IC Markets Review 2020 - Public Finance International

IC Markets Review 2020 - Public Finance International |

| IC Markets Review 2020 - Public Finance International Posted: 27 Jul 2020 04:37 AM PDT IC Markets is a forex and CFD online trading platform that was founded in 2007. IC Markets is an online broker is regulated by the FSA (Seychelles Financial Supervisory Authority), CYSEC (Cyprus Securities and Exchange Commission) and AFSL (Australian Financial Services Licence). Review SummaryIC Markets forex trading fees are low. Account opening, depositing and withdrawals are free, easy and fast. IC Markets currently doesn't provide negative balance protection. The product portfolio offered by IC Markets includes: FX, stock CFDs, cryptocurrencies, bonds CFDs, commodities and indices. IC Markets offers CFD products covering a decent range of financial assets including forex pairs, stocks, indexes, and commodities, and it is considered a safe broker as it is regulated by top-tier financial agencies around the world including the Australian Securities and Investments Commission (ASIC). The following is a list of the subsidiaries that IC Markets uses to operate in the various markets it offers its brokerage services to:

Why should you read this review?There's a large number of CFD trading platforms out there that you probably don't have the time to screen out and review individually. You probably want to concentrate your efforts in what you do best, which is trading, and that is the main reason why you should give this review a look, as we summarize the most important details you need to know about this broker and the way they work. This guide will simplify the task of comparing between the different brokers available for your country of residence and we will cover most – if not all – of the important variables you should look out for including the number of CFD products available, the trading platform's interface and features, the quality of IC Markets' customer service, and the cost of trading with this broker. This is a more detailed list of all the elements will we be addressing in this review:

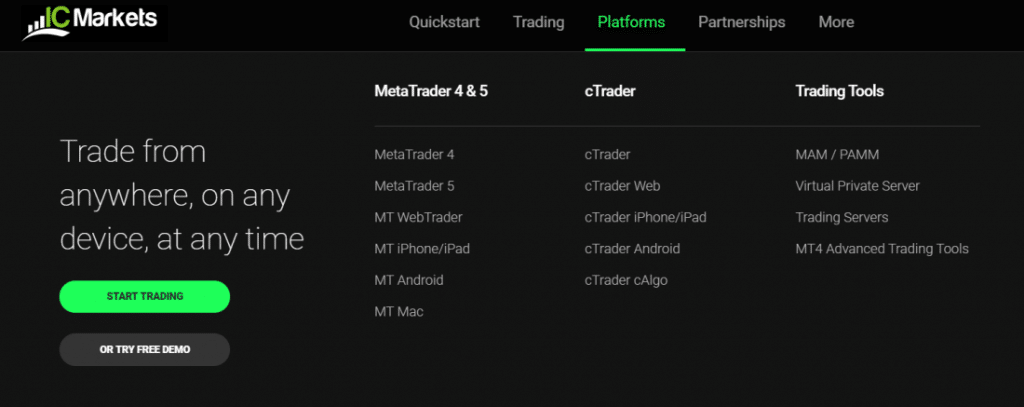

What's the best about IC Markets?IC Markets is generally seen as a good choice for forex traders who rely on algorithms and other advanced techniques to conduct their trades due to the advanced features offered by this broker. The fact that IC Markets offer potential 0 pip trades is a great advantage for high-frequency traders and day-traders while the availability of third-party platforms such as Meta Trader 4, Meta Trader 5, and cTrader also makes this broker a nice alternative for more experienced traders. Finally, even though the portfolio of CFDs offered by IC Markets is fairly limited compared to its competitors, it should suffice the scope of most traders, especially for forex pairs, indexes, and cryptocurrencies. IC Markets Trading Platform IC Markets is an online trading platform. This broker offers hundreds of Contracts for Difference (CFD) to customers in Australia, Europe, and Asia, among other locations. IC Markets provide a robust platform that supports advanced trading tools such as MetaTrader 4, Meta Trader 5, and cTrader, via web, desktop, and mobile interfaces based on MT4.

While IC Markets specializes in forex CFDs, this broker also offers CFDs that cover a selection of stocks, stock indexes, bonds, and commodities, making it an interesting choice for experienced traders seeking to take advantage of its robust trading systems while also having a wide range of financial assets to trade with. IC Markets does not offer a proprietary trading platform. Instead, this broker provides Meta Trader as the default platform, which is a third-party platform. This is a significant downside for amateur traders who may not be accustomed to using advanced trading interfaces and definitely a competitive disadvantage compared to other forex brokers. The most popular version of Meta Trader used by traders is MT4, even though MT5 and cTrader are also supported. MT4 comes in more 34 different languages and provides significant possibilities in terms of customization and reporting, even though it has various downsides as well. Here's a more detailed overview of the platform's features. WebTrader The web-version of IC Markets trading platform is a bit rough around the edges and lacks a modern design and the intuitiveness commonly seen in today's top-notch trading interfaces. However, the interface can be customized to a high degree. The search function is one of those characteristics that lacks modernity, as the platform offers a drop-down list rather than an intuitive search box. Additionally, no alerts or notifications can be set on the web version and the two-step login feature is not available either. Desktop platformThe desktop version of Meta Trader 4 is fairly similar to the web version, which means that it lacks in design and user-friendliness. However, a few features are different, including the fact that you can set alerts and notifications sent via mobile push or e-mail. Mobile Trading App The mobile trading platform of IC Markets is also supported by Meta Trader 4, but it is significantly better looking than the web version. The app is available for both Android and iOS devices and comes in many languages as well. The mobile app is very user-friendly and has a more modern look than the other versions, while it lacks extra security features such as the two-step login option. Additionally, no face ID or fingerprint ID are available. Search functions in the mobile trading app are much more intuitive and alerts and notifications can be set but only through the desktop version, which is a bit inconvenient. Order TypesIC Markets' trading platform only allows for three different trade order types:

Is IC Markets Safe?IC Markets is considered a safe broker to trade CFDs with, as the company and its subsidiaries are regulated by one top-tier jurisdiction – the Australian Securities and Investments Commission (ASIC) – and other regulators including the Cyprus Securities and Exchange Commission (CYSEC) and the Seychelles Financial Supervisory Authority (FSA). Also, IC Markets has been in business since 2007, which gives this broker a sufficient track record to qualify as a safe alternative for traders. InsuranceIC Markets (AU) – Professional Indemnity Insurance with Lloyd's of London. IC Markets (SC) – Professional Indemnity Insurance with H Savy Insurance Co Ltd in Seychelles Segregation of fundsClients money is held separately to company funds at AA rated Australian banks. Banking RelationshipsIC Markets works with NAB (National Australia Bank) and Westpac (Westpac Banking Corporation) – two top-ties Australian Banks. On the downside, IC Markets does not provide negative balance protection. How to Open an Account with IC Markets? Opening an account with IC Markets is very easy and it only takes a few minutes. The registration process can be done online and IC Markets services are available in most countries except those that have been sanctioned by the OFAC. Additionally, clients from the United States, Canada, and Israel can't trade with this broker. Minimum DepositsThe minimum deposit required to open an account with IC Markets is $200, which is on the low end compared to other advanced forex brokers, while the fees and features available for each trader vary depending on the type of account selected. IC Markets does not charge a deposit fee for any of its funding methods. Traders can deposit money via credit or debit cards, electronic wallets, or bank transfer. Bank transfers can take a few days to be cleared while payments made via credit or debit card are credited instantly. Deposits can only be made from accounts and cards that are in your name. Account Types There are three types of accounts traders can choose from:

Each account is entitled to a leverage ratio of 500:1 and raw spread accounts generate a commission of $3 (cTrader) and $3.5 (Meta Trader) per lot, while the standard account does not generate commission fees. Finally, all the accounts are allowed to trade with all of the products offered by IC Markets and micro lot trading is permitted for the three accounts as well. There are 10 base currencies available for each of the accounts offered by IC Markets including EUR, USD, GBP, AUD, CHF, JPY, NZD, SGD, CAD, and HKD. This is an advantage compared to other forex brokers as it allows traders to save money on conversion fees. Range of MarketsIn summary, there are 232 tradable CFD instruments offered by this broker including:

The cryptocurrencies offered by this broker include Bitcoin, Bitcoin Cash, Ethereum, Dash, Litecoin, Ripple, EOS, Emercoin, NameCoin, and PeerCoin. As for commodities, traders have access to a limited selection of precious metals, soft commodities, and energy commodities including WTI Crude Oil, Brent, and Natural Gas. The stock indexes covered by this broker's CFDs include the S&P 500, the Dow Jones Industrial Average, the FTSE 100, and the Australian S&P 200. Finally, the selection of forex pairs offered by IC Markets includes the most popular pairs such as the EUR/USD, GBPY/USD, and USD/JPY, along with certain exotic pairs such as the GBP/TRY and the CHF/SGD.

Trading FeesIC Markets charges both commission fees and trading fees depending on the account chosen by the trader. Raw spread accounts charge a commission fee, even though the spreads are lower, while the standard account doesn't charge commission fees but the spreads are higher. Overall, IC Markets trading fees are on the low end of the industry, even though its financing fees are reportedly on the high end. The commission fee for cTrader raw spread accounts are $3 per each $100,000, while the commission fees for Meta Trader raw spread accounts are $3.5 per lot per side. As a reference, the spread charged for EURUSD is between 0 and 1 pip for raw spread accounts and 1.1 for standard accounts. As for commodities, WTI crude oil futures pay an average spread of 0.050 while the average spread of coffee futures is 0.900. For cryptocurrencies, the average spread is 10 for the BTCUSD pair and 4.5 for the ETHUSD pair. Finally, for stock indexes, the S&P 500 index pays an average spread of 0.600 while the European STOXX50 index pays an average spread of 1.850 pips. A list of the spreads charged for each CFD is available on IC Markets website. Finally, this broker does not charge inactivity fees. Research ToolsIC Markets offer the research tools available within the Meta Trader 4 and 5 platforms. They also have a section where analysis is posted, called the WebTV. The tools available include trading ideas based on technical indicators and a news feed featuring top-notch news outlets. Additionally, the MT4 and MT5 platforms feature a set of 31 technical indicators. EducationA demo account is available for traders who may want to test the trading platform before depositing money and there are also platform tutorial videos available for those starting out with Meta Trader or cTrader. Additionally, IC Markets also provides educational videos and articles to learn more about trading, and they also host webinars periodically. Customer ServiceIC Markets offers 24/7 phone support, live chat, and e-mail support. Phone support has been qualified as very good by most traders, as you can connect with a customer service representative quickly. However, the live chat feature seems to be inactive most of the time and the average wait time is too long. Finally, e-mail support is also decent, with most e-mails answered within 24 hours. WithdrawalsTraders can withdraw money without incurring an extra fee as long as the funding method is a credit card, debit card, e-wallet, or an Australian bank account. Meanwhile, bank transfers made to international banks generate an AUD$ 20 fee. Bank transfers are typically received within 2 business days. Summary

|

| You are subscribed to email updates from "metatrader 4" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment