Near-Term Euro To Dollar Exchange Rate Forecast: 9 Reasons For EUR/USD's Decline - Where Next In 2020? - Exchange Rates UK

Near-Term Euro To Dollar Exchange Rate Forecast: 9 Reasons For EUR/USD's Decline - Where Next In 2020? - Exchange Rates UK |

| Posted: 14 Feb 2020 11:45 PM PST  The euro-dollar exchange rate has slumped to its lowest level against the US dollar in thirty-three months (since the middle of 2017), largely owing to "downside concerns for Eurozone growth." "Germany and the region as a whole narrowly avoided a Q4 fall in GDP but activity seemingly stalled in December" say currency analysts at Lloyds on Friday, February 14. "As January business surveys pointed to only a modest improvement, the coming week's February IFO survey (Tue) and Eurozone PMIs (Fri) will be watched for signs of an uptick. However, we think that modest declines in both the manufacturing and services PMIs are more likely." "Everyone wants to know how much further the euro can fall" says FX analyst Kathy Lien on Thursday, February 14. "Not only has it been in a downtrend since the beginning of the month, but it lost value 8 out of the last 9 trading days and on the one day that it rallied, the increase was modest at best." Why has the euro to US dollar exchange rate fallen so low and how far can the euro fall from here? EUR/USD slide to 33-months low risks President Trump retaliationEuro exchange rate sentiment will remain negative in the short term given persistent growth concerns and appetite for carry trades funded through the currency. If short positions become over-extended, there will be the risk of a sharp corrective reversal and aggressive US rhetoric, but an improved Euro-zone outlook will be needed to secure a sustained recovery. Euro under sustained pressure The Euro x-rates have come under sustained pressure during February 2020 with significant losses against major currencies and losses have accelerated over the past few days. EUR/USD dipped below 2019 lows of 1.0880 which triggered further selling pressure to the weakest level since May 2017 at 1.0835. The Euro has also lost ground on all the major crosses with EUR/GBP declining to 8-week lows near 0.8300 and GBP/EUR breaking above the key 1.2000 level. EUR/CHF has declined to 4-year lows near 1.06 with EUR/JPY below 120.00.

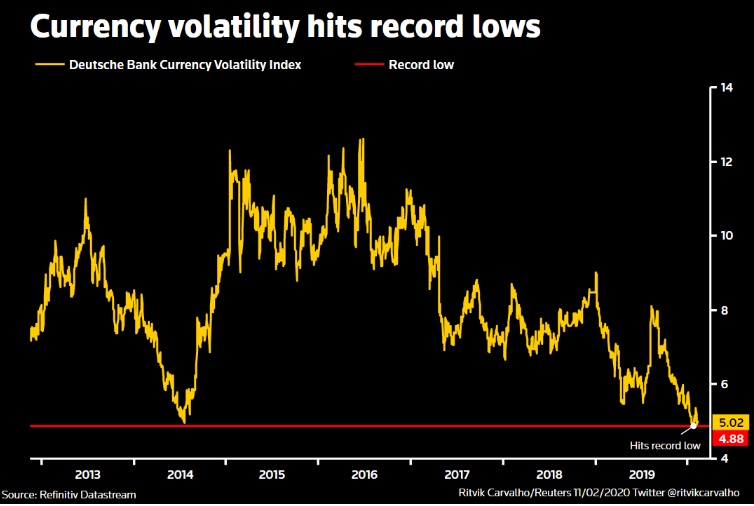

Image: Euro to Dollar exchange rate chart Here are 9 reasons behind this decline ECB will maintain zero interest ratesThe ECB main refi rate was cut to 0.0% in March 2016 and has, therefore, now been held at this level for close to four years making it impossible to justify it as a temporary move. In September 2019, the central bank cut the deposit rate further to -0.50% from -0.40% and also re-introduced the quantitative easing programme with the bank buying EUR20bn of government bonds every month. In the latest forward guidance, the bank remains committed to keeping rates at least as low as now until inflation projections near the target. Reported inflation has remained below target and the ECB has expressed further dissatisfaction with trends. The ECB has also started a wider review into its inflation target and monetary policy. There are some expectations that the bank will effectively increase its inflation target to 2% from the current target of below, but close to 2%. Any upward shift in the target would increase pressure for the bank to remain extremely low interest rates. Market expectations of Euro-zone inflation have declined to 2-month lows, reinforcing expectations that further easing could be sanctioned and further undermining support. "The euro has been taught a lesson since the ECB's last meeting, while the market's hopes for a sustained recovery of the euro area economy appear to be waning" says Marc-André Fongern, Head of FX Research & Keynote Speaker at MAF Global Forex. "This may be interpreted as a wake-up call for the European Central Bank to reconsider its monetary policy course." "It might indeed turn out to be a tightrope act for the ECB to envisage another rate cut" continues Fongern. "Fiscal stimulus can be expected to be preferred over an even looser monetary policy. And precisely this would be the glimmer of hope for the euro." Global central banks resist easingThe latest US economic data has been generally favourable with solid gains in employment and a headline 225,000 increase in non-farm payrolls for January. The Federal Reserve continues to indicate that no change in interest rates is likely in the short term with the Fed funds rate at 1.75%. Markets are still expecting a further cut in rates before the end of 2020, but yield spreads will remain against the Euro. Other global central banks have been slightly more optimistic over the outlook. The Reserve Bank of New Zealand, for example, left interest rates unchanged at 1.00% following the latest meeting and dropped the easing bias. If other central banks are more optimistic, relative selling will tend to weaken the Euro given the very loose ECB policy. Euro as a global funding currencyIn global currency trading, one currency has to be bought against another one. A popular trading strategy is to buy currencies with a high yield and sell or fund the deal through ones with low yields. This process earns a net premium even if there is no capital appreciation and is known as a "carry trade". With Euro interest rates at 0.0%, the currency is vulnerable as a global funding trade. Institutions and hedge funds will sell the Euro and buy a higher-yield currency such as the US dollar and Canadian dollar. The Euro also tends to be sold against higher-yielding emerging-market currencies. Market conditions favour carry tradesCurrent market conditions are attractive for carry trades with most global equity markets trading at record highs despite fears surrounding the coronavirus. The gains in global equities have boosted risk appetite and encouraged carry trades. Very low interest rates globally have also increased pressure for institutions to boost yields. These pressures encourage carry trades to boost returns. The recent Euro decline will boost net returns on existing short positions and tend to reinforce selling pressure on the currency. Currency volatility at record lowsAnother important element in currency trading is volatility. The yields from carry trades are clearly attractive, but earnings can easily be wiped out by capital losses if the funding currency strengthens. In periods of high volatility, there will be much greater caution over engaging in carry trades given the risk of capital losses on sharp currency moves. When volatility is low, however, the potential for carry trades will increase.

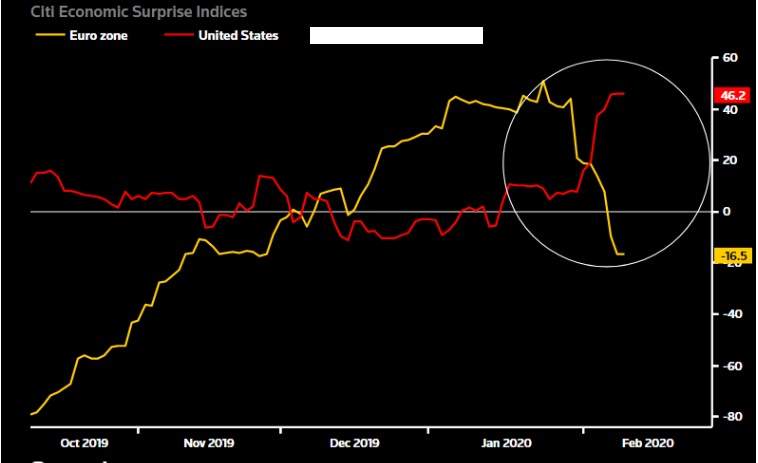

Image: Currency Volatility Index There has been a sustained decline in volatility across major currencies over the past few years. Indeed, the latest data has registered a record low for EUR/USD volatility despite stresses from the US-China trade war. Underlying market conditions are, therefore, favourable for carry trades. Further concerns over German industryAfter a torrid 2019, German business confidence registered a recovery in early 2020 amid hopes that the downturn was coming to an end, especially with a truce in the US-China trade war. Overall confidence has, however, dipped again due to China's coronavirus AKA Covid-19. There are still major uncertainties over developments within China, but it is clear that there will be a sharp dip in domestic activity for the first quarter of 2020. Retail activity will tend to be confined to basic items and purchases of high-value goods will inevitably decline sharply. There will, therefore, be a renewed decline in high-end consumer goods which will undermine sectors such as the German car industry and French luxury goods producers. "The euro continues to struggle," said Neil Wilson, chief markets analyst at Markets.com, on Thursday. "The disruption to supply chains from the coronavirus could hardly come at a worse time," he said. Overall confidence in the German and Euro-zone economy has, therefore weakened again. The latest data recorded a sharp German industrial production decline for December and a sharp drop in Italian industrial production. Economic surprises have been negative for the Euro area at the same time as US data has improved.

Image: Citi Economic Surprise Indices "Europe, and Germany in particular, have very strong trade linkages to Asian markets, and specifically with China," said Mazen Issa, senior FX strategist at TD Securities in New York. "Coming into the year expectations were for a moderate growth rebound. While it did seem reasonable at the time, the disruptions are going to delay that narrative." In the short term, expectations of US relative out-performance will continue. US anger will increaseConcerns over trade policies will also remain an important factor. Following the US-China trade truce, there are increased fears that the US Administration will target the EU for tariffs, further damaging the Euro-zone outlook. US President Trump has already protested strongly against the EU for maintaining under-valued currencies and looking to secure an unfair competitive advantage. If the Euro continues to weaken, US protests will increase with the risk of direct action to prevent further weakness. The EU could face trade tariffs if the Euro continues to weaken which, paradoxically from the US point of view, would risk further currency losses. Euro not acting as a safe havenGiven that global economic concerns have been concentrated around trade policies and Chinese demand, the Euro has not been able to generate significant defensive demand. The Euro-zone economy remains more sensitive to trade and the US economy and trade stresses, therefore, tend to undermine the Euro It is telling that the Euro has declined sharply against the Swiss franc over the past few weeks. The Swiss franc remains a key global defensive asset and the sharp Euro slide illustrates that the single currency is not being seen as a safe-haven asset at this time. Brexit concerns also damagingThe main focus on Brexit tends to be on the UK impact, but there will also be an important impact on the EU economy, especially the Euro-zone. Formal talks between the UK and EU over the future relationship are due to start at the beginning of March. The rhetoric from both sides has inevitably been tough as governments and negotiating teams look to secure a strategic advantage. Serious tensions over reaching a deal would increase concerns over the Euro-zone manufacturing sector. Domestic German politics have also tended to undermine the Euro with no clear succession plans for German Chancellor Merkel. Marshall Gittler, head of investment research at BD Swiss commented that; "The political problems in Germany may also be weighing on the currency. German Chancellor Merkel's heir apparent, Annegret Kramp-Karrenbauer, resigned on Monday as the chair of Merkel's CDU party, leaving the leadership of the ruling coalition in Europe's leading economy in disarray. The problem is not only who will succeed Merkel, but also whether the ruling coalition will even remain in power after the next federal elections, which are scheduled for September 2021 (but could be called earlier)". There is an important risk that Euro-zone countries will fragment if there is no strong leadership from Germany. Is the Euro exchange rate undervalued?In pure purchasing power terms, the Euro exchange rate does appear to be significantly undervalued with a fair value of around 1.3000 according to OECD estimates. There has, however, been deterioration in the Euro terms of trade and estimates of real exchange rates suggested that the Euro is not significantly undervalued. A recent survey from ING suggested fair value for EUR/USD rate is around $1.10. According to ING; Importantly, EUR/USD no longer screens as undervalued based on our medium-term BEER valuation framework. This is a meaningful change from the period of 2015-17 when at that time EUR/USD around 1.10 screened as heavily cheap. What has changed is the EUR/USD fair value, which has deteriorated by around 7% since 2017 largely due to the terms of trade dynamics. The lack of undervaluation also limits the scope for any meaningful EUR/USD upside (such as the one observed in 2017). What could reverse the trend?It should be noted that the Euro-zone runs a substantial current account surplus of close to 2.5% of GDP. If, therefore, there are no net capital outflows from the Euro area, the currency will tend to appreciate. Any increase in overall market volatility could also trigger a sharp reversal in carry trades and a liquidation of short Euro positions. If the short Euro trade becomes over-crowded, there would also be the potential for a sharp Euro gains as stop-loss Euro buying intensifies. Us anger could trigger direct Treasury intervention to weaken the dollar which would trigger a sharp reversal in EUR/USD. From a longer-term perspective, evidence of a meaningful recovery in the Euro-zone economy would be needed to trigger a shift in sentiment. Any concerted move to expand fiscal policy would also be an important positive factor. Kathy Lien's Take on the 6 Reasons for the Euro's decline: FX analyst at BK Asset Management, Kathy Lien wrote on Thursday, February 14: "We can identify at least six reasons for EUR/USD's decline and they mostly have to do with divergence between the EZ and US economies.

Live EUR Exchange Rates Today - Updated 14/02/2020 TRY = 6.5563786845 (+0.1%) CHF = 1.0621570797 (+0.07%) NZD = 1.68409520035432 (+0.06%) CNY = 7.568924436 (+0.06%) SEK = 10.488168558 (+0.01%) NOK = 10.03163705325 (-0%) JPY = 118.99674783 (-0.01%) CZK = 24.867326061 (-0.01%) PLN = 4.2451605108 (-0.02%) ILS = 3.71272194 (-0.03%) SGD = 1.50659460405 (-0.04%) HKD = 8.41726406025 (-0.04%) USD = 1.08369 (-0.04%) GBP = 0.830251560039992 (-0.1%) AUD = 1.61141098273632 (-0.13%) CAD = 1.4361926832 (-0.14%) MXN = 20.133334665 (-0.22%) ZAR = 16.1306389548 (-0.42%) Advertisement Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016, 2017 and 2018. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone. Find out more here. Advertisement Related News |

| Morgan Stanley Names Oweida, Abruzzo FX Co-Heads in Overhaul - Yahoo Finance Posted: 14 Feb 2020 06:55 AM PST   (Bloomberg) -- Morgan Stanley, the Wall Street lender overhauling its currency-trading business after losses and an internal probe, named new co-heads for the unit. The New York-based bank said Samer Oweida, global head of FX sales, and Craig Abruzzo, who leads futures and derivatives clearing in Morgan Stanley's equities business, would now lead the division, according to an internal memorandum obtained by Bloomberg News. Both will report to Jakob Horder, head of the macro division that houses FX trading, the memo shows. Mark Lake, a spokesman for the lender, confirmed the contents of the memo. The promotions come at a time of tumult for the business. Officials are reviewing a batch of option trades tied to the Turkish lira, and examining whether traders improperly valued the transactions and concealed losses, Bloomberg News reported. The bank last month appointed new co-heads of the FX options business that has been linked to those transactions. Morgan Stanley's currency business hasn't had a global head since the departure a year ago of Senad Prusac, who oversaw it as leader of the macro division. Although the unit has historically been one of Wall Street's smaller players in the $6.6-trillion-per-day foreign-exchange market, the firm has surged into the world of FX options, esoteric securities that can be lucrative to trade yet hard to value, Bloomberg has reported. Read More: Morgan Stanley Soared in Currency Derivatives Before Lira Mess (Adds detail on previous leadership in fifth paragraph.) To contact the reporter on this story: Donal Griffin in London at dgriffin10@bloomberg.net To contact the editors responsible for this story: Ambereen Choudhury at achoudhury@bloomberg.net, Marion Dakers, Vernon Wessels For more articles like this, please visit us at bloomberg.com Subscribe now to stay ahead with the most trusted business news source. ©2020 Bloomberg L.P. |

| You are subscribed to email updates from "currency trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment