NZD/USD Price Analysis: Bearish continuation flag pattern spotted on hourly charts - Forex Crunch

NZD/USD Price Analysis: Bearish continuation flag pattern spotted on hourly charts - Forex Crunch |

- NZD/USD Price Analysis: Bearish continuation flag pattern spotted on hourly charts - Forex Crunch

- Forex Technical Analysis, Charts: AUD/CAD, AUD/CHF, AUD/JPY, AUD/USD, EUR/AUD, GBP/AUD - Exchange Rates UK

- Dollar Eases From 4-Month Highs as Yield Spike Loses Steam By Investing.com - Investing.com

- Deliveroo Shares Slump Over 20% on Debut in London By Investing.com - Investing.com

| NZD/USD Price Analysis: Bearish continuation flag pattern spotted on hourly charts - Forex Crunch Posted: 30 Mar 2021 02:41 AM PDT

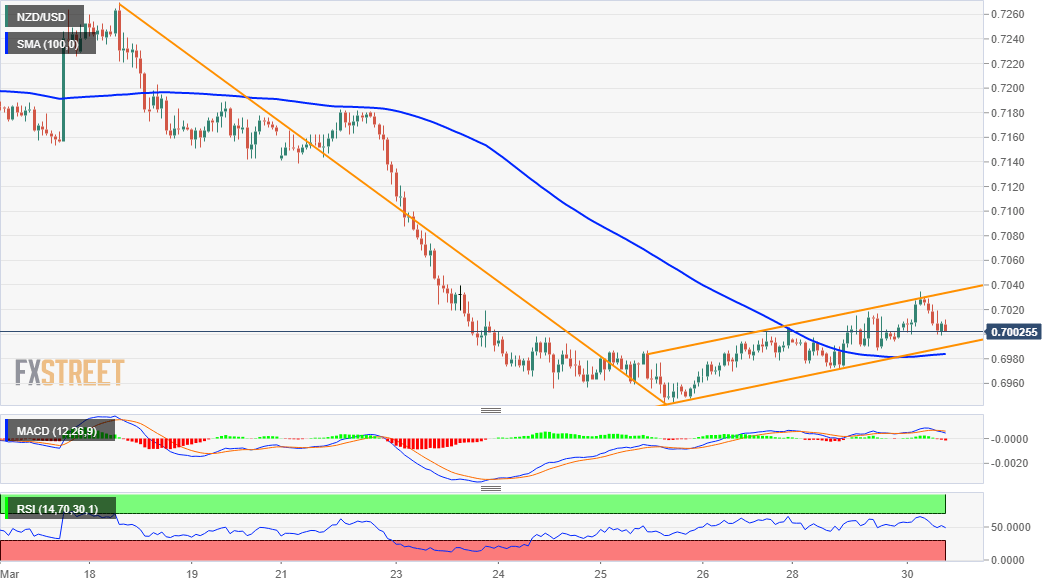

The NZD/USD pair surrendered a major part of its intraday gains to one-week tops and was last seen trading in the neutral territory, around the key 0.7000 psychological mark. The recent bounce from four-month lows stalled near a resistance marked by the top boundary of an upward sloping channel. Given last week's steep fall, the mentioned channel constitutes the formation of a bearish continuation flag pattern on hourly charts. The negative outlook is reinforced by the fact that technical indicators on the daily chart are still holding deep in the bearish territory. This, in turn, supports prospects for further losses amid a strong bullish sentiment surrounding the US dollar. Meanwhile, oscillators on the 1-hourly chart have been gaining some positive traction and recovered from the bearish zone on the 4-hourly chart. The set-up favours intraday bullish traders, through any positive move might still be seen as a selling opportunity. That said, it will be prudent to wait for a sustained break below the 0.6990-85 confluence region before placing fresh bearish bets. The said area comprises the trend-channel support and 100-hour SMA, which should act as a key pivotal point for traders. Some follow-through weakness will confirm a fresh bearish breakdown and drag the NZD/USD pair back towards multi-month lows, around the 0.6945-40 region. The downward momentum could further get extended towards challenging the 0.6900 round-figure mark. On the flip side, any attempted recovery might continue to confront stiff resistance and remain capped near the top end of the channel. The mentioned barrier is pegged near the 0.7030-40 region, which if cleared might trigger some aggressive short-covering move. NZD/USD 1-hourly chart

Technical levels to watch |

| Posted: 04 Mar 2021 12:00 AM PST   Exchange Rates UK TV: Continuing to look for amazing trade setups on the Aussie pairs. Exchange Rates UK TV: Continuing to look for amazing trade setups on the Aussie pairs. |

| Dollar Eases From 4-Month Highs as Yield Spike Loses Steam By Investing.com - Investing.com Posted: 30 Mar 2021 12:29 PM PDT  © Reuters. © Reuters.By Yasin Ebrahim Inveting.com - The U.S. dollar gave up some of its gains Tuesday following a rise to four-month highs on the back of falling U.S. bond yields – a move that analysts warn could continue. The , which measures the greenback against a trade-weighted basket of six major currencies, rose by 0.35% to $93.28, but had been as high as $93.37. "Our charts suggest maintaining a positive stance on the US Dollar, but we would tighten up stops as the move higher in US yields may soon lose upside momentum," Commerzbank (DE:) said in a note. The trickle lower in the dollar comes as U.S. yields struggled to hold onto their gains after hitting price levels that triggered strong selling action, forcing some profit taking. "The US 10 Yield nears the 50% retracement of the 2018-2020 descent at 1.79 above which sits the 1.95/2.00 major resistance area," Commerzbank added. Still, there a few betting that the latest slip in yields is a sign of reversal as data continued to point to underlying strength in the economy. The consumer confidence index rose to a reading of 109.7 in March, up from 90.4 in February, beating economists' forecasts of 96.9. In a sign of further economic recovery, inflation expectations continued to rise - reaching 6.7%, up from 6.5% previously – and will likely continue to advance amid inventory shortages. "Although we expect inflation to moderate in the medium term, the inventory story will be in play for several more months to come," Jefferies (NYSE:) said in a note. "Manufacturers have not made much progress in restocking the shelves, and the recent delays in shipping through the Suez Canal will exacerbate these issues as well." Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| Deliveroo Shares Slump Over 20% on Debut in London By Investing.com - Investing.com Posted: 31 Mar 2021 12:11 AM PDT  © Reuters. © Reuters.By Geoffrey Smith Investing.com -- Shares in Deliveroo slumped on their debut on the London Stock Exchange, as concerns about governance and profitability overshadowed the biggest IPO of the year so far in Europe. By 5:05 AM ET (0905 GMT), Deliveroo shares were quoted at 305 pence, some 22% below their IPO price. The shares were priced at the bottom of their marketing range, at 390p, after a number of high-profile U.K. institutions chose not to subscribe. A recent Supreme Court decision forcing ride-hailing company Uber (NYSE:) to treat its gig-economy drivers as workers has cast doubt over Deliveroo's own path to profitability, given that it, too, depends on a legion of low-paid contract riders and drivers. The IPO pricing had valued Deliveroo at 7.6 billion pounds ($10.5 billion). As such, the initial drop of 30% wiped over 2 billion pounds off its valuation. In addition to concerns about its exposure to labor regulation risk, there have also been concerns about the company's dual-class share structure, which leaves founder Will Shu in majority control of the company despite owning less than 10% of all shares outstanding. The model has been common in the U.S. and has encouraged many tech firms to go public without subjecting their founders' vision to short-term pressure from outside shareholders. Critics say it amplifies "key person risk", while the institutional investors that avoided the IPO have said that it reduces their scope to exert influence on management to address their ESG-related worries. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. |

| You are subscribed to email updates from "forex charts" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment