Dollar near flat, heading for fourth straight month of gains - CNBC

Dollar near flat, heading for fourth straight month of gains - CNBC |

- Dollar near flat, heading for fourth straight month of gains - CNBC

- Best platform for Forex trading - Augusta Free Press

- Malaysia's Mahathir proposes common East Asia currency pegged to gold - Reuters

| Dollar near flat, heading for fourth straight month of gains - CNBC Posted: 29 May 2019 06:44 PM PDT  A trader shows U.S. dollar notes at a currency exchange booth. Akhtar Soomro | Reuters The dollar was little changed on Thursday, on track to post a fourth straight month of gains, as the trade stand-off between China and the United States prompted traders to put money into perceived safe currencies including the greenback. Safe-haven demand lifted the dollar to a 2-year high against a basket of currencies last week. Appetite for the greenback was somewhat curbed on Thursday as Wall Street stabilized following steep losses due to the trade worries and U.S. bond yields briefly rose before resuming their recent fall. The euro and sterling held above key support levels at $1.11 and $1.26, respectively, also restraining the greenback's momentum, analysts said. "With the U.S.-China trade situation, people don't want to do anything until there's a resolution," Joseph Trevisani, senior analyst at FX Street, said of this week's light volume and tight trading ranges. In late U.S. trading, an index that tracks the dollar against six major currencies was down -0.01% at 98.151. It reached 98.371 a week ago, its strongest since May 2017. The S&P 500 was down 0.08%, wiping out initial gains, while the benchmark 10-year U.S. Treasury note yield was 1.2 basis points lower at 2.224%, reversing an earlier rise. The dollar index has increased 0.76% in May, putting it on track for four straight months of gains. Its strength has persisted even as traders have increased their bets on multiple rate cuts by the Federal Reserve. The greenback will likely extend its monthly winning streak against the euro, which began in January. Signs of a sagging euro zone economy, together with worries about the rise of euro-sceptic political parties within EU member countries, have hurt the zone's common currency. The euro was up 0.04% at $1.1135, within striking distance of $1.11055 hit a week ago, which was a two-year low. The dollar has also remained resilient against the yen, despite the risk-averse environment. The greenback was 0.05% lower at 109.535 yen, staying above a two-week low set on Wednesday. Analysts said the yen, a safe-haven currency backed by Japan's status as the world's biggest creditor nation, remained relatively weak because of domestic demand for dollars. "As there's persistent yen selling and dollar buying from Japanese investors when the rate approaches the 109.10 yen per dollar level, it's not easy for the yen to rise above the 109 level," said Yukio Ishizuki, senior currency strategist at Daiwa Securities. Sterling was poised for the biggest monthly drop against the dollar in a year as the imminent departure of Theresa May as prime minister deepened fears about a chaotic exit for Britain from the European Union. On Thursday, the pound was 0.13% lower at $1.261, while the euro was up 0.17% at 88.31 pence. |

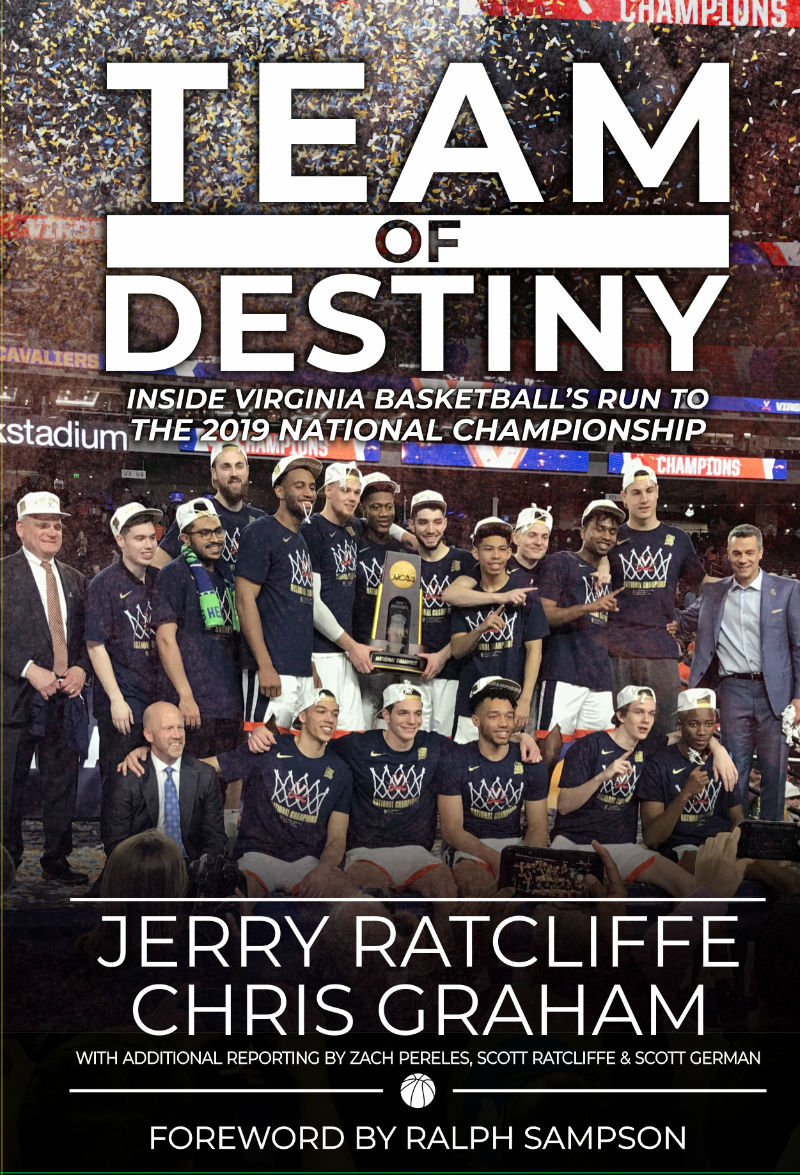

| Best platform for Forex trading - Augusta Free Press Posted: 30 May 2019 06:56 AM PDT What is Forex?Forex or as most people know it, foreign exchange, is a decentralized world market where people can trade, buy or sell currencies. It is also the biggest market in the world for currency trading. The average money that people and companies spend on this market is well above $5 trillion each day which is a huge number. It is bigger than all the stock markets combined. Every time someone goes to a foreign country and exchanges his or hers local currency to another currency, they use Forex. The point of ForexTo simplify it, Forex is a change between two currencies. The biggest companies in the world are using Forex every minute. One euro could be worth 1.06 dollars and in the next minute it could be worth as much as 1.10 dollars. These companies or people then sell their euros for the bigger price and that is how they pay off their workers. The amounts of money they use in these transactions are huge. Even if the difference is small (0.04), when they convert a lot of money it makes a big difference. This system isn't just used by companies but by a lot of people. It can get you very rich in a short period of time but can also make you broke. When people see a currency that is going down in value (example USD) they then sell that currency against other currencies (example Euro). The more the USD goes down in value against the Euro the bigger the profit people make. Some people have even made this their job and spend more than 10 hours a day watching and following the worth of different worldwide currencies. A lot of banks and companies lend money to people that start trading and the most important thing is leverage. The bigger the leverage ratios the more money you can gain or lose. What is the best platform for Forex trading?There is a variety of websites and platforms that offer people Forex trading. One of the best platforms on the market is called Metatrader 4 Forex trading platform. They have been working since 2006 as a platform. The trading volumes of this company are well above $60 billion each month. They don't charge any money for the download but you do have to invest some funds into your account after you register on their platform. The offer a variety of trading possibilities from currency trading to Forex trading and CFD trading. They even offer education on how to start trading and get good at it. It's the most flexible and fastest trading platform there is. They have expert advisors for algorithmic trading and they also offer trading signals from the best supporters in the world. People can access their platform from their PC, Mobile or the web. You can also trade with ofer 50+ Forex pairs, which include the biggest currencies in the world and they even offer trading with Bitcoin and othey crypto values.  Pre-order for $20: click here. The book, with additional reporting by Zach Pereles, Scott Ratcliffe and Scott German, will take you from the aftermath of the stunning first-round loss to UMBC in 2018, and how coach Tony Bennett and his team used that loss as the source of strength, through to the ACC regular-season championship, the run to the Final Four, and the thrilling overtime win over Texas Tech to win the 2019 national title, the first in school history. |

| Malaysia's Mahathir proposes common East Asia currency pegged to gold - Reuters Posted: 29 May 2019 10:29 PM PDT KUALA LUMPUR (Reuters) - Malaysian Prime Minister Mahathir Mohamad on Thursday mooted the idea of a common trading currency for East Asia that would be pegged to gold, describing the existing currency trading in the region as manipulative. Malaysian Prime Minister Mahathir Mohamad speaks at the opening ceremony for the second Belt and Road Forum in Beijing, China April 26, 2019. REUTERS/Florence Lo Mahathir said the proposed common currency could be used to settle imports and exports, but would not be used for domestic transactions. "In the Far East, if you want to come together, we should start with a common trading currency, not to be used locally but for the purpose of settling of trade," he said at the Nikkei Future of Asia conference in Tokyo. "The currency that we propose should be based on gold because gold is much more stable." He said under the current foreign exchange system, local currencies were affected by external factors and were manipulated. He did not elaborate on how they were manipulated. Mahathir has long been a critic of currency trading, and once famously accused billionaire George Soros of betting against Asian currencies. During the Asian financial crisis, Mahathir pegged the ringgit currency at 3.8 to the dollar and imposed capital controls. That peg was scrapped in 2005. Mahathir served a 22-year term as prime minister before stepping down in 2003. He was re-elected in May last year in a shock election, defeating the Barisan Nasional coalition that had ruled Malaysia for the six decades since independence. Earlier this week, the Trump administration said no major trading partner met the criteria required to be placed on the U.S. Treasury Department's list of its currency manipulators but named Malaysia among nine countries that required close scrutiny. In response, Malaysia's central bank said on Wednesday its intervention in currency markets was limited to managing excessive volatility. Reporting by Rozanna Latiff, writing by A. Ananthalakshmi; Editing by Sam Holmes Our Standards:The Thomson Reuters Trust Principles. |

| You are subscribed to email updates from "currency trading" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment