5 Best Forex Brokers in India for 2021 – Forex Trading in India - DailyForex.com

5 Best Forex Brokers in India for 2021 – Forex Trading in India - DailyForex.com |

- 5 Best Forex Brokers in India for 2021 – Forex Trading in India - DailyForex.com

- Modern Client Office with CRM from Match-Trade Technologies - Finance Magnates

- How to Select an Online Trading App in Kenya that is Right for You - Techweez

| 5 Best Forex Brokers in India for 2021 – Forex Trading in India - DailyForex.com Posted: 02 Dec 2020 11:54 PM PST Currency Trading in IndiaIndia is a thriving capitalist economy with the second-highest population in the world at 1.3 billion people. Net disposable wealth has increased dramatically in recent decades and especially in recent years. This has resulted in a large increase in Indian residents with some amount of capital to invest or speculate with, and many have turned to the Forex market. To start trading Forex in India successfully, it helps to know about the different types of currency markets, how they work, the details of how Forex works in India, and what you will need to get started. When Indian residents choose to trade Forex with an international broker, it means that they can trade Forex in much the same way as the rest of the world, with full access to the world Forex market and excellent trading conditions. What are Currency Market Futures?Currency market futures are contracts through which investors agree to buy or sell a number of units of a currency at the expiry of the contract period. It is similar to equity or stock futures, but the underlying asset is a Forex pair instead of a stock. The introduction of currency futures in 2008 on the National Stock Exchange (NSE), was a major milestone in the Indian financial market. Subsequently, the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) permitted trading in USD/INR currency futures in other stock exchanges, albeit with strict controls. Currency futures in India are cash-settled, i.e. not physically settled. "Cash-settled" means that the contracts are settled without the actual delivery of the currency on expiry. This makes currency or Forex trading in India an ideal speculative vehicle. Under the Indian regulatory guidelines, currency trading in India is limited to a handful of currency futures. Alternatively, by using international Forex brokers, Indian Forex traders can access dozens of Forex pairs. What is the Indian Currency market?The Indian Currency market is the market that allows traders to make money from fluctuations in the value of currencies. Due to the "Forex trading in India RBI guidelines", and their need to protect "Forex Reserves India", the Indian currency market is dominated by the Indian Rupee. The Basics of Currency TradingCurrency or Forex trading in India is conducted by buying one currency with another currency, then making the reverse transaction later. An individual currency, such as the US Dollar or Indian Rupee, cannot be bought or sold in isolation – currencies are always traded in pairs, hence the term "Forex pairs". For example, if you want to buy the US Dollar, you have to sell another currency against it. Let us say that to buy the US Dollar, you decide to sell the Indian Rupee. You are speculating that the value of the US Dollar will appreciate against the Indian Rupee. In Forex trading terminology, you have bought the USD/INR Forex pair. What is Required to Start Trading?To start Forex trading in India, the first step is to compare Indian Forex brokers and choose the most suitable for your trading needs. A big part of this is to determine the best Forex trading platform in India for your needs. Indian Forex brokers will have standard compliance measures such as requiring you to show proof of identification and proof of address before being able to open an account. Once the account is opened, the next step is to make a deposit and most Forex trading brokers in India will have a minimum deposit requirement to begin trading. Forex trading brokers in India will vary in quality, just like in any other industry. You will have to consider factors such as wanting to have the best Forex trading platform in India, good customer service, and proper regulation to protect your capital. How Does the Currency Market Work?Forex is traded in pairs of currencies. The first currency in a Forex pair is called the "Base Currency" and the second currency is called the "Quote Currency". For example, if you're trading the Forex pair USD/INR, the base currency is USD (US Dollar), and the quote currency is INR (Indian Rupee). When you buy a Forex pair, you are speculating that the base currency will rise in value against the value of the quote currency. Conversely, when you sell a Forex pair, you are speculating that the base currency will fall in value against the quote currency. The price of a Forex pair is how many units of the quote currency can be bought by 1 unit of the base currency. For example, if USD/INR = 74.5, that means $1 can purchase ₹74.5. Most currencies fluctuate by little in value against each other on a daily basis. That can make it challenging to make money by currency trading in India. However, to help you make more money from relatively small fluctuations in price, brokers offer "leverage" – this is where a small amount of money (this is known as "margin") is used to control a larger amount of capital. For example, if a broker offers you 50:1 leverage, it means for every dollar you have in your brokerage account, you can trade $50 size of a Forex position. All the Indian Forex brokers recommended by DailyForex offer leverage for Forex trading in India. Forex brokers in India will usually offer around 30 Forex pairs and crosses for you to trade, and these are divided into four main categories:

Let us look at each type of Forex pair in greater detail. Major Pairs: These Forex pairs always contain the US Dollar and represent the major world economies, hence the term "Major Pairs". There are seven major Forex pairs: EUR/USD – Euro versus US Dollar USD/JPY – US Dollar versus Japanese Yen GBP/USD – Great British Pound versus US Dollar USD/CHF – US Dollar versus Swiss Franc USD/CAD – US Dollar versus Canadian Dollar AUD/USD – Australian Dollar versus US Dollar NZD/USD – New Zealand Dollar versus US Dollar It is important to note that the base and quote currencies of Forex pairs are standardized, so you will always see Forex pairs written the same way. For example, you will always see brokers use EUR/USD and never see it written as USD/EUR. The first 4 Forex pairs in the list, EUR/USD, USD/JPY, GBP/USD, and USD/CHF, are known as the "Traditional Major Forex Pairs". Major Forex pairs are the most liquid and the most popular to trade. This results in low spreads – remember, spreads are a major cost of trading so major pairs have the lowest trading costs. They also generally have low slippage in normal market conditions which means you will get a good price when you execute your trades. EUR/USD is by far the most widely traded Forex pair in the world and usually has the lowest spread. Each of the Forex trading brokers in India that DailyForex recommends have the seven major Forex pairs on their trading platform for you to trade. Minor Pairs: These are Forex pairs that usually do not include the US Dollar. They are also known as "Cross Pairs" or "crosses". Examples include EUR/CAD (Euro versus Canadian Dollar), and GBP/JPY (British Pound versus the Japanese Yen). Minor Forex pairs usually have higher spreads than major Forex pairs. Exotic Pairs: These are Forex pairs that contain currencies from smaller nations and are less traded resulting in higher spreads and occasional price gaps. Examples of exotic currencies include the Turkish Lira and Mexican Peso. Most Forex trading brokers in India require higher margins for exotic pairs. Regional Pairs: These are the most thinly traded Forex pairs and contain currencies from the least known countries. They come with the highest spreads and the most risk in terms of price gaps. Examples of regional currencies include the Indonesian Rupiah (IDR) and Philippine Peso (PHP). How to start Forex trading in India: Start with the Majors and Minors. If you're asking yourself how to start Forex trading in India, you should focus on the Major and Minor Forex Pairs only. Almost all Indian Forex brokers will offer these as standard. What are the Risks Involved in Currency Trading?Just as with any speculative endeavor, there is a risk of loss in currency trading in India. Indian Forex brokers always have a risk disclaimer on their websites to highlight the risk of loss of capital. The main source of risk of loss of capital comes from making incorrect trading decisions. This often happens by not predicting the correct direction a currency or Forex pair will move. The other main source of risk of loss of capital is by risking too much of your capital on a single trade and not exiting a trade before a loss becomes too large if it goes against you. DailyForex recommends to all traders to only trade with money that you can afford to lose. Secondly, we advise that you set a "stop-loss" for every trade: this is where you have an exit for a trade communicated in advance to your broker in case the trade goes against you to prevent the loss from becoming too large. The third source of risk in currency trading in India is placing money with a broker that is not properly regulated or does not provide good trading conditions. In such cases, they may not return your principal capital and/or trading profits when you try to withdraw money, or they may provide poor execution on your trades. You can mitigate this risk by only trading with regulated Forex brokers with good reputations. Start Trading Forex in IndiaOnce you decide to make a start Forex trading in India, there are two key steps: firstly, you must select a broker. It goes without saying that you want to have access to the best Forex trading platform in India. The second step is to make a deposit with your chosen Indian Forex broker. To be a successful Forex trader requires knowledge of the markets and how to manage risk. Is Forex Trading Legal in India?Yes – Forex trading is legal in India under certain conditions. The "Forex trading in India RBI guidelines" and the Securities and Exchange Board of India, or SEBI, govern Forex trading in India. The Forex trading in India RBI guidelines restricts currency trading in India to just 7 currency pairs: 4 Indian rupee pairs (INR) and 3 non-INR Forex pairs. The 4 INR pairs are USD/INR, EUR/INR, GBP/INR, and JPY/INR, and the 3 non-INR pairs are EUR/USD, GBP/USD, and USD/JPY. These must all be traded as currency futures or derivatives. The second aspect that makes Forex trading in India unique is that Indian residents may only trade through brokers that are regulated by the Securities and Exchange Board of India, or SEBI, and allow access to Indian exchanges such as the NSE, BSE, and MCX-SX. These brokers cannot use traditional electronic or online Forex trading platforms and remain compliant. The main reason for such a strict regulatory environment is that Forex reserves India are considered a national priority and is therefore protected. The regulatory conditions make Forex trading in India feel like a completely different market compared to Forex trading anywhere else in the world. For example, Forex brokers in Europe and North America can offer dozens of Forex pairs at varying degrees of leverage, and they are not obliged to go through a centralized exchange to fill their clients' trades. That level of flexibility gives traders a much more open, transparent, and low-cost environment to participate in the Forex markets. Punishment for Forex trading in India is not to be taken lightly but the truth of the matter is that the Indian regulatory authorities have so far taken the path of not cracking down on individuals, but rather cracking down on Forex brokers operating illegally onshore in India. The advice is that if you want to conduct Forex trading in India, the solution is to use a well-regulated broker outside of India that accepts Indian residents. That way, you will have access to a true spot Forex market with dozens of pairs at low cost. When transferring money to Forex brokers outside of India, it is recommended not to use a wire transfer, or credit or debit card that can alert Indian authorities, but rather use PayPal or a similar electronic wallet service. This is the most practical way of conducting Forex trading in India. Trading Strategies Suitable for Trading in IndiaMany trading strategies are suitable for Forex trading in India. Some of these key ones include:

Price Action: This is a broad term to describe Technical Analysis without the use of indicators (for example, Moving Averages, Stochastics, RSI, etc.) or at least the use of very few indicators. Price Action trading is suitable for any high-volume liquid market as it relies on crowd psychology to be effective. As the Forex market is the largest and most liquid market in the world, it is a perfect candidate for price action trading strategies. Trend Trading: A trend is made when price makes a series of higher lows (in the case of an uptrend) or lower highs (in the case of a downtrend). When a Forex pair starts moving in a trend, it is one of the most profitable and consistent market conditions to make money in Forex. This is because the market has shown a clear direction for you to follow. Many traders use the phrase "the trend is your friend" to express how important it is to trade in line with the trend. Counter-Trend Trading: This is trading against the direction of the overall trend. Counter-trend trading is considered riskier, but you can often find trades which other traders do not spot, and it increases the number of available opportunities. Range Trading: When the price is moving up and down between two levels (i.e. support and resistance levels), price is described to be making a "Range". If the levels are clearly defined, range traders will buy at the bottom of the range and sell at the top of the range. Breakout Trading: When a price breaks through a support or resistance level or breaks out of a range, capturing that move is known as "breakout trading". Breakouts happen fast and the price often moves significantly. That means breakout trading can deliver decent profits in a fast amount of time if traded correctly. Once a price has broken out of a certain level, it can reverse and go back through that original level – this is known as a "false breakout". Position Trading: You can think of position trading as the opposite of day trading. Position trading is holding a trade for several days or more and is great for capturing longer-term trends. It is also great if you cannot be at your screen all day to monitor the markets and you would rather let the trade run for several days (or several weeks or months if that suits you) to realize your profits. Carry Trade: The carry trade is unique to Forex trading. It takes advantage of interest rate differences between two currencies. For a successful carry trade, you want to buy a currency with a high-interest rate (where you receive interest) and sell a currency with a low-interest rate (where you pay interest) and collect the difference. Scalping: Scalping is the method of trading to capture very small moves in the market. Traders who are scalping are usually in trades for a matter of seconds or minutes. Because the moves are so small, you want to choose currencies with low spreads to reduce your trading costs if you choose to scalp. Traders with a psychological preference for short-term trading are often drawn to scalping as a trading method. Day Trading: This is simply opening and closing a trade on the same day. Day trading is generally considered short-term. To be a day trader, you should be able to be at your screen during the day to monitor the markets. Swing Trading: This is where trades are held for many hours or a few days in order to realize larger moves in the Forex market than day traders will typically capture, but less than position traders are looking for. Who is Qualified to Trade in Currency Futures Markets in India?As long as you are able to open an account with an Indian Forex broker, you are qualified to trade the currency futures market in India. Indian Forex brokers will require you to submit a copy of your identification and proof of address as part of their compliance before opening an account. Cross Currency ExchangeAlso known as a cross-currency swap, this is an agreement between two parties to exchange interest payments and principal denominated in two different currencies. A cross currency exchange is traded as a derivative product. Generally, as an individual or retail trader, you will not be trading cross-currency swaps. Indian Forex MarketThe Indian Forex market is defined as the market that is regulated by the Securities and Exchange Board of India, or SEBI, and follows the "Forex trading in India RBI guidelines". However, many Indian traders will use international Forex brokers that accept Indian clients to facilitate their Forex trading because it gives them more flexibility and access to a more profitable trading environment. Time ZonesAlthough there is no hard line that defines when Forex should be traded as it runs 24 hours a day, five days a week, the first couple of hours of the US open beginning at 8.a.m. ET are historically the best time to trade Forex as the most liquid during any 24-hour Forex period. This is because New York, London and other European financial centers are operating simultaneously at this time. If you are strictly trading through the Indian exchanges to access the official Indian currency futures market, you will have to follow the local exchange hours. Back to top ⬆Making Money Trading Forex in IndiaTo make money through Forex trading in India, you must have a Forex account with a reputable Indian Forex broker, and that has the best Forex trading platform in India to meet your needs. Secondly, you must develop knowledge of what moves the Forex markets. Additional Factors to Consider Before Opening a Forex AccountRegistered with Reputable Financial RegulatorThis is probably the single most important factor in choosing a Forex broker. Ultimately, your Indian Forex broker will be holding your deposit and you want to be certain that it is held separately from the operations of the company (this is known as "segregating the funds"), and that you can withdraw your money reliably. Trading AssetsOf course, you must have a reasonable amount of money deposited to trade Forex in a way that makes it worthwhile to spend your time and effort trading. Back to top ⬆LeverageLeverage means allowing a trader to control a large amount of capital with a smaller amount of money deposited in their account. The more leverage a broker offers, the larger the trade sizes you can place. However, using too much leverage is very risky, so it is important to strike a balance between risk and potential reward. Commissions, Spreads, and FeesAs with any financial endeavor, you will wish to keep your costs low. Commissions and spreads (the difference between the bid and ask prices) will be your main cost as a trader. Trading PlatformsYou will want the best trading platform in India for your Forex trading to increase the chances of success. The platform should allow you to use it on your preferred device, whether that's a desktop computer, or smartphone or tablet. Whichever trading platform you choose should be very stable. Account TypesMany Indian Forex brokers offer different account types depending on how you want to execute your trades and the size of your initial deposit. For example, some account types will rely on a dealing-desk where the broker carries the trade on their books. Dealing-desk accounts are often suitable for small account sizes. In contrast, an ECN account connects buyers and sellers directly without a dealing-desk and offers lower spreads. However, ECN accounts are usually reserved for larger account sizes with higher minimum deposits. Back to top ⬆Minimum DepositA simple question to ask yourself is whether you can you meet your chosen Indian Forex broker's minimum deposit requirement. Negative Balance ProtectionSometimes a trade can go against you so quickly that your account records a negative balance due to huge slippage, and the best Indian Forex brokers offer a negative balance protection feature to safeguard against this eventuality. Trading AppIf you want to trade from a smartphone or tablet, your broker will have to make available a trading app. All the Indian Forex brokers recommended by DailyForex have trading apps for smartphones and tablets. Customer ServiceStrong customer service can resolve queries and disputes efficiently and quickly. You want to ensure you can access your Forex broker's customer service at hours that are convenient for you, and that you can reach them by both email and phone. Additional servicesMany brokers offer live analysis and training to help you succeed as a Forex trader. Pros & Cons of Forex Trading in IndiaPros: Forex trading in India is a great way to earn a new source of income regardless of local economic conditions. Cons: There is a risk of loss of capital in Forex trading. The Indian regulatory framework is so strict that most Indian traders would rather use international Forex brokers to execute their trading. Methodology (How We Test/Choose)As an Indian Forex trader, you must have plenty of questions when choosing from a selection of Forex trading brokers in India with the best trading platform in India. As always, our team of analysts and industry experts at DailyForex have done much of the hard work for you to bring you the best Indian Forex brokers. We employ a rigorous methodology that measures multiple variables to find the best Indian Forex. First and foremost, we are most concerned with the financial stability and regulatory compliance of any broker we review. Next, we look at the reliability of their execution, including speed of execution and accuracy of filling client trades. Then we consider the cost of trading whether it is through spreads and/or commissions. We review the capability of the platforms they offer traders for charting and execution, followed by the level of customer service they give clients. For example, are they available by phone 24 hours a day? Or is customer service by email only? Very often, our team has direct experience of the brokers we're assessing through live or demo accounts, and by dealing with their customer service personnel. This 360-degree review of every Indian Forex broker gives us a complete understanding of whether they should sit on our list of Forex trading brokers in India. Back to top ⬆FAQsIs trading Forex legal in India?Yes. Forex trading is legal in India. Under government regulations, you can only trade from a selection of seven currency market futures, and you must use onshore brokers that have direct access to Indian exchanges. Many Indian Forex traders instead use international Forex brokers that are regulated in different jurisdictions but still accept Indian clients. Using international Forex brokers gives Forex traders access to the best Forex brokers in the world, dozens of Forex pairs, good leverage, and the best trading platform in India for Forex traders. Going this route of using an international Forex broker is against Indian regulations, however Indian authorities have not pursued individual traders in recent years. Most Indian Forex traders will deposit and withdraw money with Forex brokers using PayPal or a similar electronic wallet service, rather than a wire transfer, or credit or debit card that can alert Indian authorities. Which is the best Forex trading app in India?One of the best Forex Trading apps in India is MetaTrader 4 (MT4). This is the most popular Forex app in the world for Forex charts and is used by hundreds of brokers around the world. Another popular Forex app is the DailyForex app which has free Forex Signals & News and is available on Android and iOS devices. How to start trading Forex in India?To start Forex trading in India, the first step is to compare Indian Forex brokers and choose the most suitable one for your trading needs. A big part of this process is to determine the best Forex trading platform in India that meets your exact requirements. Different Forex brokers will have different trading platforms. Once you have chosen your Indian Forex broker and the best Forex trading platform for your trading needs, you will need to open an account. As part of the account opening procedure, Indian Forex brokers will require you to show proof of identification and proof of address. Once the account is opened, the last step before placing trades is to make a deposit. Most Forex trading brokers in India will have a minimum deposit requirement to begin trading. Where can I trade Forex in India?You can trade Forex in India with any broker that accepts Indian residents. Officially, Indian regulations specify that you must use an onshore Indian Forex broker that conducts currency trading using the permitted seven currency market futures traded directly on Indian exchanges. However, may Indian Forex traders use international Forex brokers to access the best Forex trading opportunities so they can be profitable. Which Forex pairs are legal in India?Under "Forex trading in India RBI guidelines", seven currency market futures are allowed: USD/INR, EUR/INR, GBP/INR, JPY/INR, EUR/USD, GBP/USD, and USD/JPY. However, there are international Forex brokers that accept Indian residents as clients. These brokers have access to a much larger range of Forex pairs, often with better leverage and execution. Which broker is the best for Forex in India?FXTM, with its fast execution, very low minimum deposit, and high floating leverage, is currently the broker best for Forex in India. Back to top ⬆ |

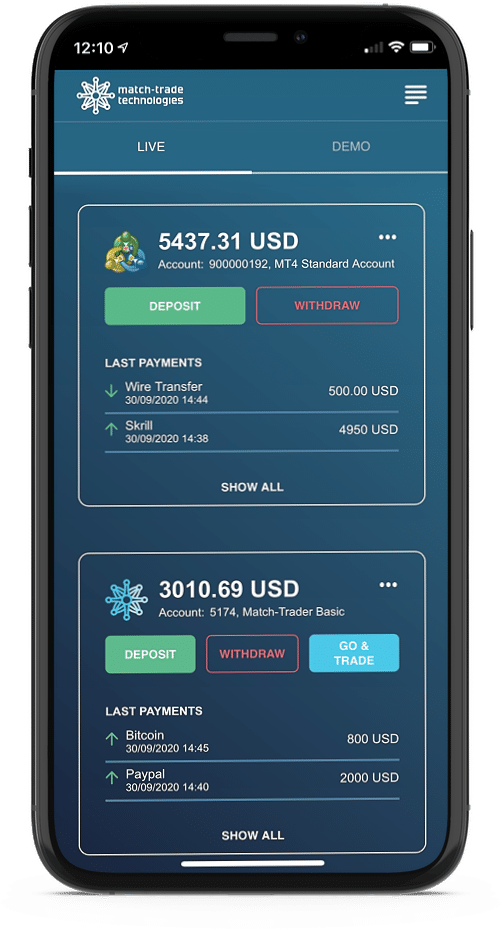

| Modern Client Office with CRM from Match-Trade Technologies - Finance Magnates Posted: 02 Dec 2020 02:24 AM PST  Match-Trade Technologies, the provider of turnkey solutions for Forex Brokers, has recently launched a new generation Forex Client Office app with CRM. The new application will increase the efficiency of brokerage business management thanks to the automation of all of the onboarding and payment processes. "The launch of our new Client Office (Trader Room) & CRM is closely related to the dynamic development of the Forex market that we observe during the coronavirus pandemic and increased interest in becoming a Forex Broker" – said the Chief Operating Officer at Match-Trade Technologies, Michał Karczewski. "Client Office with CRM is a must-have solution for every novice broker who wants to be able to compete in the Forex industry as investors require a convenient application to manage their trading accounts independently. At the same time, our CRM system has been designed to convert more leads into traders and track the key performance indicators (KPIs) of the Broker's business. Therefore, it allows Brokers to optimize many processes and thus reduce operating costs" – he adds. Match-Trade's team adapted the new Client Office to the most advanced business requirements of the clients. It is already integrated with most popular trading platforms: MT4, MT5, and Match-Trade's proprietary, trading platform Match-Trader; but thanks to the flexible API it is possible to expand the app and seamlessly integrate with third-party software. Convenient mobile app for traders and IBsThe new Client Office with Forex CRM includes a dedicated application for traders and IBs allowing them to manage the accounts (including IB commissions) independently. Traders can open demo and real accounts on their own directly from the app, transfer funds between trading accounts and making deposits and withdrawals. The app supports several languages as well as direct communication with the Broker's team via popular online communicators to provide more convenience for traders.

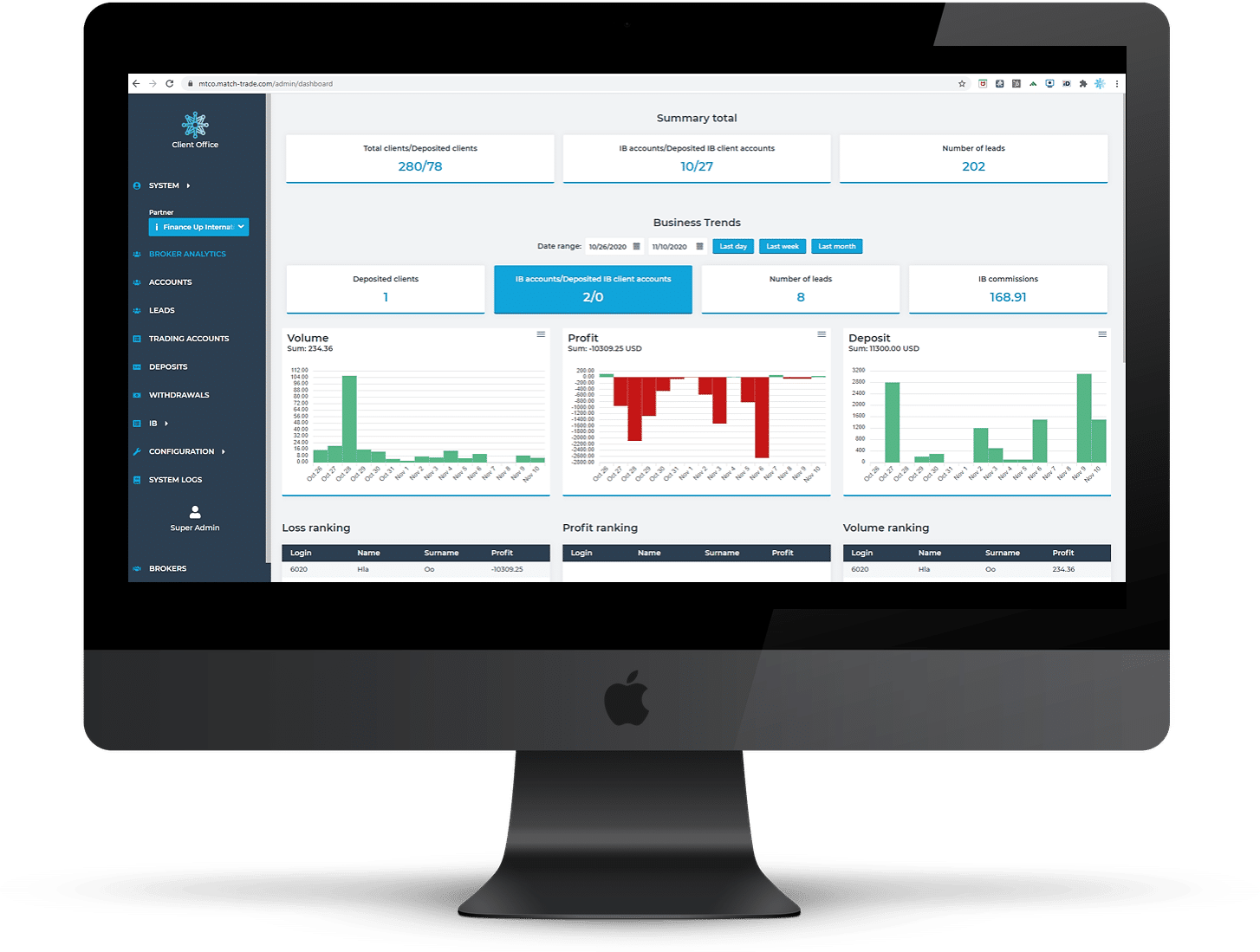

Each client can also install the Client Office app on his mobile as an app, on request we can also upload it to Apple and Android stores. A Broker in the CRM can also effectively measure and manage its leads. It is possible to assign leads to particular account managers, change statuses, leave notes or engage leads and investors by promoting special offers using built-in banner ad space or using mass mailing. Match-Trade's Client Office is integrated with major payment service providers and blockchain networks to guarantee hassle-free money transfers via credit card, wire transfer and more. This allows depositing funds directly from the trader's app without the need to add additional intermediaries by the Broker. CRM tailored to Brokers' needsThe Broker's application (CRM) enables staying up to date with all payments and withdrawal requests by sending e-mail notifications whenever a specific action occurs. The system also significantly speeds up the onboarding procedure. After registration, customers can upload relevant documents in the app for immediate review and verification. Moreover, the Broker decides to enable the KYC option, e.g. only for a particular payment method. Also, Broker can track the balances of all client's accounts, view all open positions, historical trades and ledgers on each trading account, all enclosed in a single app.

Business Intelligence – Broker's AnalyticsWhat is becoming an industry trend, the Client Office CRM provides embedded Analytics tool. Apart from tracking KPIs like the number of clients, the number of active accounts, net deposit value; there are also included statistics of net payout value, the number of IBs, profit per day and most profitable clients. The Business Intelligence feature enables the Broker to comprehensively analyze its cash flows, making it an essential tool to expand the business and increase profits. Trusted Partner for BrokersChris Dankowski, Chief Business Development Officer at Match-Trade Technologies, explains – "We have been cooperating with Brokers for many years now, and we are observing changes taking place in the industry. Strong competition makes it more difficult for new businesses to stay in the market. Therefore, we constantly invest in the development of the IT department and work on our own technologies to be able to offer our clients who want to become Forex Brokers modern solutions at an affordable price so that they can invest in building their brand and focus on customer acquisition. We have created our own Match-Trader trading platform, which is an all-in-one solution and already has a built-in modern Client Office module. Therefore we wanted to provide the same high-quality service to our MT4 / MT5 White Label clients, so we've created a completely new application for them".

For detailed information about Client Office with CRM visit match-trade.com Match-Trade Technologies is a company that has been providing its solutions to Forex brokers for many years and enjoys the great trust of clients. Over the last year, the company has grown significantly by establishing partnerships with companies such as Devexperts, Skale, Centroid Solutions and Takeprofit Tech, thus expanding the group of Brokers to whom it provides its services. Great market interest in advanced solutions developed in-house in cooperation with Match-Trade's Forex and IT experts resulted in the opening of another office in South Korea. All information about the latest implementations, technologies and services of the company can be found on its official website. Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates. |

| How to Select an Online Trading App in Kenya that is Right for You - Techweez Posted: 09 Nov 2020 12:00 AM PST Retail Online trading has been a growth industry around the world & in Kenya too for the past few years. The COVID-19 pandemic & the rise in market volatility caused by the events have caused huge spike in number of retail traders lured by thoughts of making quick money. Many brokers have reported record trading volumes & new customer signups during the first half of 2020.Some of the popular regulated brokers in Kenya have gained the trust of a significant number of traders. In the last few years, the number of brokers in Kenya has marginally increased on the web as well as on mobile for stock and forex trading. The popular trading apps in Kenya include FXPesa, Faida Investment Bank, SBG Securities, PepperStone, Scope Markets etc. The rise of Online trading platforms has allowed individuals easy access to the financial markets while working from home. However, this has also given rise to number of scam brokers too. So, choosing a right platform is really important for safe investing. Besides safety, traders must also have access to tools for market research, charting capabilities, live market feed, and news services. Good trading platforms often offer these services free to cost to their clients. If your broker doesn't offer a specific tool, you would probably need to find independent services on the Internet like TradingView, Reuters, Bloomberg, MarketWatch. But its best to find a platform that offers all the tools that you would need to make efficient trading decisions. You must ensure that the trading app you are choosing provides all the necessary tools and is also secure & trustworthy by keeping these below factors into consideration.

Every trader has a different perspective of trading online and seeks different outcomes through different strategies. If the trader is aware of the goals and objectives, choosing a suitable broker becomes an easy task. The choice of a broker can vary according to financial literacy, trading instrument, trading strategy, etc. But as a general rule, the broker that you choose should offer suitable tools and services that you need for your analysis, and easy access to your desired financial instruments. A day trader will be more interested in a broker that offers custom leverage, lower fees per trade if you trade higher volumes, charting tools for technical analysis, risk management tools like stop loss, negative balance protection, etc. Similarly, a long-term trader would seek a broker that offers multiple trading instruments, asset classes to diversify the portfolio and charges lesser non-trading fees. The selection of a broker must be done according to your personal trading requirements.

A broker that offers excellent service for stocks, futures, and options might not offer the same quality of service for forex and CFD and vice versa. Each broker has a specialization for different types of instruments and is popular among traders for specific services. Traders must choose a broker in accordance with the trading instrument you are looking to trade. If you want to diversify your portfolio then you might want a platform that has access to multiple markets. Research all the regulated brokers in Kenya, and check the instruments on their platform & markets, asset classes that they offer. Another point to note is that some brokers offer multiple types of accounts to suit the demands of different types of traders and investors. Some account types can have lower spread but the overall maintenance fees can make it costly for the traders who do not trade frequently. An insightful trader must select the broker that offers a convenient account type & the trading instrument that you want to trade at reasonable prices. Before selecting any platform, analyze all the pros & cons, and all the available features of the different account types, and compare it with other regulated platforms in the market.

It is very important to check the reputation and verified reviews of a broker by the experts and past clients before you deposit any funds with them. Most of the brokers in Kenya are new in the industry while some have been operating for more than a decade. Traders must check the background and history of the broker to ensure the safety of their invested money. Also check how the brokerage firm has performed and served the clients during bearish as well as bullish market trends in the past. Are there any bad reviews? If there are, then for what reasons? Regulation or License is a very important factor that must be considered by every trader before choosing a broker. Regulatory authorities keep an eye on the activities of a broker and safeguard the traders while offering them protection. Traders must ensure that the selected broker is regulated by regulatory authorities in Kenya & preferably across multiple jurisdictions. For example: Kenyan traders looking to trade in forex market must choose CMA regulated forex brokers, while for stock trading you should trade with a NSE licensed broker. There are currently only 3 brokers licensed by CMA for forex trading in Kenya which are FxPesa, Scope Markets & PepperStone Kenya, whereas there are 15 licensed NSE stock brokers. The insurance cover, segregated funds & support by a banking firm can be an added advantage for the safety of your funds.

For a smooth and efficient trading experience, a trader must ensure that the broker provides convenient and user-friendly trading platforms on all 3 devices i.e.: desktop (both PC & Mac), web & mobile (iPhone & Android). The availability of fast & feature-rich trading platform on the web and mobile can enhance the trading experience and allow trading anytime and anywhere. The management of your account, funds withdrawal, access to support should be easily available from inside their platform. The trading platform should also be secure & it is best if it includes 2 Factor authentication & multi user support. The layout and design of the trading platform should allow traders to quickly place new orders & close them without delays. The chosen trading platform should also provide regular updates through SMS, email etc. to notify the activities of the trading account.

Some brokers offer more advanced charting and analytical tools than others. Features including margin, leverage, stop loss, and details of trades executed in the past should be easily accessible. The availability of algorithmic trading tools like expert advisors (EAs) can also be useful. Traders must also check whether the broker provides real-time data of the capital markets along with the regular news and updates.

Each broker in Kenya charges different fees for different trading instruments. You must check & compare all the fees and commissions involved in the trades of each instrument. The fees and commission can greatly affect your profit and loss from a trade. But look at the overall fees, including spread, commission, maintenance charges, inactivity fees, withdrawal & deposit fees etc. Some brokers can charge very high non-trading fees like inactivity fees, maintenance fees, or any other fees that have to be paid without making trades. Brokers with high non-trading fees should be avoided. But remember that, lower fees should not be the only basis for the selection of a broker. Some of the new, unregulated, or unprofitable brokers might offer cheap services to gain clients and promote business.

Most of the new traders lose due to a lack of experience and knowledge of the risks. Demo account can be useful for beginners who seek to learn the basics, and can help you build your strategies for different market conditions before making actual trades. If the trading instrument involves high risk, it is always advisable to gain decent experience via virtual trades on a demo account. Most brokers offer demo account like FXPesa & Pepperstone. Beginner traders must choose a regulated broker that offers a demo account, which allows you to practice without the risk of losing any real money.

Unregulated brokers operating in Kenya would not be transparent with the traders about the methods of withdrawals and deposits and the charges associated with it. Deposits with such brokers would be easier than withdrawals. You must make the required effort to inquire about every information regarding withdrawals and deposits. And also check reviews whether other traders faced issues during withdrawals. If they did then for what reasons? Also, check the fees & limits for deposits & withdrawals. Some brokers might offer free of cost withdrawals and deposits while some charge variable fees for different withdrawal and deposit methods. The minimum limit for withdrawals and deposits should also be checked before selecting any broker. Be wise in choosing a Trading platform Due to a consistent rise in trading demand in Kenya, the number of brokers has also increased significantly in the last few years. The brokerage industry is getting highly competitive in Kenya & the costs are getting lower – this can be advantageous to the traders, but only if you are insightful and informed about the available options. You should check and compare features, fees, instruments available, and technical tools – and then choose the most convenient broker for your requirements. As a rule, only choose brokers that are reputed & licensed in Kenya for offering the instrument that you want to trade or invest in. Also, new traders must only trade with virtual money in a demo account before making actual trades, until you have a working strategy & experience. Assess your goals, objectives, and risk factors before investing in any trading instrument. If you are a beginner then it is better to seek advice of a licensed investment adviser before choosing any platform. |

| You are subscribed to email updates from "forex trading app" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The application has a modern design, is very simple and intuitive to use; any trader can easily handle it. It has also a special interface for mobile devices, giving high-quality experience for mobile users.

The application has a modern design, is very simple and intuitive to use; any trader can easily handle it. It has also a special interface for mobile devices, giving high-quality experience for mobile users.

Comments

Post a Comment