Trade Forex or Invest in Regular Stocks? Which is Better? - Yahoo Finance

Trade Forex or Invest in Regular Stocks? Which is Better? - Yahoo Finance |

- Trade Forex or Invest in Regular Stocks? Which is Better? - Yahoo Finance

- Forex Forecast: Pairs in Focus - DailyForex.com

- After Confusion, IRS Clarifies Tax Treatment Of Fortnite & Gaming Currencies - Forbes

| Trade Forex or Invest in Regular Stocks? Which is Better? - Yahoo Finance Posted: 20 Jan 2020 12:00 AM PST HOUSTON, TX / ACCESSWIRE / January 20, 2020 / Both forex trading and stock trading provides investors with a diversity of investment opportunities, each with its own features, perks, and risk levels. Though they both deal with buying and selling, their major difference can be drawn from the kind of commodities they trade-forex trades foreign currencies over the counter (OTC) while stock trading is focused on trading company shares on a central exchange.  View photos What is the Forex Market? "The forex market is the market in which participants can buy, sell, exchange, and speculate on currencies…the currency market is considered to be the largest financial market with over $5 trillion in daily transactions, which is more than the futures and equity markets combined." What Is The Stock Market? "The stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place." Trading Forex Vs Trading Stocks Trading Platform: In stock trading, investors or traders require a central exchange like the New York Stock Exchange (NYSE) to trade. These central exchanges provide stock traders and investors access to order-books that have records of all stock purchases and sales. With a record of all the buying and selling, traders/investors are able to analyze similar patterns that occurred on the exchange in the past and recent times. Stock traders and investors study past buying and selling patterns for different reasons one of which is tracking the exchange activity to know the best time to buy or sell a stock. While for forex trading, currencies are traded over the counter (OTC)-meaning that there is no central exchange that regulates forex as all transactions are privately done between buyer and seller. Trading Time: Another major difference between forex and stock trading can be seen in market trading hours. Since forex has no central exchange and it spans across different time frames, it is open 24 hours. Meaning that traders can trade currencies around the clock at all forex trading sessions. The major trading sessions are New York, London, Sydney, and Tokyo sessions. Note that the forex market is only open for trading during working days and closed for trading on weekends. On the flip side, the stock market is only open for trading on central exchanges from 8 am to 5 pm daily (the time is subject to the exchange geographical location). Once the market closes by 5 pm all pending trades can only be made when the market opens the next day by 8 am. For some traders, the stock market timing stands as a major limitation. Trading Pattern: In forex trading, currencies always quoted in pairs (e.g. USD/GBP or EUR/USD). Each currency quoted in a pair is dependent on the other. So, a forex trader is not only concerned about the financial status in the country of the currency that is being traded but also the financial situation of the country that is being traded against. Whereas, in stock trading, the trader is only concerned with the happenings surrounding the company he owns shares in. That is, if a trader owns Apple shares, he is only concerned with financial occurrences and other occurrences that happen around Apple. Whatever happens in other companies is absolutely none of his business, unless for other interests. Forex trading pairing nature requires that the trader be consciously aware of the economic standing of both countries before trading their currencies. A downside for the forex market is that it is prone to political and economic influence, unlike the stock market which is hardly affected by any socio-political and economic issues that may arise in a country. Minimum Capital Required: For most investors, forex is a more preferable way to enter into the financial market due to the lower capital required to enter the market. Unlike trading stocks which require more capital to get started. Through leverage, forex allows small speculators or traders to enlarge their controlling units when trading. This can be both beneficial and unprofitable for these speculators. Forex trading amounts can go as low as $500, but such an amount wouldn't yield much profit compared to a forex trader who trades $5,000 daily. Compared to stocks, the minimum trading amount would be on the high side, especially if the investor desires high returns. Leverage: The leverage in stock trading and forex trading greatly differ, and most traders prefer forex overstock for this reason. "Leverage allows the trader to buy more currencies with less cash, and when the currency's value increases the trader gains more return." In stock trading, traders are allowed a maximum of 2:1 leverage, that is, being able to make trades only twice above their current account balance. While in forex, some brokerage firms allow traders leverage of up to 50:1-allowing them to make trades up to fifty times above their account balance. 50:1 is the highest leverage in America, other countries can go as high as 400:1 leverage. High leverages may seem like a great opportunity provided to the trader, however, it also holds high tendencies of incurring losses. Leverage has the ability to increase your profits and losses, it all depends on how you place your bet. Insider Trading: Insider trading is an act that is greatly prohibited because it gives certain investors and traders an advantage over the rest of what's supposed to be a fair market. However, the issue of insider trading is one that is still ongoing as a large number of public listed companies give room for insider trading. The category of stock traders who take advantage of insider trading work hand-in-hand with stock market insiders who have firsthand information about a company's financial position, ongoing plans for a new product line, or any other important information required to make a successful stock trade or investment. The case is not so in forex trading, though the forex market is the largest financial market, it cannot be manipulated to support insider trading because there is no central exchange and the currencies are particular to each country. If peradventure, a case of insider trading almost arises in forex trading, the liquidity and size of the forex market are able to cover any trading pressure that may come from insider trading. Commissions and transaction costs: Forex is considered as one of the easily accessible financial markets because of its low commissions and transaction costs. Some forex brokers run commission-free services but get their fees off the bid-ask spread. While other brokers charge upfront commissions. In the stock market, some brokers may decide to generally charge low commissions and transaction fees while others may charge according to the type of investment made and the risk level. Tradable Instruments: When it comes to the number of available tradable instruments, the stock market beats the forex market. The stock market gives traders and investors a wide variety of investment options-the New York Stock Exchange alone has about 2,000 listed stocks whereas the foreign market provides its traders with a variety of only eight major currencies. The major currencies include the US dollar (USD), Euro (EUR), British Pound (GBP), Canadian dollar (CAD), Swiss Franc (CHF), New Zealand dollar (NZD), and the Japanese yen (JPY). The major currencies form the major pairs which make up about 72% of the forex volume. The overall number of forex pairs are nothing compared to a number of accessible investments that can be made in the stock market. On the contrary, the stock market may have the advantage of providing investors with multiple investment options, however, it is quite easier to control fewer currencies or shares compared to controlling a large base. It would then be preferable for stock traders to channel their focus on the shares of a particular industry for better monitoring and control, rather than having multiple shares from various industries. Presence of Middlemen: Since forex, trades are done over the counter, and transactions made directly between the buyer and the seller, there'd be no room for a middleman. Unlike stock trading which requires the services of a middleman which is a stockbroker. Stock traders or investors can only access the stock market through their brokers which serve as an intermediary in processing all transactions by routing or "buying and selling orders to match the best possible prices on the market." Pros & Cons of Forex Trading Pros

Cons

Pros & Cons of Stock Market Pros

Cons

Conclusion Contact Details SOURCE: Investingport View source version on accesswire.com:  View photos |

| Forex Forecast: Pairs in Focus - DailyForex.com Posted: 15 Feb 2020 10:00 PM PST The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets. Big Picture 16th February 2020In my previous piece last week, I forecasted that the best trades were likely to be short of both EUR/USD and AUD/USD. Over the week, EUR/USD fell by 1.07% while the AUD/USD currency pair rose by 0.51%, so overall these were winning trades with an averaged win of 0.23%. Last week's Forex market saw the strongest rise in the relative value of the British Pound, and the strongest fall in the relative value of the Euro. Fundamental Analysis & Market SentimentFundamental Analysts are now tending to see less chance of a U.S. rate cut after recent releases of stronger than expected economic data which surprised the market, sending the U.S. Dollar higher almost everywhere. The non-farm payrolls employment change came in very strong at 225 thousand new jobs when only 163 thousand had been expected. However, the past week saw all U.S. numbers arrive more or less as expected. The Euro saw weaker sentiment as the British government, having secured Brexit, is now in a much stronger negotiating position with the E.U. and made it clear that it is prepared to walk away at the end of the 2020 transition year without a trade deal. Despite weak British GDP growth, sentiment on the Pound is a little more bullish than it had been. The Chinese coronavirus outbreak may have stabilized, with new data just released suggesting that the outbreak has peaked. Stock markets broadly rose last week, especially the U.S. and German markets which both hit new all-time high prices. Advertisement Great trade opportunities are waiting - don't wait to profit from this pair! TRADE NOWTechnical AnalysisU.S. Dollar IndexThe weekly price chart below shows last week printed a small and slightly bearish candlestick. However, the bearish retracement represented by this candlestick was small, and the support level at 12361 has continued to hold, which are bullish signs. The long-term trends are now more bullish, with the price only just below its level from 6 months ago and clearly above its level from 3 months ago, which indicates a weak but basically bullish trend. Therefore, there is technical evidence that we are likely to see a further upwards move in the U.S. Dollar Index next week. EUR/USDThe EUR/USD currency pair just made its lowest weekly close in nearly three years. The weekly candlestick was large and closed right on its low, which are bearish signs. There is a slow but strengthening convincing long-term bearish trend and the price looks likely to fall further over the coming week. S&P 500 IndexThe S&P 50 Index just made its highest ever weekly close, hitting a new all-time high price. The weekly candlestick was bullish and of a reasonably strong size, and also closed very near to the top of its price range, all of which are bullish signs. ConclusionThis week I forecast the best trades are likely to be short of EUR/USD and long of the S&P 500 Index. |

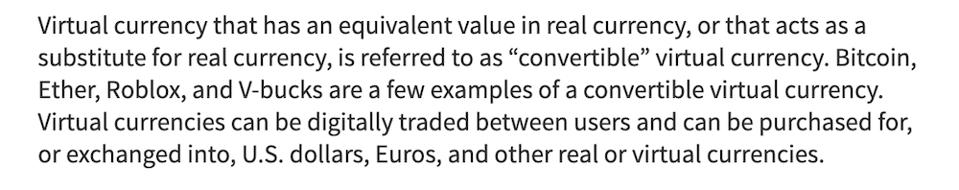

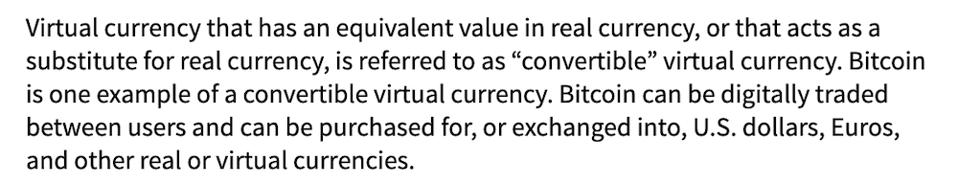

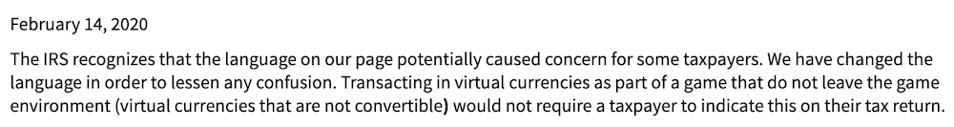

| After Confusion, IRS Clarifies Tax Treatment Of Fortnite & Gaming Currencies - Forbes Posted: 15 Feb 2020 11:09 AM PST  A gamer plays the video game 'fortnite' developed by Epic Games on a laptop from the Razer company ... [+] Getty ImagesGamers (and their parents) can finally breathe a sigh of relief: Fortnite virtual currency is not taxable. If you've seen headlines suggesting that it is taxable - and then contrary headlines saying that it is not - here's what happened. In October of 2019, the following language was spotted on the Internal Revenue Service (IRS) website (archived link from the Wayback Machine):  Wayback/KPE It read: Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as "convertible" virtual currency. Bitcoin, Ether, Roblox, and V-bucks are a few examples of a convertible virtual currency. Virtual currencies can be digitally traded between users and can be purchased for, or exchanged into, US dollars, Euros, and other real or virtual currencies. The IRS has been increasing awareness on virtual currency and, in recent months, emphasized that taxpayers may have reporting requirements when buying, selling, trading, or otherwise dealing in cryptocurrencies like Bitcoin. The IRS is so serious about it that a question about cryptocurrency now appears on your federal income tax return. But Roblox and V-bucks? Roblox is the name of an online game where users can buy upgrades for avatars or special abilities in games using proprietary Robux. V-bucks are a similar in-game currency for the popular game, Fortnite. As with Robux, V-bucks can be used "to purchase things like outfits, pickaxes, wraps, emotes and Battle Passes." Tax pros began murmuring within the tax community about the language, with most suggesting that the IRS interpretation was wrong. Last week, the IRS quietly modified the paragraph:  IRS/KPE It now reads: Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as "convertible" virtual currency. Bitcoin is one example of a convertible virtual currency. Bitcoin can be digitally traded between users and can be purchased for, or exchanged into, US dollars, Euros, and other real or virtual currencies. There's no mention of virtual game currency in the new language. The IRS later confirmed that including the original wording had caused confusion and that it had removed the language. It further clarified the treatment of in-game currencies in the following statement on its website:  IRS/KPE It reads: The IRS recognizes that the language on our page potentially caused concern for some taxpayers. We have changed the language in order to lessen any confusion. Transacting in virtual currencies as part of a game that do not leave the game environment (virtual currencies that are not convertible) would not require a taxpayer to indicate this on their tax return. Still confused? A little history and some definitions might help. In 2014, the Internal Revenue Service (IRS) issued guidance to taxpayers (downloads as a PDF), making it clear that virtual currency like Bitcoin will be treated as capital assets, provided they are convertible into cash. In simple terms, this means that capital gains rules apply to gains or losses. In-game currencies like V-bucks, however, are generally considered "closed" or non-convertible currencies. Closed currencies are those not available outside of specific areas. They commonly discussed in terms of foreign currencies - like those in Cuba. Cuba has two official currencies: the Cuban convertible peso (CUC) and the Cuban peso (CUP), and neither are available outside of Cuba. The same basic principles apply to in-game currencies. While you can typically buy them with US dollars, you usually can't freely use or exchange them outside of the game, making them non-convertible. The IRS guidance for virtual and cryptocurrency - so far - only applies to convertible currencies. While this feels like a new struggle, taxpayers have been seeking guidance on alternate currencies, including virtual currencies, for years. More than a decade ago, there was chatter about whether to include Linden dollars from Second Life in taxable income (I took the site for a test drive to find out what the fuss was about). And a half-dozen years ago, an alternative currency debuted in Philadelphia as one of many experimental local currencies. The IRS will, no doubt, continue to issue guidance - and occasionally falter - as the ways that we continue to think about currency and value changes. For now, the rule is this: if a virtual currency, including digital currency and cryptocurrency, is convertible, meaning that it has an equivalent value in real currency or acts as a substitute for real money, then it is treated as a capital asset. That means that it may be reportable and taxable. For more information, check out the IRS FAQ and this article. |

| You are subscribed to email updates from "currency trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment