easyMarkets Signs Agreement with Real Madrid CF to Become Its Trading Partner - FinSMEs

easyMarkets Signs Agreement with Real Madrid CF to Become Its Trading Partner - FinSMEs |

- easyMarkets Signs Agreement with Real Madrid CF to Become Its Trading Partner - FinSMEs

- Forex trading in the digital era – guidelines for beginners - Eastern Eye

- What is MT4 and why is it the most important trading - FinancialNews.co.uk

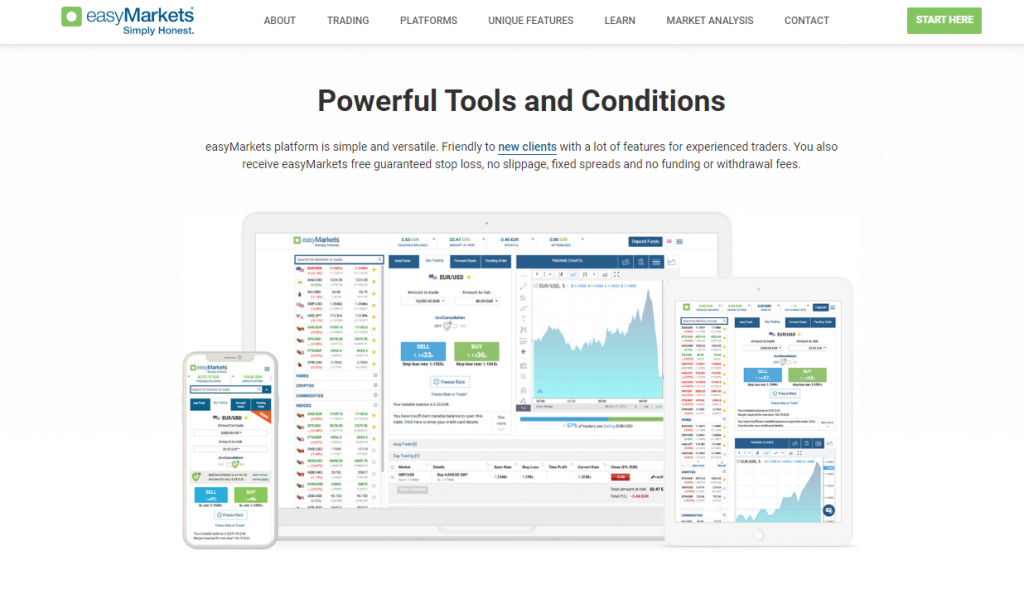

| easyMarkets Signs Agreement with Real Madrid CF to Become Its Trading Partner - FinSMEs Posted: 01 Sep 2020 09:57 AM PDT The CySEC and ASIC-regulated online trading provider easyMarkets has recently reached a sponsorship agreement with the 2020 La Liga champions Real Madrid CF. This means the broker who managed to democratize the retail trading industry will be the official global trading partner of the club for the next three years, opening up the road for a fruitful and mutually beneficial partnership. easyMarkets reached multiple milestones over the past few years With a history of more than 19 years, easyMarkets is one of the first companies to open up access to financial markets for retail traders. Since 2001 when it started its activity, the broker had gradually grown to become one of the major European brands, holding tens of different awards and benefiting from a huge flow of customers. Trading with easyMarkets means access to forex, commodities, indices, shares, and other instruments. Also, the company is providing access to Vanilla Options, helping traders hedge against volatility, or to gain long-term exposure on the markets.  They will benefit from multiple trading platforms (Web platform, MetaTrader 4, mobile apps, and Vanilla Options platforms) and other proprietary trading tools such as dealCancellation (enabling traders to undo losing trades for a specific period of time and in exchange for a small fee) or Freeze Rate (allowing traders to freeze the price to perform the trade). Since it managed to provide reliable trading services consistently, easyMarkets had grown into a solid financial services provider, being able to sign agreements with brands like Real Madrid, which are on the same line in terms of work ethic and philosophy. Real Madrid follows on the same path The agreement between easyMarkets and Real Madrid comes at the end of a successful La Liga season for the Spanish club. For the 34th time in its history, "Los Blancos" ended on the first spot after, winning the title one round before the championship ended. As Zinedine Zidane mentioned, it has been a really great season for the club, after a year without any trophy. Looking at the numbers, Real Madrid continues to be one of the best clubs in Europe, holding 13 European Cups, 7 FIFA Club World Cups, 4 European Super Cups, 2 UEFA Cups, 34 National Leagues, 19 Spanish Cups, and 11 Spanish Super Cups. It is a leader in the world of football, the same as easyMarkets is one of the leaders in the world of trading. Uniting the benefits of trading and football Bringing football and trading closer together means uniting two industries relying on the same values: discipline, transparency, simplicity, and a constant drive to achieve great results. Emilio Butragueño, Institutional Relations Director at Real Madrid, is looking forward to starting working with easyMarkets as Official Global Trading Partner with the 20/21 season. Both companies are looking forward to a great three-years partnership that can mutually benefit. Trading popularity can increase thanks to the solid brand of Real Madrid, while as a trading partner, easyMarkets can share its trusted services with one of the best European football clubs. |

| Forex trading in the digital era – guidelines for beginners - Eastern Eye Posted: 28 Aug 2020 05:22 PM PDT autotrading systems developed for the MetaTrader 4 https://fx-list.com/automated-systems The digital age has brought us the Internet, which offers access to limitless online resources. In the given environment, the foreign exchange, also known as the forex market, has gained ground and became the largest financial market worldwide. At present, it exceeds in size even the stock market, registering daily a volume of $5.1 trillion. The forex market is unique in the financial world, and its unparalleled attributes may surprise a new trader. This article provides information for beginner investors and introduces them to a world that can boost their income if they invest time and effort into discovering its paths. But before diving into complex information, do you know what forex is? A specific exchange rate is paid when you exchange a currency for another. This particular exchange process drives foreign exchange. At present, there are over 100 official currencies people use worldwide, but most international trades are using Euro, US Dollar, British Pound and Japanese Yen. Other popular currencies are New Zealand Dollar, Canadian Dollar, Swiss Franc and Australian Dollar. You can trade currencies through option contracts, swaps, forwards or spot transactions. The journey to earn money by trading currencies involves research, patience, and practice. Luckily, for new traders, the digital age has also brought forex automated strategies and trading platforms that allow them to revolutionise their operations and grow their income. Let's find more about automated trading.  Apply a forex automated strategy Is automated forex trading different than traditional currency exchange? The word automated highlights the difference because it points out that the process implies a minimum human influence. The software prevents the trader from allowing their emotions to influence their decisions. At its base, automated trading is a method that will enable investors to use a program to analyse various conditions and determine if an action is profitable at a given time. When using a PC program to trade foreign currencies, you can advance the software by teaching it to make decisions based on a set of signals you introduce, and the technical analysis charting tools provide. How to choose an automated forex strategy Before diving into guidelines, it's best to highlight that automated trading systems and algorithmic trading strategies are one and the same. Four factors should influence your decision when you look for an automated forex strategy the description, entry-exit-signals, application and leverage. Description – when approaching an automated forex strategy, check its description. Find out what the strategy stands for and try to figure out if the logic behind it is plausible. Scan for terms like risk, breakout, trend, rage, profit target, stop-loss, and momentum. Before picking an automated trading strategy, determine if it fits the market conditions. Most strategies are created to perform in specific environments, and it's almost impossible for a beginner to make them work in other conditions. Entry and exit signals – the automated trading strategy is an inception for hundreds of trades you'll complete. At this point, the outcome of a collection of trades interests you. During the selection stage, place both winning and losing trades in the same category to figure out what the average winner and average loser are. Pick the strategies that improve your average winners. Application – when you evaluate the market conditions properly, you can identify the strategies that conform to requirements. There are two main conditions you should pay attention to. When the market is in trend, the prices are steadily and progressing. But there are also instances when the market isn't progressing. You need to decide what condition you prefer and locate the market when the scenario hits. Leverage – often, traders apply too much leverage to their trades and ignore the potential losses the strategy may trigger. To place profitable trades, it's best to apply no more than ten times effective leverage. At the start, use leverage at five times the amount you invest. Forex automated strategies are more suitable to seasoned investors, but even beginners can use them when they research and act cautiously. They must know what they want, what they expect, and don't mislead themselves by grounding their trades on their emotions. Find a trading platform that encourages automated trading strategies Set aside plenty of time to vet different forex trading platforms and go through their reviews. You'll probably find out that most people use MetaTrader 4 because it's the most popular trading platform due to its user-friendly features and ease of use. MetaQuotes Software company launched MetaTrader in 2005. The provider licenses software to forex brokers who act as middlemen for traders, offering access to MetaTrader 4 when they open a new account. Investors use the platform to check live prices, use pending orders, or buy and sell. To make trades and generate profit 24/7, they use autotrading systems developed for the MetaTrader 4 because it allows them to complete orders faster than if they would use manual trading methods. Traders also prefer algorithmic trading because they can backtest it in the long run and across various currency pairs. To access the MT4 platform traders must install it on their mobile devices or computers before they can gain access to indicators and charts. Once they download and install MT4.exe, they need to fill the account details, and if they choose, they can try the demo trading first. If you don't like the MetaTrader 4 platform, and you want to look for alternatives, focus on five factors.

|

| What is MT4 and why is it the most important trading - FinancialNews.co.uk Posted: 18 Aug 2020 01:38 AM PDT  MetaTrader 4, commonly known as MT4, is the most important electronic trading platform as of today. MT4 is very popular among online retail foreign exchange traders due to its convenience, versatility, reliability, and customization possibilities. Created in 2005 by MetaQuotes Software, it has gained popularity thanks to its intuitive features and client and server components, which make communication faster and more efficient. Today, MT4 is the most widely used trading platform in the world, with more than 14 satisfied million users. This standalone platform is designed to help users automate their trading. MT4 offers the possibility to use their set algorithms or create them from scratch, designing a personalized trading strategy that will run constantly, increasing the trader's opportunities. Even though it's commonly connected with Forex trading, it can also be used to trade other markets. But why has MT4 consolidated itself as the most important trading platform in the world? Here we will discuss the aspects that make this Forex trading platform unique and popular. Why is MT4 the most important trading platform?There are quite a few reasons that have made MT4 so popular and widely used. First of all, the platform is very easy to use. MetaQuotes has succeeded in creating intuitive tools that can be used by experienced traders as well as new ones. MT4 offers a lot of useful information easily available to users that can easily access charts, indicators, and prices while avoiding overwhelming users with complexities. MT4 has been tested over and over again to assure its reliable operation. In trading, this aspect is fundamental since a second delay could cost a wealthy profit. It's even possible to set up the platform with slow internet connections and older devices, adapting its performance to be reliable 100% of the time. A very interesting and attractive aspect of MT4 is that allows the user to automatize their trading. By introducing EAs (expert advisors), MetaQuotes allows traders to multiply their opportunities in the Forex market, which works 24 hours a day, or continue trading while doing something else at work or at home. EAs is a powerful tool that has increased MT4 popularity and made it an indispensable tool among traders. It is possible to use a given algorithm, or even create a personal strategy for automatic trading. Another further interesting aspect of MT4 is that it can be used simultaneously from different devices. It works well with Windows, Apple, and Android among their different computers and phones, making it possible for a user to trade from anywhere at any time. A smart solution to help traders to never miss an opportunity. Using different devices is easy since the user can log in in all of them with the same account, having live information when required. The platform also uses very little resources from your computer or telephone, having a fast reaction, and being more reliable. Many users worry about security online, and the platform has proven to be very safe, which is an aspect not to ignore in these times when hacking and computer fraud are common. Where to get MT4?Downloading and installing the platform is rather easy. An MT4 broker or an FX dealer will be able to provide you with access to the platform through them. This is easy if you already have a broker or have one in mind. If this is not your case, however, the MT4 platform can be downloaded from their website for free to try a demo account, though it may be their latest version of the trading platform, called MT5. Related Articles |

| You are subscribed to email updates from "metatrader 4" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment