, less any fees incurred while holding the position. Cost such as holding and for opening the position are automatically deducted from your trading account. The buy price/sell price – initial buy/sell price - interest cost x days – transaction costs = profit or loss. Trading on a margin means exponential profits based on the initial investment, but also the risk that any losses will be magnified. To manage risk traders should be aware of position sizing and how to use a stop loss. CFD Trading Prognosis for 2021:

Broker Considerations When choosing the CFD trading platform, there are several key points to investigate to know the right fit. They are pricing, fees and commissions, market accessibility, opening times, account balance and deposit security (FSCS, etc.), features, order platform, market tools, and educational services. Trading Authority is a privately owned financial services industry research company based in London, UK. We deliver independent, deep insights research on the behaviours, preferences and needs of retail investors and intermediaries for the financial services companies that serve them across Australia, Singapore, Hong Kong, France, Germany, Spain, and the UK.For more information about this country profile visit https://trading-authority.com Media Contact: This information was brought to you by Cision http://news.cision.com https://news.cision.com/trading-authority/r/cfd-trading-uk---2021-market-outlook,c3357622 |

| You are subscribed to email updates from "forex trading platforms" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment