EUR/USD Forex Market Trading Strategies: Strong Bear Trend In Play - Investing.com

EUR/USD Forex Market Trading Strategies: Strong Bear Trend In Play - Investing.com |

- EUR/USD Forex Market Trading Strategies: Strong Bear Trend In Play - Investing.com

- FOREX-Dollar bounces higher as traders brace for inflation data - Investing.com India

- Institutions Investing In Bitcoin Isn't About Money — It's About The Mindset - ForexTV.com

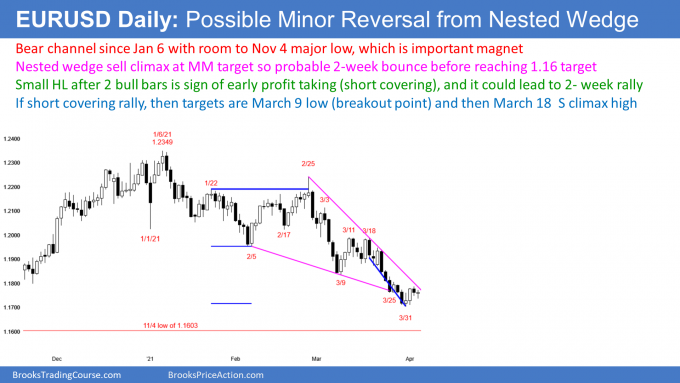

| EUR/USD Forex Market Trading Strategies: Strong Bear Trend In Play - Investing.com Posted: 05 Apr 2021 07:06 AM PDT EUR/USD forex daily chartWe've got a strong bear trend in play for . Today triggered a Low 1 bear flag sell signal by going below Friday's low. The Target below is the Nov. 4 low, which would be the start of the final leg up of the wedge top on the weekly chart. There's also the possibility of a wedge bottom, so that might transform into a 2-week short covering rally. Bulls hope today will be a small higher low and the start of a rally. Bulls are targeting the Mar. 9 low, which is the most recent breakout point, and then the Mar. 9 high, which is the start of the most recent sell climax.  EUR/USD forex possible short covering rally after wedge bottom Overnight EUR/USD forex trading on 5-minute chart

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| FOREX-Dollar bounces higher as traders brace for inflation data - Investing.com India Posted: 12 Apr 2021 01:25 AM PDT  * Dollar gains after heavy loses last week * U.S. inflation data due on Tuesday * Euro back below $1.19, sterling bounces off two-month low * Graphic: World FX rates https://tmsnrt.rs/2RBWI5E By Tommy Wilkes LONDON, April 12 (Reuters) - The dollar gained ground on Monday after last week's drop as traders assessed the outlook for Treasury yields, while awaiting crucial U.S. inflation and retail sales data in coming days. Elsewhere it was a quiet start to a data-heavy week for foreign exchange markets. The euro dipped back below $1.19 while the British pound briefly fell to a two-month low, with some analysts citing blood clot concerns around AstraZeneca's COVID-19 vaccine, which the UK has relied heavily on for its aggressive vaccination programme. The dollar's fortunes have been tied to the performance of Treasury yields for most of 2021, after concerns about rising inflation in the United States and a stimulus-fuelled economic rebound triggered a significant jump in yields on U.S. government bonds in February. A fall in U.S. yields last week triggered the worst week for the dollar in 2021, but the currency found some stability on Monday. Federal Reserve Chairman Jerome Powell said in a U.S. media interview released on Sunday that the U.S. economy was at "an inflection point" and looked set for a strong rebound in the coming months, but he also warned of risks stemming from a hasty reopening. are now waiting for U.S. March inflation data due on Tuesday. "We are set to see the first evidence of the much anticipated surge in inflation that is widely expected through the coming months as base effects from a year ago begin to take effect as the sharp declines post-COVID start to fall out of the annual calculations," said MUFG analysts. They said the dollar's fortunes could well "remain linked to 10-year yields". The benchmark 10-year Treasury yield was at 1.6462% after dropping to as low as 1.6170% last week. It had surged to a more than a one-year high of 1.7760% on March 30. The , which measures the greenback against a basket of currencies, rose 0.1% to 92.275 =USD while the euro dropped 0.2% to $1.1875 . traded above $60,000, closing the gap to its record high. Against the pound the dollar initially gained before reversing course. The British currency was last up 0.2% at $1.3734 after briefly touching a two-month low of $1.3669 GBP=D3 . The dollar fell 0.2% to 109.41 yen versus the Japanese currency. "USD has some upside potential this week," Commonwealth Bank of Australia strategist Kimberley Mundy wrote in a report. "Strong U.S. economic data will highlight the divergence between the U.S.'s fast economic recovery and the more stunted recoveries in other developed economies." The dollar can lift back toward 110 yen, while the euro has scope to retrace most of the recent gains from its almost five-month low near $1.17, she said. <^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ World FX rates https://tmsnrt.rs/2RBWI5E ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> |

| Institutions Investing In Bitcoin Isn't About Money — It's About The Mindset - ForexTV.com Posted: 11 Apr 2021 03:01 PM PDT With the recent influx of corporate interest in bitcoin, the cryptocurrency is poised to accelerate into the mainstream. Bitcoin is now a $1 trillion asset. It is more valuable than Tesla and Facebook … Latest posts by Bitcoin News Editor (see all) |

| You are subscribed to email updates from "investing forex" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment